How Will the IRA Impact Product Launch Prices?

Summary

IRA inflation rebates and drug price negotiation will impact drug launch prices in Medicare, with spillover effects in the Medicaid and commercial markets.The Inflation Reduction Act (IRA) is bringing landmark policy changes to the healthcare industry, raising important questions about pipeline investment, drug price negotiation, and reimbursement. In the IRA Question of the Week series, Avalere answers the pressing questions shaping healthcare stakeholders’ strategic decision making as the law is implemented.

In this installment, Avalere experts discuss how prescription drug launch prices must account for the IRA’s Medicare inflation rebates and negotiation provisions, and how the changes could also influence pricing in the Medicaid and commercial markets.

The Effects of Inflation Rebates

The IRA requires manufacturers to pay rebates to the government when price growth for drugs covered under Part B and Part D exceeds the rate of inflation. Price will be evaluated using the manufacturers’ average sales price for Part B drugs and average manufacturer price (AMP) for Part D drugs. If manufacturers do not comply with rebates, the Centers for Medicare & Medicaid Services (CMS) may issue civil monetary penalties of 125% of required rebate amounts.

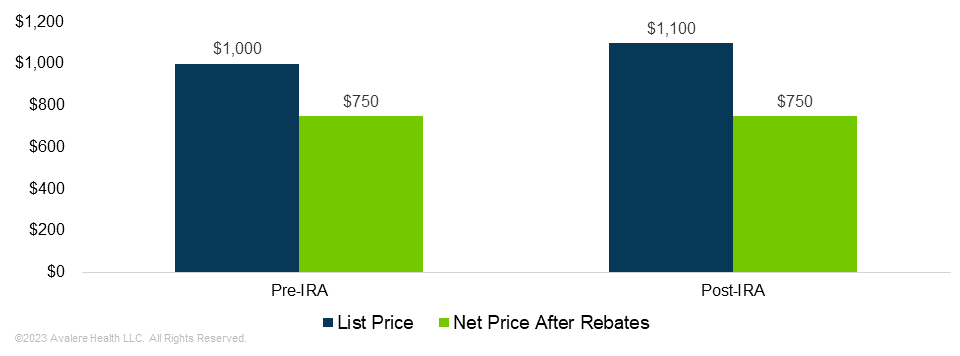

Inflation rebates are designed to limit price increases after launch but may result in higher initial prices for Part B and Part D drugs. The Congressional Budget Office expects manufacturers to set higher launch prices than they would without inflation rebates. Over time, manufacturers could increase prices less than they would have before. Due to the higher initial price, however, the net price would not decrease compared to a hypothetical scenario without inflation rebates.

The Effects of Negotiation

The IRA’s Medicare Drug Price Negotiation Program accelerates the lifecycle of Part B and Part D products. Small molecule drugs are eligible for negotiation 7 years after initial approval, and biologics are eligible after 11 years. At the point of negotiation, the manufacturer’s net revenue may decline substantially compared to before the negotiation. Thus, manufacturers of products that are likely to be negotiated (i.e., those products with high Medicare spending) have a condensed timeframe to recoup investments in products. The condensed period may lead to increased launch prices as manufacturers prepare for eventual price reductions in Medicare, especially for products targeted for the Medicare population.

Manufacturers may also be incentivized to launch drugs at higher prices or pull back on rebates due to the IRA’s definition of maximum fair price (MFP). The law caps a product’s MFP at the lesser of the Medicare net price or a percentage of non-federal AMP (non-FAMP) based on the number of years since the Food & Drug Administration approved the product. Negotiated prices are expected to fall below the MFP ceiling. To the extent competitive dynamics allow, manufacturers may pursue pricing strategies that are less reliant on rebates to manage the eventual ceiling price for a product. In classes where rebates are less of a factor in driving coverage and access, manufacturers may set higher prices to ensure that the negotiation price window is maximized assuming a ceiling based on non-FAMP.

Potential Spillovers

Inflation rebates and negotiated pricing only apply to the Medicare market, but these policies are expected to have wider effects, spilling over into the Medicaid and commercial markets.

Higher launch prices may increase net Medicaid spending on some products prior to Medicare negotiation. Given Medicaid’s mandatory 23.1% discount, a drug that launches at $1,000 may cost Medicaid $769 in the launch year, excluding any additional rebates a state may negotiate. If a manufacturer increases the launch price by 10%, Medicaid’s net cost would be $846.

The spillover effects of the Medicare inflation rebate provisions into commercial markets will likely depend on the target patient populations for a given drug. If a drug targets a condition very common amongst Medicare beneficiaries, manufacturers will likely be more cautious about price increases due to the risk of triggering the IRA’s inflation rebates. However, if the drug targets a condition uncommon in Medicare populations, the manufacturer may be less hesitant to increase the list price due to limited exposure to Medicare inflation rebate requirements.

The CMS’s reliance on Medicare net price and non-FAMP to set the MFP ceiling may incentivize manufacturers to raise net prices. However, the net cost to plans may not increase due to the new importance of non-FAMP. Non-FAMP and AMP do not depend on any rebates that manufacturers pay to plans and pharmacy benefit managers. Thus, while manufacturers may increase launch price to maximize non-FAMP, manufacturers could also increase rebates to plans and PBMs without disadvantaging the manufacturer regarding MFP.

Dive Deeper

Increased launch prices could have a myriad of impacts for manufacturers beyond revenue. Several IRA provisions are designed to lower drug costs, and—while net costs may not rise—higher list prices could continue to be a communications challenge for manufacturers. Competitive pricing could also change under the IRA. Data collection and evidence generation requirements for negotiation may also affect launch price decision making with CMS requiring numerous data points pertaining to pricing throughout a product’s lifecycle when that product is selected for negotiation.

Avalere experts in drug pricing, Medicare, evidence strategy and generation, and plan design can help you understand what IRA provisions mean for your organization and weigh in on key implementation decisions. To better prepare for and shape the changing healthcare landscape in 2023 and beyond, connect with us.

Webinar | 2026 Part D Plan and Manufacturer Contracting Strategies

On Wednesday, October 30, at 1 PM ET, join our webinar to learn how Part D redesign and drug price negotiation will shape the Plan Year 2026 market, and what this means for manufacturers and plans.