CMS Best Price Discount Stacking Proposal May Trigger AMP Cap

Summary

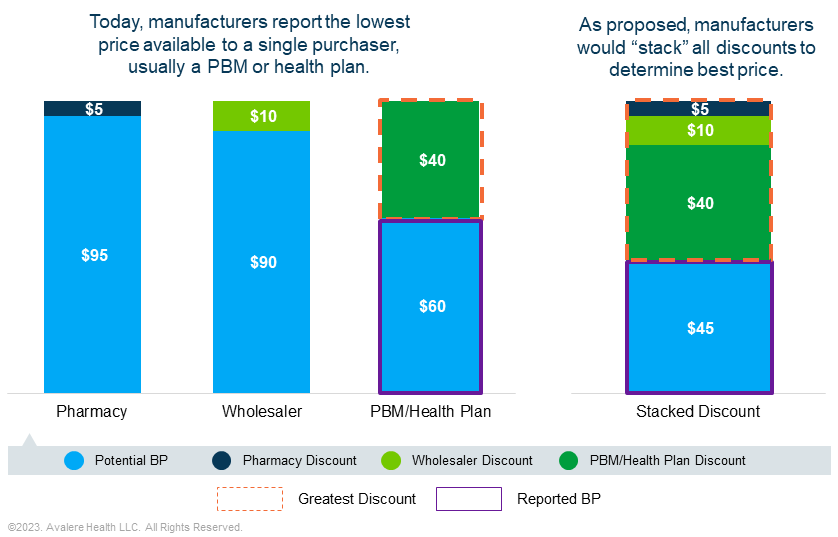

Requiring manufacturers to stack all discounts provided through the supply chain could increase Medicaid rebate liability and complicate rebate dynamics.The Centers for Medicare & Medicaid Services (CMS) has proposed a change to best price (BP) determination that may increase the amount of Medicaid rebates manufacturers are required to pay. A recent proposed rule, “Misclassification of Drugs, Program Administration and Program Integrity Updates Under the Medicaid Drug Rebate Program” (MDRP), changes the definition of BP to require manufacturers to “stack” all discounts provided throughout the supply chain. Currently, manufacturers report BP as the lowest price available to any BP-eligible entity rather than aggregated across multiple entities. CMS’s proposal could require manufacturers to report a lower BP than they do today, potentially resulting in higher Medicaid rebates that could be greater than the cost of the drug.

The MDRP formula requires manufacturers to pay rebates that ensure Medicaid programs get the lowest or “best price” and pay back any price increases higher than inflation. At minimum, manufacturers of most brand drugs pay a rebate of 23.1% of the average manufacturer price (AMP). If BP is a discount greater than 23.1% of AMP, the rebate would be the difference between AMP and BP. The inflation portion of the rebate would be added to this base rebate to arrive at the total rebate amount.

While the proposed change to BP determination is likely to increase rebate liability on its own, it may interact with other policies to further expand Medicaid rebate exposure. Beginning on January 1, 2024, the cap that limits mandatory Medicaid rebates to 100% of the drug’s AMP will be removed. This could result in manufacturers experiencing a substantial increase in Medicaid rebate liability, particularly for drugs whose prices have increased. The proposed rule’s stacking provision may increase the likelihood of a product’s rebate exceeding AMP, given the requirement to aggregate discounts offered along the supply chain.

Additionally, the Inflation Reduction Act (IRA) requires CMS to negotiate a maximum fair price (MFP) for selected Part B and Part D drugs. The MFP may establish a new Medicaid BP if the MFP is lower than the total discounts negotiated with BP-eligible entities.

Manufacturers should evaluate how CMS’s proposed changes to BP could complicate rebate dynamics across markets when considering pricing, access, and advocacy strategies. This is especially true when considering these changes amid implementation of IRA drug pricing provisions and AMP cap removal. Depending on market response, changes to BP determination could impact stakeholders across the supply chain including pharmacy benefit managers (PBMs), health plans, wholesalers, providers, and pharmacies.

To learn more about best price discount stacking, connect with us.