Looming Deadlines Could Trigger Congressional Action on Healthcare

Summary

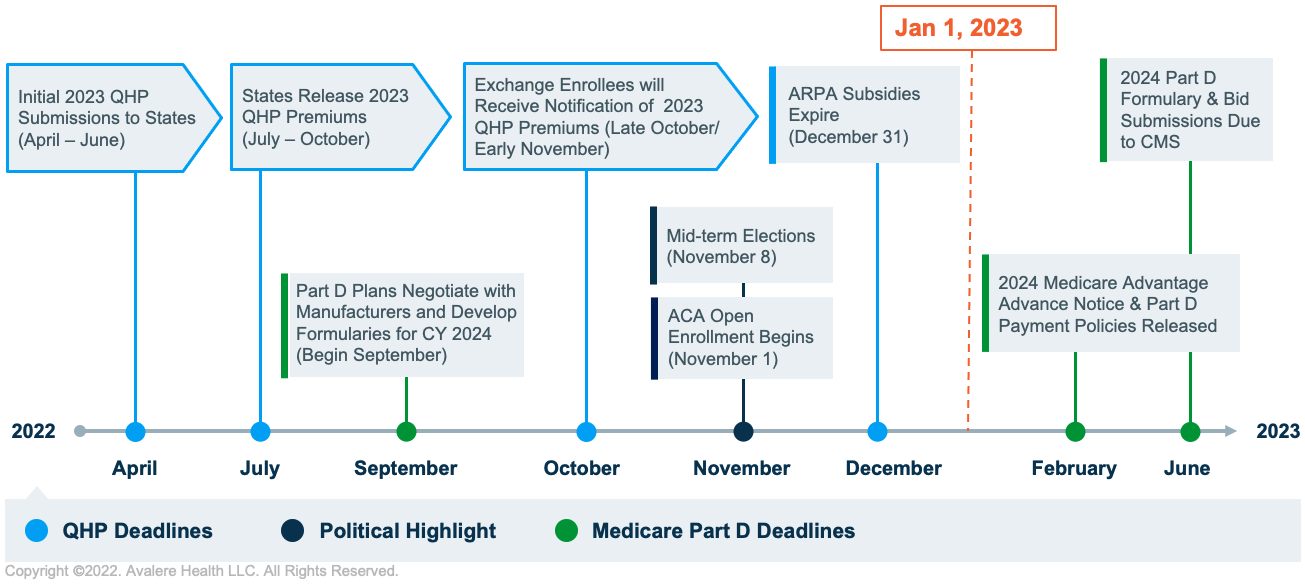

Congressional Democrats have indicated interest in a slimmed-down BBBA alternative that could pass the Senate. Pending deadlines and the expiration of ARPA subsidies may create impetus for Democrats to act on legislative health care priorities in 2022.As momentum on advancing the $1.75 trillion Build Back Better Act (BBBA) has stalled in the Senate, it is unclear when and how Democrats could pursue key parts of their agenda during this election year. Recently, Congressional Democrats have indicated interest in a slimmed-down BBBA alternative that could pass the Senate. As Democrats consider this course of action, key upcoming milestones could influence the timing of any upcoming legislative activity. Notably, enhanced premium subsidies included in the American Rescue Plan Act (ARPA) are set to expire at the end of this year. To avoid concerns from constituents about 2023 premium increases related to the expiration of ARPA subsidies, Democrats may revisit BBBA proposals that would further extend these subsidies or make them permanent and would identify a funding stream to pay for this spending increase.

In addition to ARPA, Democrats may seek to pass other elements of the BBBA related to drug pricing. If they pursue policies that would retain the level of savings previously estimated by the Congressional Budget Office (CBO), Congress would need to consider how the policies’ effective dates would interact with the Part D bid cycle. Specifically, the legislation would have to pass prior to the approaching Calendar Year (CY) 2024 Part D bid cycle and subsequent Part D Advance Notice to ensure the Centers for Medicare & Medicaid Services (CMS) have enough time to incorporate any legislative changes into proposed rulemaking. Otherwise, Congress may have to delay the effective date of Part D changes to 2025 or after. Such a change would reduce the savings estimated by CBO.

State of Play of ARPA

Last year, through ARPA, Congress increased and broadened premium tax credits for individuals and families to purchase health insurance. Since its passage, exchange enrollment has reached a record high of 14.5 million people, including 5.8 million new enrollees. Many of the coverage-related ARPA policies will expire January 1, 2023, which will affect nearly all enrollees who receive a premium tax credit. Key coverage enhancements include:

Completely subsidizing exchange premiums for low-income individuals and individuals receiving unemployment insurance. For those not eligible for Medicaid, fully subsidized premiums for individuals with incomes between 100% and 150% of the federal poverty level in 2021 and 2022.

Increasing existing APTCs. Increased advance premium tax credits (APTCs) for individuals with income levels between 150% and 400% of the federal poverty level in 2021 and 2022.

Expanding exchange APTC eligibility and implementing new premium caps. Expanded availability of APTCs to individuals with incomes above 400% of the federal poverty level and capped maximum exchange premiums at 8.5% of the federal poverty level for those individuals in 2021 and 2022.

With the major ARPA coverage provisions expiring on January 1, 2023, Qualified Health Plans (QHP) must set 2023 premium rates amid a great deal of uncertainty. If Congress fails to extend these subsidies, multiple states may announce 2023 premium increases this summer and fall, leading up to the mid-term elections. This may pressure Democrats to extend these subsidies prior to the completion of the 2023 QHP rate-setting process. If Democrats do not address these issues prior to midterm elections, ARPA enhancements are likely to expire, causing millions of people to pay more in premiums and to have fewer available low-premium options.

Medicare Part D Bid Process

The start of the CY 2024 Part D bid cycle will begin in earnest in early-to-mid September 2022, followed by the release of annual Part D sub-regulatory guidance and proposed CMS rulemaking in early 2023. If the expiration of ARPA subsidies creates urgency for Congress to act prior to 2023 ACA premium announcements, Democrats will also need to consider how the timing of the Part D CY 2024 bid cycle could affect Part D-related proposals contemplated in parallel. If Democrats consider a legislative package that incorporates the BBBA’s drug pricing policies (many of which would begin in 2024), Congress may seek to avoid changing the policy effective dates to preserve the total amount of savings that could be expected within the applicable 10-year budget window (2022–2031). Uncertainty for stakeholders could be reduced if legislative changes effective in 2024 were enacted prior to the CY 2024 Part D bid cycle and rulemaking process.

Implications

Democrats in Congress may feel political pressure in the months ahead to extend enhanced ARPA subsidies prior to the public release of 2023 QHP premiums, in order to avoid concerns from voters about increased healthcare costs. Extending ARPA policies may increase federal spending from $73.9 billion to $200 billion, and this extension is likely to be pursued by Democrats through the budget reconciliation process. The current budget resolution prohibits the reconciliation package from increasing the deficit, forcing spending policies be offset. Recently, Biden has urged Congress to pass legislation related to drug pricing, similar to that of the BBBA, that could be used to pay for the enhanced premium subsidies. Additionally, a fast-approaching start to the CY 2024 Part D bid cycle and regulatory calendar could further heighten the urgency for legislative action in the coming months on Part D and other drug pricing policies from the BBBA. Understanding these important Medicare and ACA deadlines could provide a roadmap in forecasting when Congress may act this year.

To receive Avalere updates, connect with us.