California, North Carolina, and New York Will See the Largest Provider Payment Cuts and Beneficiary Savings Due to 340B Program Changes

Summary

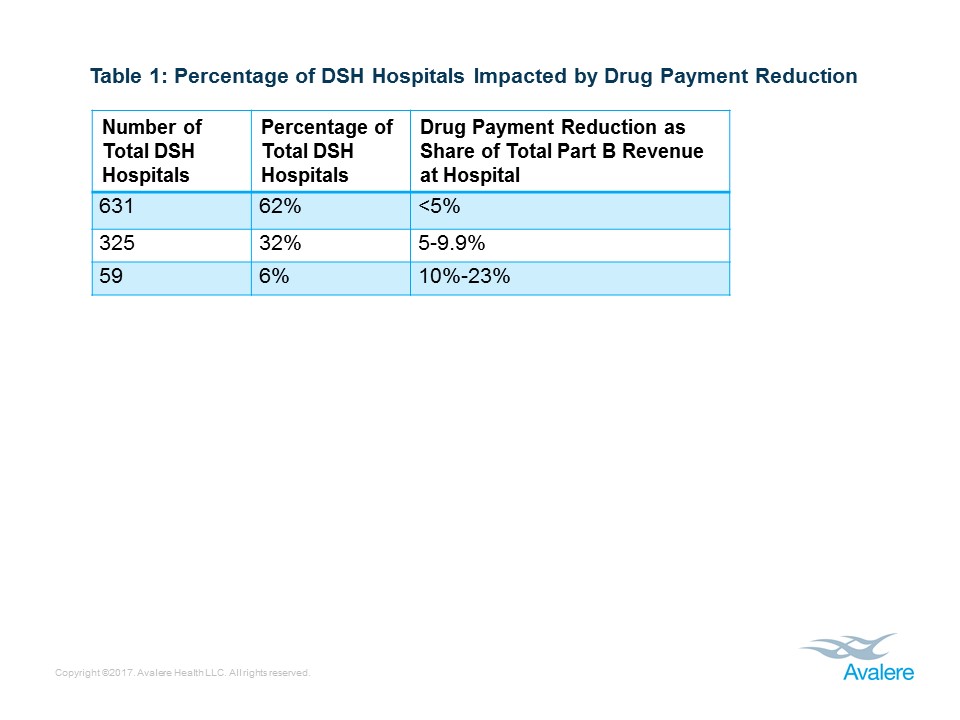

Analysis also finds that 62% of impacted facilities will experience less than a 5% reduction in Medicare Part B revenue due to the drug cuts, but 6% of applicable hospitals will experience cuts greater than 10%.New research from Avalere finds that hospitals in California, North Carolina, and New York will experience the greatest drug payment cuts nationally, ranging from $126M to $62M, as a result of recent changes to the way Medicare pays for 340B drugs. Overall, six states will see drug payment cuts of more than $50M in 2018 (Figure 1). Avalere experts note that other, concurrent Medicare payment increases will offset these cuts for some hospitals, including raising net payments to certain facilities.

Because Medicare beneficiaries are responsible for a portion of the total drug reimbursement, lower Medicare payments to providers will also result in savings to patients. States that will see the highest total consumer savings on drugs are California, North Carolina, and New York-ranging from $32M to $15M (Figure 2). Ten states will have aggregated Medicare beneficiary savings greater than $10M in 2018.

“This payment change represents a significant reduction in drug-related revenue and profitability for some hospitals, and will require immediate action to plan for 2018 budgets,” said Dan Mendelson, president at Avalere Health. “At the same time, the payment change also delivers meaningful savings to Medicare beneficiaries who are responsible for paying a portion of their drug costs.”

Avalere experts explain that the impact on states is driven by the number of Medicare beneficiaries in the state, how many drugs are prescribed in the state through Medicare’s drug benefit program (Part B), and the number of 340B facilities in the state. The Medicare cuts to drug payments will be offset by across-the-board reimbursement increases for non-drug services. However, because the drug-related cuts will disproportionately impact 340B hospitals while the non-drug payment increases will be distributed evenly across facilities, some hospitals stand to see increased payments while hospitals with high 340B volumes will likely see decreases.

The 340B program provides discounted outpatient drugs to disproportionate share hospitals (DSH) that serve low-income patient populations. Beginning in 2018, the Medicare program intends to reduce payments for 340B drugs paid under Medicare Part B by lowering the reimbursement rate from average sales price (ASP) plus 6% to ASP minus 22.5%, which the Centers for Medicare & Medicaid Services (CMS) estimates to be closer to the hospitals’ acquisition cost. CMS projects that this change will mean $1.6B less in Medicare funding to hospitals for these drugs. Hospital groups have sued to prevent those cuts and litigation is ongoing.

Avalere’s research also found that due to the drug reimbursement cuts, 62% of DSH hospitals will see a reduction of less than 5% of their total Part B revenue, and 32% will experience a decrease of 5% to 9.9%. However, 59 hospitals (6%) are projected to have payment reductions greater than 10% of their total revenues as a result of the drug cuts (Table 1).

“While the total amount of drug payment cuts is significant, the increase in non-drug payments will mean that most hospitals will have very minimal changes to their revenues,” said Fred Bentley, vice president at Avalere. “Given the lean margins at most hospitals, those hospitals that will have more than 10% reductions in revenues could face serious financial hardship.”

Methodology

Avalere analyzed 2015 Part B drug spending using the Medicare Standard Analytical File (SAF) that includes 100% of fee-for-service (FFS) drug billing by hospital outpatient departments (HOPDs). Although Critical Access Hospitals and hospitals located in Maryland are eligible for 340B prices, the entities are not paid for Part B drugs using the ASP methodology, and therefore are not included in the analysis. We also excluded the hospitals that the Outpatient Prospective Payment System (OPPS) rule indicated will be excluded form payment cuts: rural sole community hospitals, PPS-exempt cancer hospitals, and children’s hospitals.

Avalere identified Part B drugs reimbursed by Medicare based on ASP methodology. Avalere captured all drugs appearing in the quarterly 2015 ASP Drug Pricing Files for J-, Q-, A- and P-codes. Avalere excluded vaccines per CMS’ final OPPS rule.

Avalere assessed hospital 340B participation in 2015 using 340B Office of Pharmacy Affairs information System (340B OPAIS) from Health Resources and Services Administration (HRSA). Avalere used Medicare cost reports and other CMS data files to assess overall hospital revenue and hospital characteristics. Under the sequester, government share of drug payments to the hospital is 79.7% and beneficiary’s cost sharing is 20.3%

Avalere grew Medicare Part B payments obtained from the 2015 Medicare SAF to reflect 2018 spending. Specifically, we used historical projection tables from the CMS’ Office of the Chief Actuary (OACT) and applied year over year growth in Part B spending for hospital services estimated for 2016-2018, which averaged to ~9% annually.

To receive more expert insights on the latest healthcare news, connect with us.

Learn More