Political Realities Require Trade-Offs from Democrats on Skinny BBBA

Summary

As Democrats seek consensus on a "skinny BBBA," concerns over inflation and deficit reduction will place greater emphasis on "pay-for" targets to advance healthcare priorities.While efforts to advance the President’s Build Back Better Act (BBBA) have been stalled in Congress for many months, private negotiations are ongoing toward an agreement on a slimmed down version of the BBBA as the midterm election approaches.

With lawmakers’ focus on inflation concerns, Senator Joe Manchin, viewed by many as key to any potential compromise, has indicated that he would only support a scaled-down version of the BBBA in which half of the revenue raised in the bill would fully offset the cost of any new domestic spending policies and the other half would be used to reduce the budget deficit.

On March 2, Senator Manchin outlined this rationale. “Half of that money should be dedicated to fighting inflation and reducing the deficit. The other half you can pick for a 10-year program, whatever you think is the highest priority and right now it seems to be the environment—and that’s a pretty costly one—would take care of it.”

Additionally, given the debate that stalled Democrats’ efforts to pass the BBBA in late 2021, a new legislative package would likely have to be focused only on policies where considerable support already exists throughout the Democratic caucus, such as efforts to combat climate change and extend the enhanced premium tax credits passed under the American Rescue Plan Act (ARPA), which are set to expire at the end of this year. These proposals would most likely be financed by tax code changes and the largest drug pricing1 policies proposed in the original BBBA.

Political Trade-Offs

With considerable support for climate changes policies mostly in place, Democrats would need to consider the following for a new bill to reach the President’s desk:

- Whether to pursue permanent funding of ARPA tax credits or a temporary extension

- How much revenue they can raise from tax code changes

- Whether all or only a portion of the revenue from the BBBA’s drug pricing provisions are needed to pay for the bill and meet the deficit reduction goals outlined above

While there is general agreement among Senate Democrats on drug pricing, differences exist in the amount of tax revenue they would be willing to raise. As a result, Democrats may have to consider trade-offs in how long to extend ARPA tax credits, given the imperative among key decision-makers to produce a bill that is both revenue neutral and provides deficit reduction. As negotiations progress on a skinny BBBA, policymakers are considering what combination of policies will satisfy all parties.

High- and Low-Spend Scenario Analysis

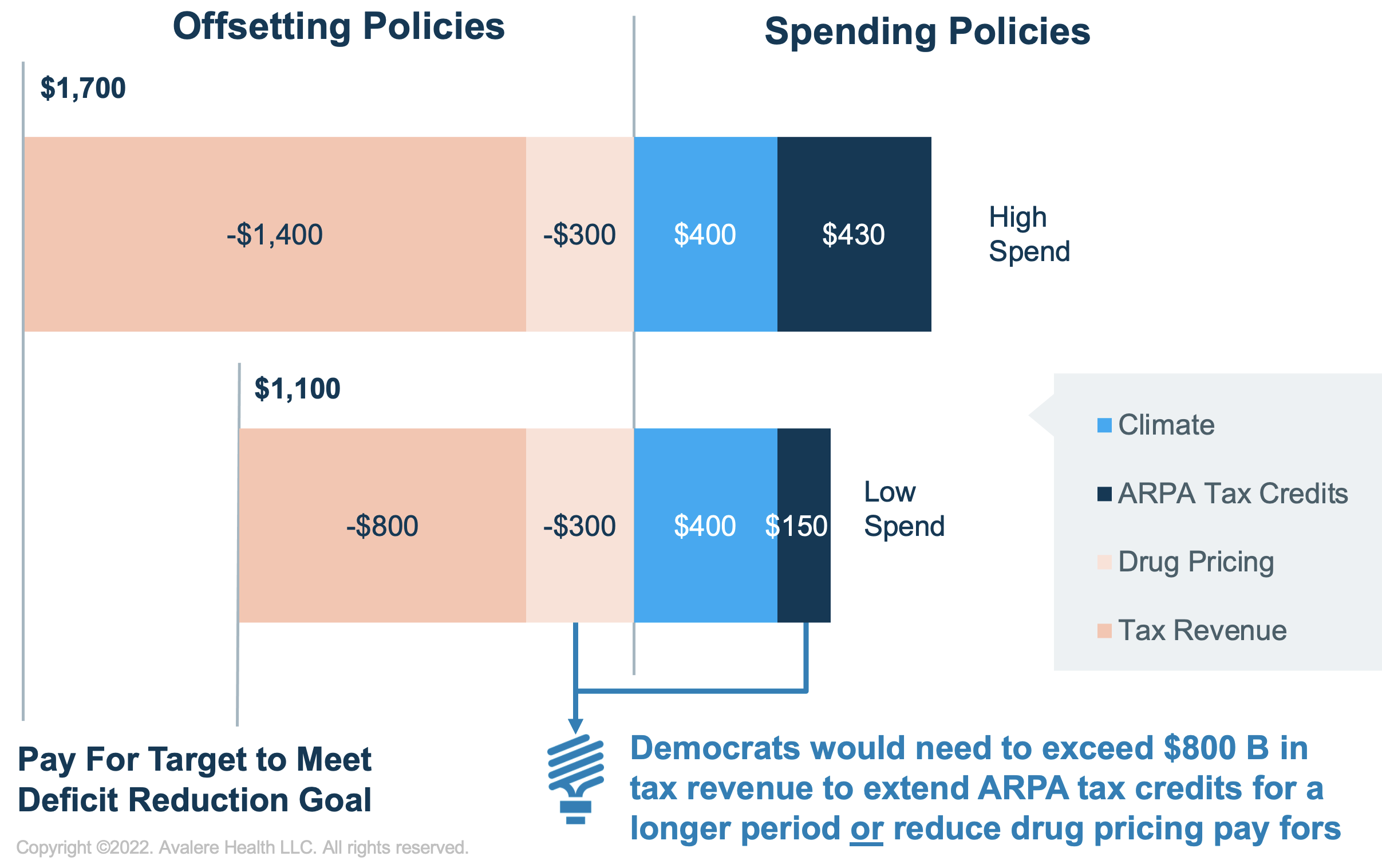

These potential decisions raise important questions about the composition of a skinny BBBA bill. To assess how a potential package could take shape, Avalere evaluated the budgetary impact of 2 hypothetical policy scenarios, informed by an analysis of recent political developments on Capitol Hill and public statements from key lawmakers. Avalere analyzed public scores from the Congressional Budget Office and balanced various budgetary options that included the Democrat’s domestic policy priorities to forecast 2 potential scenarios that could play out in a scaled-back bill.

To stay within the required parameters for political support, Avalere assumed in both scenarios that enough revenue would need to be raised for half of the total to fully offset any new spending and the other half to be applied to deficit reduction. Additionally, given broad Democratic support for climate change policies, Avalere held climate spending constant in both scenarios, assuming that Democrats would seek full 10-year funding of the climate policies included in the original BBBA effort.

Based on these assumptions, Avalere examined how a high- versus low-spending package could influence the size and scope of the bill’s primary healthcare provisions—extension of ARPA tax credits and drug pricing policies (Table 1).

- The high-spend scenario shows the impact of the BBBA’s climate policies and a permanent extension of ARPA tax credits, which would require a substantial amount of offsetting revenue.

- The low-spend scenario shows the impact of the BBBA’s climate policies and a short-term extension of ARPA tax credits, which would require a lower amount of tax revenue that better reflects the political preferences of key Senators.2

| Spending Policies | High-Spend Package | Low-Spend Package |

|---|---|---|

| Climate | 400 | 400 |

| Extension of ARPA Subsidies* | 430 | 150 |

| Total | 830 | 550 |

| Offsetting Policies** | ||

| Tax Revenue | -1400 | -800 |

| Drug Pricing | -300 | -300 |

| Total | -1700 | -1100 |

| Total Impact | ||

| Net Budgetary Impact | -870 | -550 |

**Scenarios assume that total revenue must be 2X of total spending to fully pay for the bill and meet deficit reduction targets.

Findings

In a high-spend package like Scenario 1, where the Democrats seek to pass the BBBA’s climate change policies and permanently fund an extension of the ARPA tax credits, they would likely need almost $1.7 trillion in revenue to offset new spending and meet their hypothetical deficit-reduction target. Unless consensus can be reached on other policies, this would likely require all of the BBBA’s largest drug pricing policies plus an additional $1.4 trillion in tax code revenue.

In a low-spend package like Scenario 2, where Democrats pursue the same level of climate spending and only a 2-year extension of ARPA tax credits, they would need $1.1T in revenue to offset new spending and meet their deficit reduction target. This could be accomplished with the BBBA’s largest drug pricing policies and $800B in tax code savings (see Figure 1).

Thus, Scenario 2 represents a “tipping point” on the amount of tax revenue needed to shape the bill’s primary healthcare provisions. If Democrats can exceed $800 billion in new tax revenue, they could (1) fund ARPA tax credits beyond a short-term extension, (2) decrease the amount of drug pricing pay-fors, or (3) some combination of both. If tax revenue is equal to or less than $800 billion, Democrats would be limited in their ability to extend ARPA tax credits for a longer period or consider a smaller package of drug pricing policies than those included in the original BBBA.

How Stakeholders Can Prepare for a Skinny BBBA

Stakeholders should carefully assess the possible combinations of spending and pay-for policies that could emerge. Preparation for a skinny BBBA should include a detailed understanding of how these policy preferences could be balanced with political and fiscal realities if Democrats make a final attempt to pass new legislation through budget reconciliation.

Interest among Democrats to act on any new legislation will be highest between now and the Congressional recess in August. Healthcare stakeholders should use this balance of time to understand how the various combinations of policy proposals could affect their priorities and strategic responses.

To learn more about policy changes that affect your business, connect with us.

Notes

- Part D redesign, inflation-based rebates, Medicare negotiation, repeal of rebate safe harbor rule.

- Based on public statements and press coverage of BBBA negotiations, Avalere assumed that political support within the Democratic caucus may exist for raising ~$800 billion through a combination of a millionaires’ surtax and a minimum tax on corporations.

January 23, 11 AM ET

Learn More