EO on Rebate Reform Raises Key Considerations for Pharmacies

Summary

As currently written, a proposed rule on rebate reform from January 2019 may impose financial and operational challenges for pharmacies related to cash flow and new technology requirements.Introduction

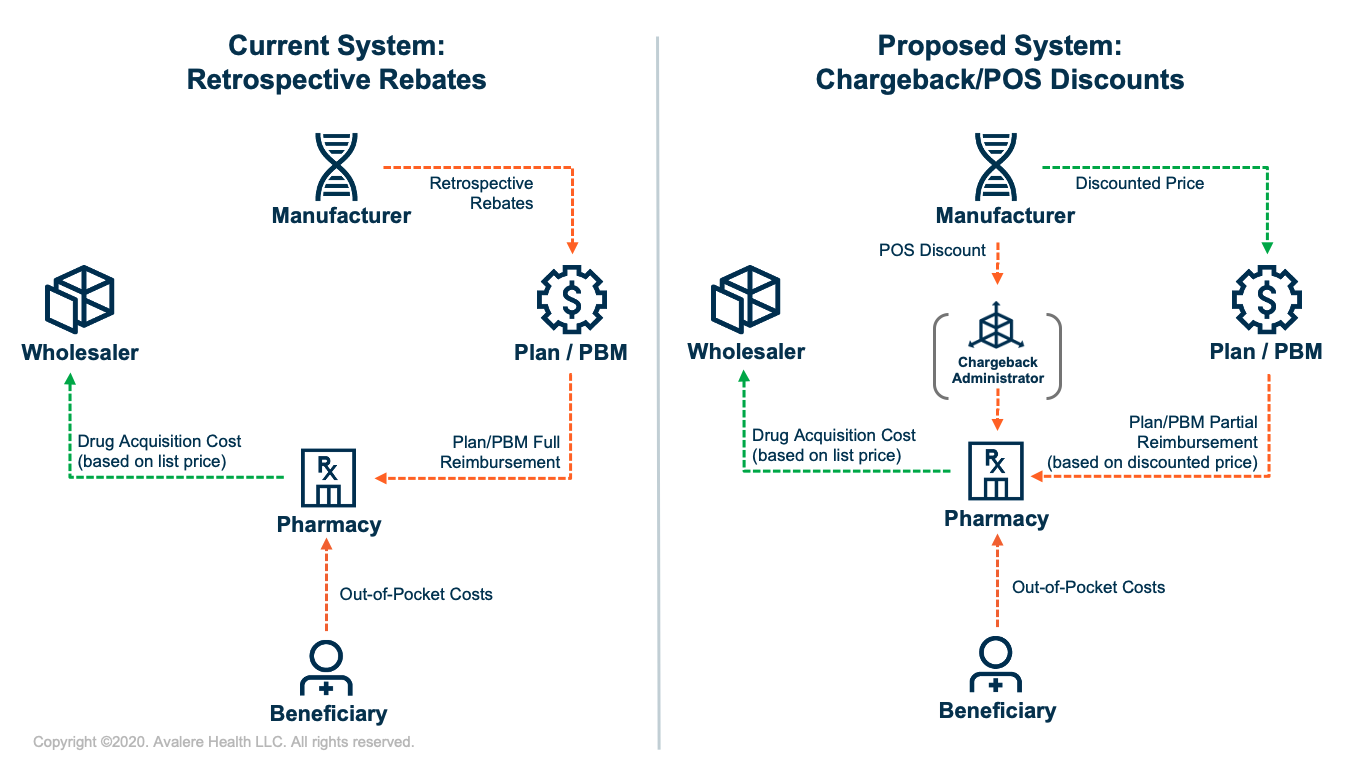

An executive order (EO) released on July 24 directs the Secretary of the Department of Health and Human Services (HHS) to finalize a January 2019 proposed rule that would eliminate retrospective prescription drug rebates paid to plans and pharmacy benefit managers (PBMs) and replace them with point-of-sale (POS) discounts. The HHS would effectuate this change through reform of Anti-Kickback Statute safe harbors and the creation of a new “chargeback system” for payment of discounts at the POS (Figure 1).

Under the new chargeback system, reimbursements to pharmacies would likely be split into 2 streams—direct payments from plans/PBMs and chargeback payments from manufacturers. For drugs with POS discounts, pharmacies would still acquire the drug based on the list price, but upon dispensing the drug would be partially reimbursed from the plan/PBM based on the discounted price. The manufacturer would then reimburse the pharmacy for the remainder (i.e., the POS discount amount) through a chargeback.

Operational and Financial Considerations for Pharmacies

The proposed rule included limited details on how the chargeback system would be operationalized and regulated, raising important operational considerations and uncertainties for pharmacies related to chargeback payments.

Timing of Chargeback Payments and Implications for Cash Flow: Today, plans/PBMs reimburse pharmacies based on the negotiated price of a drug, which is roughly equal to the list price. However, under the proposed rule, pharmacies would receive lower plan/PBM reimbursements based on the lower, discounted price, and manufacturers would pay pharmacies the remaining amount in the form of a chargeback. However, this model could create cash-flow challenges for pharmacies if chargeback payment delays occur and pharmacies are left holding financial risk for a significant portion of the acquisition cost for certain brand drugs with discounts. For example, the Medicare trustees estimate that manufacturer rebates and other price concessions accounted for 25% of Part D spending in 2018, which could represent a significant amount of new risk if all current rebates are converted to POS discounts.1

Required Technology Changes and Associated Costs to Implement Chargebacks: Significant modifications to claims transmissions, information sharing, compliance measures, and data standards between pharmacies, plans/PBMs, manufacturers, and the chargeback entity may be necessary to accurately capture, relay, and adjudicate POS discounts for each claim. This amount will vary by plan, patient, and drug, likely further complicating the informational flow. Pharmacies may need to bear costs of modifying technology systems and may face additional processing fees for chargeback payments.

Further Considerations and Next Steps

The proposed rule includes few details on the operational model for chargeback payments and, as currently written, is unclear about total pharmacy payment. Given these challenges, there are open questions as to what may be included in a final rule and whether a different approach to operationalizing POS discounts may be considered, as well as the timeline for implementation. Additionally, regulatory next steps for the proposed rule remain uncertain, given conditions set forth in the EO requiring the secretary to publicly confirm that the rule would not increase beneficiary premiums, federal spending, or total patient out-of-pocket costs. The 2020 elections and other potential drug pricing reforms such as Part D benefit redesign will also influence the trajectory of rebate reform in Medicare Part D.

To learn more about Avalere’s ability to deliver policy analysis informed and backed by robust data analytics on drug pricing and rebate reform policies, especially in preparation for post-election policy scenarios, connect with us.

Notes

- Estimates by the Centers for Medicare & Medicaid Services’ Office of the Actuary and the Congressional Budget Office assume that under the proposed rule 75%–85% of current Part D rebates would be applied to discounted prices.