CMS Introduces Changes to CAR-T Reimbursement in IPPS Proposed Rule

Summary

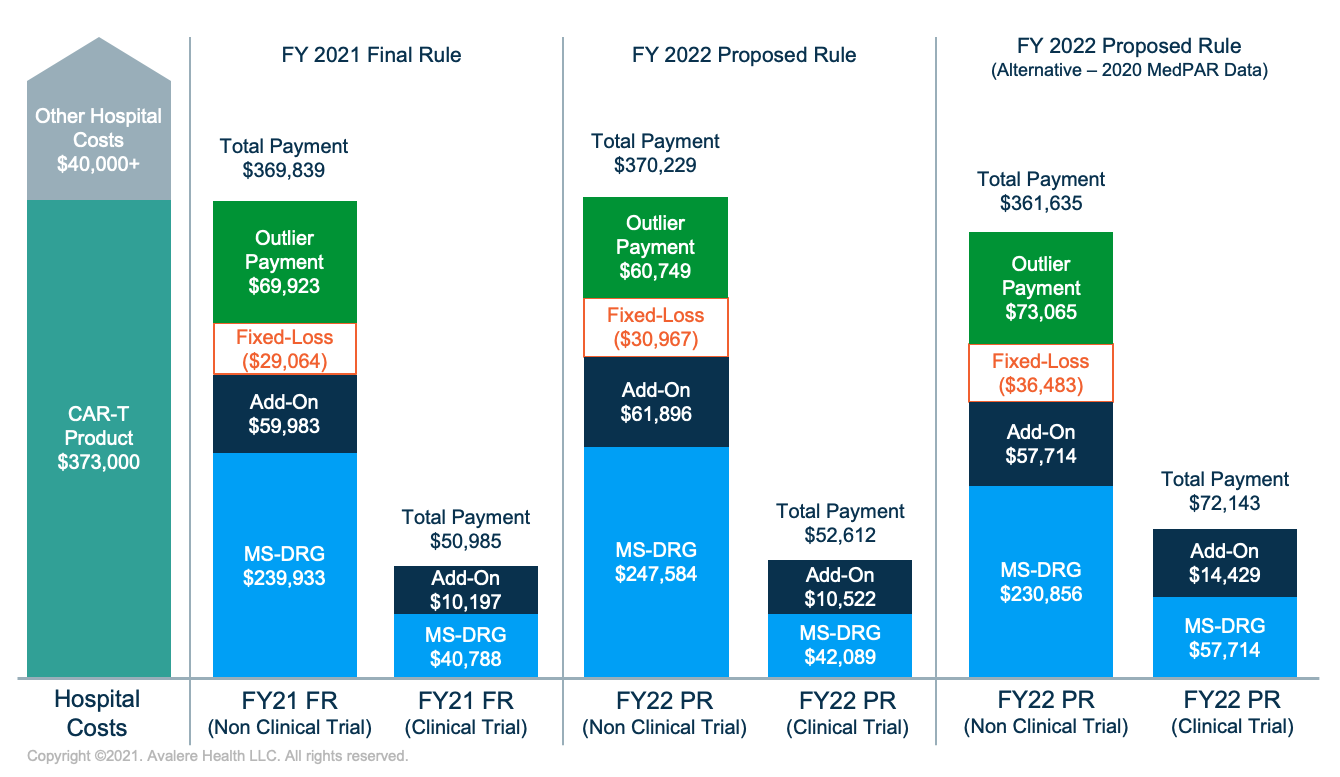

Policy proposals for Medicare’s CAR-T inpatient reimbursement build on policies finalized in last year’s rulemaking. Looking ahead, stakeholders will continue to weigh the appropriateness of payment.In the fiscal year (FY) 2022 Inpatient Prospective Payment System (IPPS) proposed rule, the Centers for Medicare & Medicaid Services (CMS) proposed continuing to utilize its newly established Medicare Severity Diagnosis-Related Group (MS-DRG) for Chimeric Antigen Receptor T-cell (CAR-T) treatment stays, with differential reimbursement based on whether the product was provided as part of a clinical trial. However, the CMS proposed using 2019 spending data to establish the relative weight for the MS-DRG rather than using 2020 spending data, due to the impact of the COVID-19 pandemic on inpatient utilization patterns in 2020. Additionally, the CMS proposed adding additional procedure codes affecting pre-MDC MS-DRG 018 and renaming the MS-DRG to “Chimeric Antigen Receptor (CAR) T-cell and Other Immunotherapies” to account for these changes. The financial impact of these changes will vary by hospital, and as a result reimbursement may fall short of fully recognizing provider costs of treatment in some cases. This proposed continuation of policy will impact the way future inpatient cell-based immunotherapies are paid by Medicare, accounting for a broader suite of treatments and allowing for continued clinical trial development.

Background

Since the first Food & Drug Administration (FDA) approval of a CAR-T product in 2017, concerns have persisted over how the Medicare program would reimburse for these products, which are currently administered in the inpatient setting and have a significant cost for providers (i.e., $373,000 average sales price for 1 indication). Hospital inpatient reimbursement is calculated on an episodic basis using a MS-DRG base payment rate that is adjusted for factors such as hospital geography, new technology add-on payment (NTAP), and outlier payments.

In FY 2021, inpatient stays with CAR-T treatment are assigned to DRG 018 (Chimeric Antigen Receptor (CAR) T-cell Immunotherapy), which has an average national reimbursement rate of $239,933. Hospitals may receive additional payments for products with NTAP status; however, the NTAP is limited to 65% of the product cost and no CAR-T products currently have NTAP status (though the CMS is considering establishing NTAP for 4 new CAR-T products in FY 2022). Outlier payments are available to hospitals to cover extremely costly cases in which the costs exceed the MS-DRG payment, NTAP payment (if applicable), and the fixed-loss threshold of $29,064. Even with these adjustments, Medicare reimbursement for CAR-T cases today sometimes fails to cover total hospital costs, with potential negative impacts on provider uptake and patient access.

Proposed FY 2022 Changes

For FY 2022, the CMS proposes several policies that would impact provider reimbursement for CAR-T.

- Payment Increase for CAR-T Cases: Due to an increase to the proposed base operating and capital rates for all IPPS payments and an increase in the proposed relative weight for MS-DRG 018, the proposed base payment for CAR-T cases in FY 2022 would increase by 3.2% to $247,584.

- Rename and Broaden CAR-T MS-DRG: The CMS proposed renaming MS-DRG 018 to “Chimeric Antigen Receptor (CAR) T-cell and Other Immunotherapies” to reflect the proposed addition of new procedure codes for non-CAR-T-cell therapies and other immunotherapies that would map to the MS-DRG. Over time, this would lead to more cases being considered when setting reimbursement.

- Use of 2019 Data to Establish Payment: The CMS proposed using 2019 Medicare Provider Analysis and Review (MedPAR) data to set relative weights for MS-DRGs, going against a standard process that would have incorporated 2020 MedPAR data for FY 2022. This proposed change in methodology is due to the COVID-19 pandemic’s impact on utilization during 2020, which may distort cost estimates. In the case of CAR-T, this means that FY 2022 rates will be largely based on cost data incorporating the 2 on-market products that were available in 2019 despite additional products having been approved or used in clinical trials since. The CMS is soliciting comments on the decision to use 2019 MedPAR data. If the CMS used the alternative approach incorporating 2020 MedPAR data, the base payment rate would be lower ($230,856) than the proposed rate.

- Adjustment for Clinical Trial Cases: The CMS proposed continuing to reimburse for CAR-T clinical trial cases, which do not incur drug costs, at a lower rate than non-clinical trial cases. The CMS stated in the FY 2021 final rule that clinical trial cases for CAR-T treatment typically cost 17% of non-clinical trial cases and therefore applied an adjustment factor of 0.17 to the relative weight of MS-DRG 018 for these cases. Continuing this policy would result in a base rate for clinical trial cases of $42,089 in FY 2022. However, the CMS noted that if 2020 MedPAR data were incorporated in rate-setting for FY 2022, the clinical trial case adjustment would increase from 17% to 25%, for a higher overall payment amount ($57,714).

- Product NTAP Decisions: There are currently no CAR-T therapies with NTAP status, although 4 applications for NTAP were included in the FY 2022 proposed rule. The CMS will accept public comment on whether the following CAR-T products meet the newness, cost, and clinical improvement criteria required for NTAP status in FY 2022:

- TecartusTM (brexucabtagene autoleucel), for treatment of relapsed/refractory mantle cell lymphoma

- Breyanzi® (lisocabtagene maraleucel), for treatment of relapsed/refractory large B-cell lymphoma

- Abecma® (idecabtagene vicleucel), for treatment of relapsed/refractory multiple myeloma

- Ciltacabtagene autoleucel, for treatment of multiple myeloma

Figures not to scale.

Assumptions:

- Hospital charges for CAR-T episode are kept constant across all examples, consistent with the geometric mean charges included in the FY 2021 Final Rule AOR/BOR file ($1,387,945)

- Hospital has an average operating and capital cost-to-charge ratio of 0.3

- Hospital has an indirect medical education adjustment factor of 0.2 and disproportionate share hospital adjustment of 0.05

- Hospital area wage index is 1.0

Key Considerations Looking Ahead

Stakeholders should consider several outstanding questions and potential implications stemming from the proposed 2022 changes for existing assets and for future cell and gene therapies.

- Impact of DRG 018 Expansion: The proposed FY 2022 base rate for MS-DRG 018 is generally in line with FY 2021. Total reimbursement will vary by hospital and case, with adequate reimbursement in some cases but with potential financial risk for hospitals on significantly costly cases. However, the inclusion of additional immunotherapies that could be mapped to MS-DRG 018 may lead to reductions in the base rate over time. This could result in uniform reimbursement for cases that differ significantly in resource costs.

- Combined NTAP Consideration: In cases where 2 products under consideration for NTAP are viewed as substantially similar (i.e., have the same targeted therapeutic outcome, same or similar mechanism of action, and map to the same MS-DRG), the CMS may consider those products as a single application for the purposes of NTAP. This means that the CMS will blend cost data for both products to arrive at a maximum NTAP add-on payment. Manufacturers should consider how blended NTAPs could impact them in the rapidly developing CAR-T space. In this proposed rule, the CMS has indicated it is seeking additional information on whether to consider ciltacabtagene autoleucel and ABECMA® (idecabtagene vicleucel) as a single NTAP application given perceived substantial similarity.

- Alternative Payment and Value-Based Arrangements: Between the 2021 IPPS final rule and the 2022 proposed rule, the CMS finalized the Medicaid Value-Based Purchasing final rule to establish flexibilities to implement value-based arrangements in the commercial and Medicaid markets, which could be attractive financing options for CAR-Ts. In the coming years, the CMS may consider whether innovative approaches should extend to the Medicare Fee-for-Service or Medicare Advantage space, potentially through a Center for Medicare & Medicaid Innovation demonstration.

- Potential for Shifts in Site of Care: As CAR-T treatment toxicity profiles increasingly make a move to outpatient sites of care more viable, providers may face different financial risk considerations. However, a shift in volume toward the outpatient setting may also result in increased scrutiny on Medicare payment in that setting, potentially resulting in changes to current reimbursement, which is ASP plus 6 percent for separately payable drugs.

To receive Avalere updates , connect with us.