Evolving Vaccine Recommendation Landscape Prompts New Evidence Needs

Summary

As the processes, priorities, and membership within the ACIP evolve, vaccine manufacturers should adapt their evidence generation planning to support optimal review.Background

The Advisory Committee on Immunization Practices (ACIP) serves as the National Immunization Technical Advisory Group (NITAG) for the United States and advises the Centers for Disease Control and Prevention (CDC) on vaccines and immunizations. The CDC develops national immunization schedules based on the ACIP’s recommendations. The ACIP’s charter, which is updated biannually, details the statutory role and responsibility of the Committee. The Committee is tasked with reviewing and making recommendations for newly licensed vaccines, reconsidering recommendations for existing vaccines as necessary, and revising the list of vaccines in the Vaccines for Children Program. A notable recent charter amendment specified that the ACIP may review “vaccines and other immunobiological agents,” allowing for discretionary review of novel technologies such as preventive monoclonal antibodies. In the past year, eleven new members have joined ACIP, changing the expertise within the group.

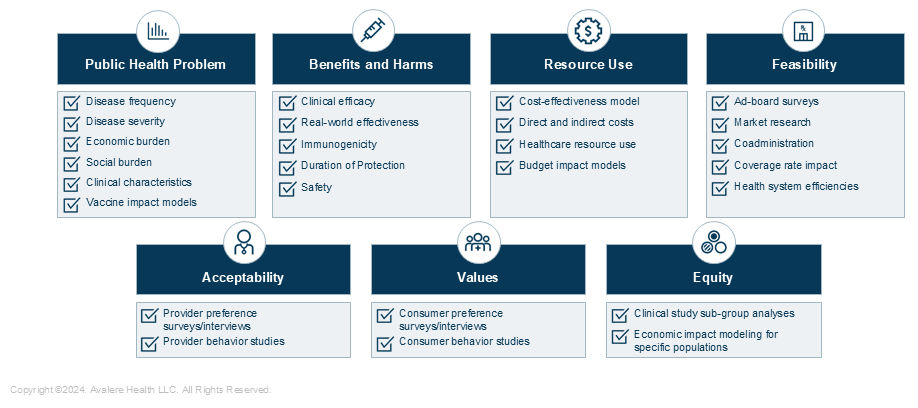

To inform evidence-based recommendations which ultimately serve as the basis for federal coverage policies, the ACIP follows specific policies and procedures. Since 2010, the Committee has used the Grading of Recommendations Assessment, Development and Evaluation (GRADE) methodology to assess vaccine data and the certainty of such findings. Beginning in 2018, ACIP Work Groups adopted the Evidence to Recommendation (EtR) framework, which helps to synthesize of evidence and structure discussions to inform recommendations votes. The EtR is designed to provide guidance on the criteria for decision-making for new or updated immunizations and is organized to account for data in seven domains detailed below. Qualitative and quantitative manufacturer-provided data can be applicable and eligible for inclusion in a product’s GRADE assessment and EtR review, though many EtR domains are most informed by CDC data.

Emerging Evidence Domains

With new ACIP members and novel products for the Committee to consider, manufacturers’ evidence should respond to evolving ACIP discussions through strategically tailored evidence generation. In recent meetings, the ACIP has pointed to emerging priority research areas within the established evidence domains to more comprehensively enhance the Committee’s considerations and deliberations:

- Public Health Problem: Epidemiology, clinical course, and overarching disease burden varies substantially by disease area. The ACIP has more recently expressed interest across disease areas to better understand the burden in specific settings (e.g., nursing homes), and in specific subgroups (e.g., high-risk disease groups). Examples of industry-led studies to fill these gaps include: (1) literature reviews characterizing unmet clinical need, (2) data related to timing of vaccination for certain populations, and (3) economic disease burden studies.

- Benefits and Harms: This domain relies on manufacturer data on a product’s clinical and safety profile. The ACIP has requested more robust data in specific higher-risk populations (e.g., immunocompromised individuals, comorbid populations, older adults). To meet requests, manufacturers can consider: (1) expanding clinical trial enrollment to recruit diverse populations, (2) stratifying trial results to better define and characterize high-risk populations groups, and/or (3) planning real world evidence studies to further understand vaccination in populations with unmet clinical need.

- Values and Preferences: This domain explores target population reactions to vaccination. The CDC has historically developed data supporting this. However, with new technologies and vaccine types (e.g., adult combination vaccines, therapeutic vaccines), manufacturers have opportunities to demonstrate how evolutions in the landscape may impact patient perceptions and preferences. The ACIP may value well-powered primary research on the target population’s perception of vaccines, including direct and indirect benefits for caregivers.

- Acceptability: The ACIP also accounts for provider- and stakeholder-related considerations, often reviewing evidence collected via provider surveys. While ACIP most often reviews CDC-driven studies in this field, manufacturers can contribute. For example, studies evaluating provider access, use, and preference of products can supplement CDC surveillance and monitoring.

- Resource Use: Under the resource use domain, ACIP evaluates the cost effectiveness of products, and has recently heavily focused on the costs of products. While ACIP has historically stratified these analyses by age group, it has also shifted to conduct analyses based on varying disease severity and risk. To inform cost effectiveness analyses, manufacturers must build models that align with ACIP guidance and are comparable to CDC-model parameter inputs.

- Equity: This is the newest EtR domain, and ACIP is still evolving its approach to it. Various members have expressed the importance of understanding equity in terms of disease burden and vaccine access, consistently requesting more data within specific sub-populations. Manufacturers can engage in studies (1) evaluating vaccine use by risk groups, socioeconomic strata, geographic region, and race, and (2) studying vaccine impact on caregivers for various demographics.

- Feasibility: The feasibility domain attempts to account for implementation barriers that should be considered for recommendation development. Manufacturers can provide data that support the use of novel vaccines in existing immunization schedules or highlight the challenges of existing schedules. Example studies include: (1) co-administration studies, (2) vaccine coverage rate models, and (3) studies demonstrating benefits to health system processes.

Figure 1: Studies Manufacturers Can Plan to Prepare for ACIP EtR Framework Reviews

Key Takeaways

Early in the pipeline, manufacturers should consider which evidence generation efforts should be prioritized for ACIP review and NITAG recommendations. As the ACIP continuously evolves and new members participate in discussions, evidence priorities should be responsive to evolving needs. Careful monitoring of ACIP actions can guide tailored evidence generation planning for optimal product review and effective recommendation development. Novel immunizations, such as monoclonal antibodies, combination vaccines, and therapeutic vaccines, merit additional targeted and nuanced strategies.

A Trusted Partner for Vaccine Support

Avalere’s experts in vaccine policy, evidence generation and strategy, and market access can help manufacturers effectively plan and conduct evidence generation activities, responding to evolving evidentiary needs. Activities may include supporting scientific narrative development ahead of launch, evidence packaging and submission for NITAG review, and go-to-market strategy for both medical affairs, market access, and policies teams. Connect with us to learn more.

January 23, 11 AM ET

Learn More