Avalere Analysis: Consumers Should Look at Maximum Out-of-Pocket Limits & Deductibles in the Exchanges

Summary

New analysis from Avalere Health finds that 74 percent of Silver plans offered on exchanges have maximum out-of-pocket limits below what is required by law.A plan’s maximum out-of-pocket¬ limits the amount a consumer will spend for any covered, in-network services, including both deductibles and cost-sharing (e.g., copays). In 2015, plans are required to limit out-of-pocket costs to $6,600 for individual plans and $13,200 for plans offered to families. Approximately two-thirds of exchange enrollees picked Silver plans in 2014.

“The variation in plans’ approach to out-of-pocket limits underscores the importance of consumers looking at more than premiums when they shop for coverage,” said Elizabeth Carpenter, director at Avalere Health. “Consumers with high health care needs may benefit from paying a little more in monthly premiums, in exchange for a plan with a lower out-of-pocket cap.”

In addition to the Silver plans mentioned above, 71 percent of Bronze plans, 94 percent of Gold plans and 98 percent of Platinum plans will have out-of-pocket limits below $6,600 in 2015.

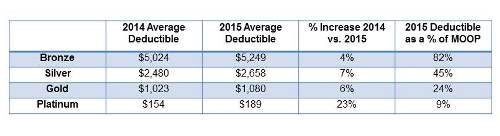

Consumers should also closely review plans’ deductibles, which increased by 7 percent on average in Silver plans from 2014 to 2015. In 2015, individuals enrolled in Silver plans will be subject to an average deductible of nearly $2,700-45 percent of their out-of-pocket limit-before their plan begins to share in the cost of care. The increased deductible amounts may leave consumers paying more in the first few months of coverage until they meet the allocated deductible amount and their plan coverage kicks-in.

“Exchange consumers could face a higher burden of costs early in their benefit year depending on the plan they choose,” said Caroline Pearson, vice president at Avalere Health. “Consumers with complex health conditions should closely consider factors other than premiums. Out-of-pocket limits and deductibles will also play a critical role in determining the total cost of coverage for many enrollees.”

Methods

Analysis using Avalere PlanScape®, a proprietary analysis of exchange plan features, updated December 2014. Data include the federally-facilitated marketplace (FFM) landscape file, as well as data from Covered California and New York State of Health. Avalere revised the FFM landscape file to ensure that only unique plan designs were included in the analysis and a consistent set of states across years. In the FFM landscape file, plans note either a combined deductible, which includes the medical and drug deductible, or separate medical and drug deductibles. Additionally, plans note either a combined MOOP, which includes the medical and drug MOOP, or separate medical MOOPs and drug MOOPs. The information above represents combined MOOP data.

For more exchange related questions, please contact Caroline Pearson at CPearson@Avalere.com.

Download Avalere’s complete release attached.