2020 Implementation of Rebate Rule Could Create Uncertainties for Part D Plans

Summary

On April 5, CMS issued guidance announcing a voluntary, 2-year demonstration that would modify the Part D risk corridors if the proposed rule to revise the Anti-Kickback Statute safe harbors is effective for 2020.The guidance also instructs plan sponsors to submit Part D bids “in a form and manner that is consistent with the Anti-Kickback Statute (AKS) law and regulations in effect as of the bid submission deadline, including, for the purposes of bid development, the treatment of manufacturer rebates per CMS’ existing rules and guidance.” The bid deadline is June 3. On April 8, CMS held an industry call clarifying that the revised AKS safe harbors would not be in effect by that date, directing Part D plans to bid under current rules.

Though this guidance provides clarity on plan bidding and the demonstration offers some financial protection for plan sponsors against a 2020 change to rebating practices, outstanding questions and considerations remain related to Part D plan operations for 2020.

Potential for Misalignment Between Bids and 2020 Operations

Per CMS guidance, a bid must reflect a plan’s “best and final” proposal and best estimate of plan costs. Following the bid submission deadline, plans may only make limited, CMS-directed bid modifications. Accordingly, plans will likely not have the ability to make wholesale changes to their bids or formularies after June 3 to reflect rebate changes. CMS will likely approve plan bids and formularies based on current law.

Key Questions Related to Cost Sharing and Plan Marketing

If the rebate rule is finalized for 2020, plans will need to make operational adjustments to remain compliant, primarily by adjusting beneficiary cost sharing. The proposed new safe harbor for price reductions would require that the full value of a reduction in price be, “reflected at the point of sale to the beneficiary.” If rebates are converted into point-of-sale price reductions, plans will need to reflect those in decreased cost sharing. This raises a few questions for plans, including:

- Plan/PBM Contracting: If the rebate rule is finalized, to what extent would plan contracts need to be amended? Plans may need to revisit contracts with drug manufacturers to convert rebate amounts to discounts, which may not be a 1-to-1 conversion. Plans may also need to revise contracts with pharmacies to reflect the conversion to reduced prices. Plan-pharmacy contract changes would likely be necessary if implementation of the new safe harbor requires chargebacks through an entity other than a pharmacy benefit manager (PBM). Additionally, under such a system, plans may also have to contract with the chargeback administrators so that the appropriate chargeback amount is paid to the pharmacy.

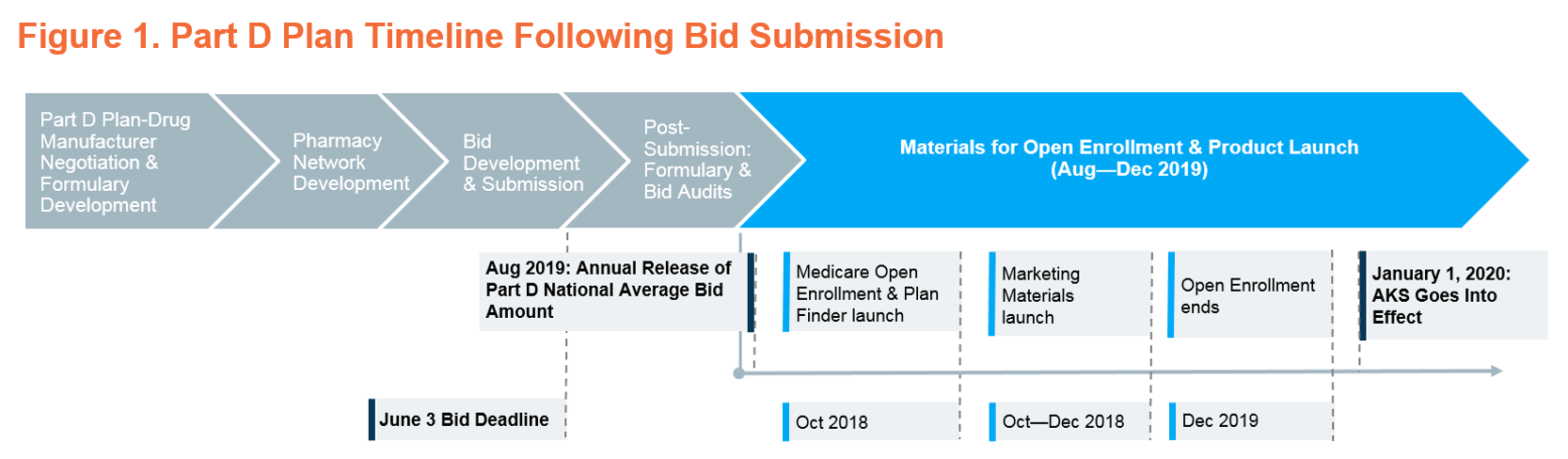

- Plan Marketing Materials Timeline & Process: If the rebate rule is effective for 2020 but plans have submitted bids and formularies based on current law, would plan sponsors be able to adjust their marketing materials? After the Annual Part D National Average Bid Amount is released on August 1 based on information submitted in bids, plans must meet a series of deadlines for marketing materials related to Medicare Open Enrollment and the start of the 2020 plan year. Plans must meet these deadlines to ensure that beneficiaries have accurate benefit, premium, and formulary information while shopping for plans. If the rebate rule is finalized and plan sponsors need to make changes to provide price reductions to beneficiaries at the point of sale, plan marketing materials could need to reflect those adjustments across thousands of plans.

- Medicare Open Enrollment & Plan Finder: Would plans be able to appropriately update Plan Finder information in time for Medicare Open Enrollment? More specifically, would plans be able to reflect changes to beneficiary cost sharing, Part D formulary and benefit design, assumptions for unit costs of prescription drugs, and the appropriate negotiated price? Delays in the release of accurate marketing and benefit information in Plan Finder could disrupt the beneficiary plan selection process—confusing, conflicting, or missing information could limit beneficiaries’ ability to select an appropriate plan. During the plan year, inaccurate information in Plan Finder would make it difficult for beneficiaries to anticipate their out-of-pocket costs.

Additional Considerations

In addition to operational and contracting challenges, plan sponsors would also face uncertainty around employer group waiver plans (EGWPs) and potential enrollment shifts, including the treatment of individuals receiving the low-income subsidy (LIS), if the rebate rule were finalized for 2020.

In particular, questions remain regarding how EGWPs—which do not submit bids and whose benefit design and cost sharing is dependent upon average Part D bids—would be able to reconcile differences between benefit designs and premiums developed under current law and plan administration based on the new safe harbor. EGWPs will not be able to participate in the 2-year demonstration that would modify risk corridors if the safe harbor changes are finalized and, as a result, will not benefit from the same level of financial protection available to other Part D plans. EGWP contracts may need to be renegotiated or modified as funds available to reduce premiums shift instead to reductions in cost sharing. EGWPs typically have more generous benefits than individual plans; further reductions in cost sharing may increase utilization by EGWP enrollees, potentially exacerbating uncertainty around expected costs.

In addition, plans will need to consider potential swings in LIS enrollment due to unpredictability in bidding under the proposed demonstration. The implementation of chargebacks or point-of-sale rebates will introduce additional complexity to the calculation of LIS cost sharing subsidies and may put plans at compliance risk without further guidance.

Comments on the proposed rule to revise the AKS safe harbors were due on April 8. More information on the CMS guidance to health plans is available here.

For more Avalere news and updates, connect with us.

Funding for this research was provided by CVS Health. Avalere maintained full editorial control.