FDA Supply Chain and Quality Balancing Act: What’s Next?

Summary

The industry should expect and prepare for changes to regulatory oversight of drug supply chains and quality.With an increasingly globalized medical product market, supply chain reliability and harmonization of quality management are essential to ensure patient access to safe, critical medicines. The volatility of the supply chain and recent drug shortages, including shortages of chemotherapy drugs such as carboplatin and cisplatin, have put pressure on regulators and industry stakeholders to address root causes, driving legislative and regulatory momentum for supply chain and quality reform.

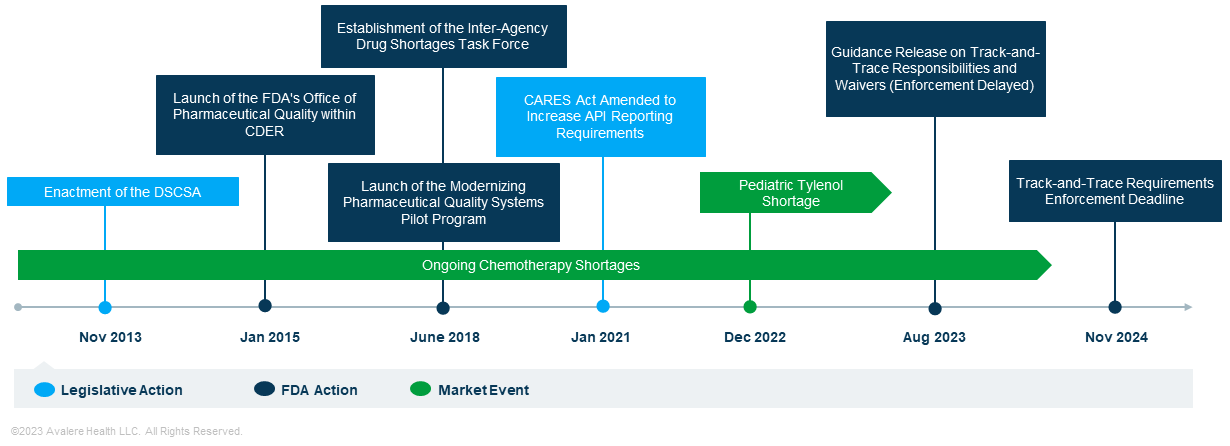

The Federal Food, Drugs & Cosmetics Act (FD&C) requires the Food & Drug Administration (FDA) to oversee safety of medicines through two core pillars that continue to evolve: quality of products entering interstate commerce and integrity of the pharmaceutical supply chain. However, as recent events (see Figure 1) have shown, meeting the needs of global pharmaceutical supply chains, mitigating drug shortages, and protecting the integrity of drug quality—tasks that must occur all at the same time—poses challenges for both regulators and industry.

Recent Developments Impacting FDA Supply Chain Oversight

Recent shortage events along with the public health emergency have fueled discussions around the need for oversight without creating undue burden. For example, due to recent chemotherapy shortages, the FDA temporarily allowed imports of unapproved chemotherapy drugs. This action raised questions from Congress and the industry about whether the FDA has the appropriate tools and resources to predict and address shortages and supply chain issues.

Discussions are coming to a head with the latest implementation phase of the Drug Supply Chain Security Act (DSCSA). The law defines supply chain stakeholders and intends to improve drug quality and prevent safety issues through track-and-trace requirements for manufacturers and other trading partners. This represents a drastic shift in the FDA’s authorities and industry compliance requirements for supply-chain integrity. Since the law’s adoption in 2013, the industry has established lot-level tracking and serialization, and the package-level tracking phase was set to be complete by November 27, 2023, creating waves of urgency and discussion within the industry. On August 28, however, the FDA delayed the enforcement of package-level tracking compliance, pushing the deadline for select policies to November 27, 2024, and leaving the healthcare industry uncertain around the impact of delaying policy enforcement on supply chain integrity and quality.

API: Active Pharmaceutical Ingredient; CARES: Coronavirus Aid, Relief, and Economic Security; CDER: Center for Drug Evaluation and Research

Implications for the Industry

The industry, including manufacturers, wholesale distributors, and dispensers, should consider the remaining effort required to ensure compliance with the package-level DSCSA track-and-trace requirements once enforced. Many stakeholders have not yet established the necessary infrastructure for full DSCSA enforcement. While stakeholders received an extension of the timeline, the FDA stated it intends for the extension to act as a grace period and encourages stakeholders to continue preparations.

To prepare for enforcement, as a first step, trading partners should ensure complete understanding of the legislative and regulatory requirements and expectations, including their impact on broader business goals and product market-access strategies. Subsequently, stakeholders should conduct internal assessments of trading processes to evaluate readiness and coordinate with each other to ensure interoperability. Trading partners should also begin considering eligibility for waivers to the requirements outlined in recent FDA guidance.

While DSCSA enforcement may impose an additional administrative burden on trading partners in the short term, the law aims to increase transparency in the pharmaceutical supply chain in the long term. Supply chain transparency can provide industry stakeholders, regulators, and legislators with information that could allow earlier identification of potential shortages and supply chain inefficiencies and their root causes. Additional time for strategy development and tailored solutions could, in turn, mitigate last-minute responses that may compromise product quality.

Proposed Reform

Pressures from many stakeholders will likely lead to adjustments in the FDA’s authority, including a change in the balance of existing authority over supply chain and quality. Several proposed bills have been introduced in Congress to support mitigation of supply shortages, including the Drug Origin Transparency Act and the Ensuring Access to Livesaving Drugs Act. As Congress continues to contemplate the FDA’s authority, industry should monitor any changes that may affect their regulatory, manufacturing, market-access ,and reporting processes.

How Avalere Can Help

Avalere experts in regulatory strategy and market access can help you understand policy pressures related to drug quality and the supply chain, including DSCSA requirements, the evolving quality framework, and the broader impact of these policies on FDA engagement and on market access. To learn more about how we can help your organization prepare for and respond to the changes, connect with us.