Measuring Scope of COVID-19 Relief Coverage Expansion Provisions

Summary

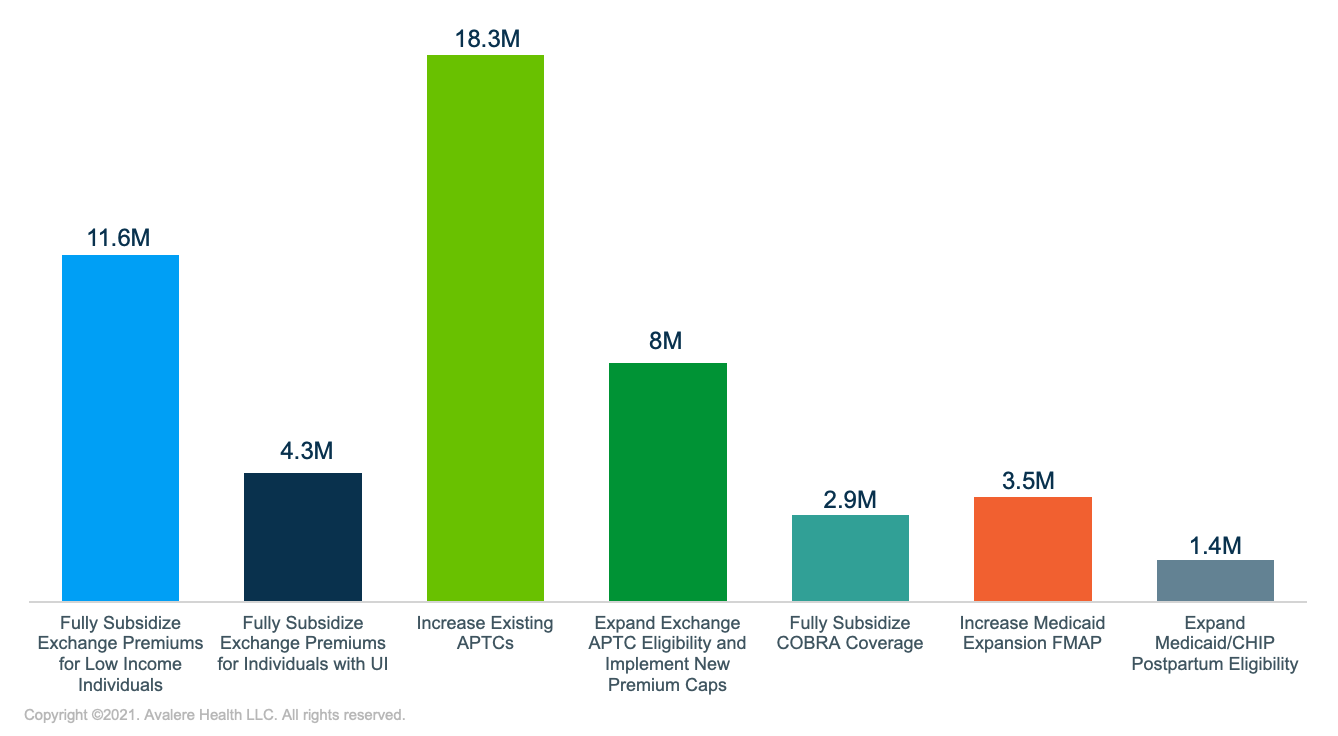

Avalere analysis finds that Congress's healthcare reforms under the COVID-19 relief bill could expand exchange coverage subsidies for up to 18.3 million individuals.On March 11, President Biden signed a $1.9 trillion COVID-19 relief bill, the American Rescue Plan Act of 2021, into law. Among other reforms, the law includes significant short-term provisions that could expand Medicaid and exchange coverage subsidy eligibility in 2021 and 2022. While the policies differ in the degree to which they alter existing coverage, millions of Americans could see higher premium subsidies, which may lead to shifts to more affordable forms of coverage in the near term.

Accordingly, Avalere estimated the number of individuals by insurance market who could be impacted by select coverage reforms. Key coverage enhancements include:

- Fully Subsidizing Exchange Premiums for Low-Income Individuals and Individuals Receiving Unemployment Insurance: For those not eligible for Medicaid, cap exchange premiums at 0% of federal poverty level (FPL) for individuals with incomes up to 150% FPL in 2021 and 2022, as well as those receiving unemployment insurance (UI) through the end of 2021.

- Increasing Existing APTCs: Increase exchange plan advance premium tax credits (APTCs) for individuals with income levels between 150% and 400% of FPL in 2021 and 2022.

- Expanding Exchange APTC Eligibility and Implementing New Premium Caps: Expand availability of exchange plan APTCs to individuals with incomes above 400% of the FPL and cap maximum Affordable Care Act (ACA) premiums at 8.5% of FPL for individuals in 2021 and 2022.

- Fully Subsidizing COBRA Coverage: Implement support for continuation of employer-based health insurance by subsidizing the Consolidated Omnibus Budget Reconciliation Act (COBRA) coverage at 100% through September 2021 for individuals who have lost employment within 60 days.

- Increasing Medicaid Expansion State FMAP: For a 2-year period following state implementation of ACA Medicaid expansion, temporarily increase base Federal Medical Assistance Percentage (FMAP) by 5%.

- Extending Medicaid/CHIP Postpartum Eligibility: For Q1 FY 2022 through Q1 FY 2026, give states the option to extend Medicaid and Children’s Health Insurance Program (CHIP) eligibility to individuals for 12 months postpartum.

| Coverage Reform | Number of Lives Impacted |

|---|---|

| Fully Subsidize Exchange Premiums for Low Income Individuals | 11.6M |

| Fully Subsidize Exchange Premiums for Individuals with UI | 4.3M |

| Increase Existing APTCs | 18.3M |

| Expand Exchange APTC Eligibility and Implement New Premium Caps | 8M |

| Fully Subsidize COBRA Coverage | 2.9M |

| Increase Medicaid Expansion FMAP | 3.5M |

| Extend Medicaid/CHIP Postpartum Eligibility | 1.4M |

Note: Number of lives impacted may overlap across provisions and do not sum to an aggregate total.

Key Considerations

While the coverage provisions do not focus on patient cost-sharing barriers (e.g., deductibles, coinsurance, copay costs), the reforms are expected to reduce the number of uninsured and make accessing insurance more affordable for many enrollees. It will be important for stakeholders to monitor how fast exchanges and employers can operationalize the changes and what enhancements will be extended or added to future legislation. In addition, stakeholders should also consider provision-specific dynamics.

- Full subsidies may increase exchange enrollment among those currently unemployed and reduce the likelihood that current enrollees disenroll due to affordability issues. New customers will have access to increased subsidies on the exchanges starting April 1, and individuals who are already enrolled in exchange plans must actively update their information to benefit from higher subsidies. Otherwise, additional subsidies will be applied to 2021 taxes filings.

- Consumers should understand how midyear switching in 2021 could cause deductibles or maximum out-of-pocket limits to reset, potentially increasing their cost sharing and offsetting any savings from new premium subsidies. In most states, including those with a federally facilitated exchange, individuals will have the option to switch plans until May 15.

- Despite increased eligibility, some individuals may not receive tax credits if the cost of their benchmark plan is less than 8.5% of their household income. However, for some individuals with incomes above 400% of FPL who have been historically priced out of subsidized exchange market coverage, eligibility expansion could improve premium affordability and drive new enrollment.

- COBRA changes could improve risk pools for employer coverage. Specifically, full subsidies may motivate healthy individuals, who would not otherwise enroll in COBRA without subsidies, to opt into coverage.

- States should carefully consider the financial implications of the increased base FMAP and the enhanced FMAP for Medicaid expansion. However, states that have not yet expanded are unlikely to be swayed by an FMAP boost, given that the barriers to expansion may not be solely financial.

- The impact of the option to extend Medicaid and CHIP postpartum eligibility will vary nationally. Adoption could shift enrollment away from the exchanges into Medicaid, potentially improving maternal mortality or other birth-related outcomes.

Importantly, this analysis does not attempt to project the number of people who would shift between sources of coverage nor the qualitative impact on affordability or access of each policy. This analysis simply estimates the number of people, subject to the intricacies and details of each policy, that could see changes to their coverage if each individual coverage reform were enacted.

Methodology

To estimate the number of people who could be impacted by the COVID-19 relief package coverage reform proposals, Avalere analyzed the eligible adults in each market using the American Community Survey (ACS) 2019 1-year sample of health insurance coverage in the US, the Department of Labor’s (DOL’s) March 4 report on Unemployment Insurance Weekly Claims, and the Bureau of Labor Statistics’ (BLS’s) March 5 Employment Situation Summary.

Expanded Exchange APTC Eligibility and Premium Caps

Avalere estimated the number of individuals impacted by legislative enhancements to the exchanges under the ACA—including expanding APTCs to individuals above 400% of FPL and capping premiums at 8.5% of FPL, as well as lowering premium caps for individuals with incomes between 150% and 400% of FPL. Specifically, Avalere analyzed the number of individuals that would be eligible for enhanced subsidization using the ACS 2019 1-year sample of individuals in the individual market and the uninsured from 100% to 500% of the FPL. In addition, Avalere assessed the Congressional Budget Office’s (CBO’s) Composition of the Uninsured Population report for 2021 to determine the number of uninsured individuals currently eligible for marketplace subsidies or subsidized employer-based coverage or those with FPLs above state marketplace subsidy eligibility levels.

Full Exchange Premium Subsidies for Individuals Under 150% of FPL or Currently Enrolled in UI

Avalere estimated the number of individuals impacted by 100% premium subsidies for exchange coverage for 2 eligibility groups: (1) individuals not already enrolled in a government health insurance program (Medicare, Medicaid, TRICARE, Indian Health Services, or the Veteran’s Administration) who are below 150% of the FPL, and (2) individuals currently enrolled in UI. Accordingly, similar to the analysis of APTC eligibility and premium caps, Avalere analyzed the number of individuals that would be eligible for enhanced subsidization using the ACS 2019 1-year sample of uninsured, or individuals with employer-sponsored insurance who are below 150% of the FPL, along with the current individual market population using Avalere’s Proprietary All-Payer Enrollment Model.

Full COBRA Coverage Premium Subsidies for Newly Unemployed

To estimate the number of individuals that could be impacted by 100% premium subsidies for COBRA coverage, Avalere analyzed the total number of initial UI claims within the last 60 days, as reported by the DOL weekly Unemployment Insurance Weekly Claims report. Using the BLS March 2019 National Compensation Survey, Avalere applied an estimated share of employed individuals with employer sponsored insurance (46.4%) to the total number of UI claims to determine the number of individuals losing employment who would be eligible for COBRA. Individuals eligible for full COBRA coverage premiums may also be included in the estimate of those eligible for fully subsidized exchange premium subsidies on the basis of receiving UI.

State Medicaid Expansion

To estimate the number of individuals impacted if all remaining states expanded Medicaid under the ACA, Avalere analyzed the ACS 2019 1-year sample of the individual health insurance market and uninsured populations with incomes under 138% of the FPL. All enrollment numbers exclude dual-eligible beneficiaries. Additionally, Avalere analyzed CBO’s Composition of the Uninsured Population report for 2021 to determine the number of individuals with an income below the FPL threshold to qualify for subsidized exchange coverage in a state that has not yet expanded Medicaid.

Medicaid/CHIP Postpartum Eligibility Expansion

To estimate individuals eligible for extended 12-month Medicaid postpartum coverage, Avalere analyzed new Medicaid and CHIP births by state in the Vital Statistics Online Data Portal and National Statistics System on Mortality Data via the Center for Disease Control’s WONDER Online Database, along with the 2019 Kaiser Family Foundation Medicaid Budget Survey of state-reported share of births that were financed by Medicaid in the most recent 12-month period. California and Texas were excluded from the analysis, given that 12-month postpartum coverage already exists. Both expansions states where individuals could have gained Medicaid coverage postpartum and states that have not expanded Medicaid were included in the estimate.

To receive Avalere updates, connect with us.