IRA Negotiation Creates Ripple Effects Across Drug Markets

Summary

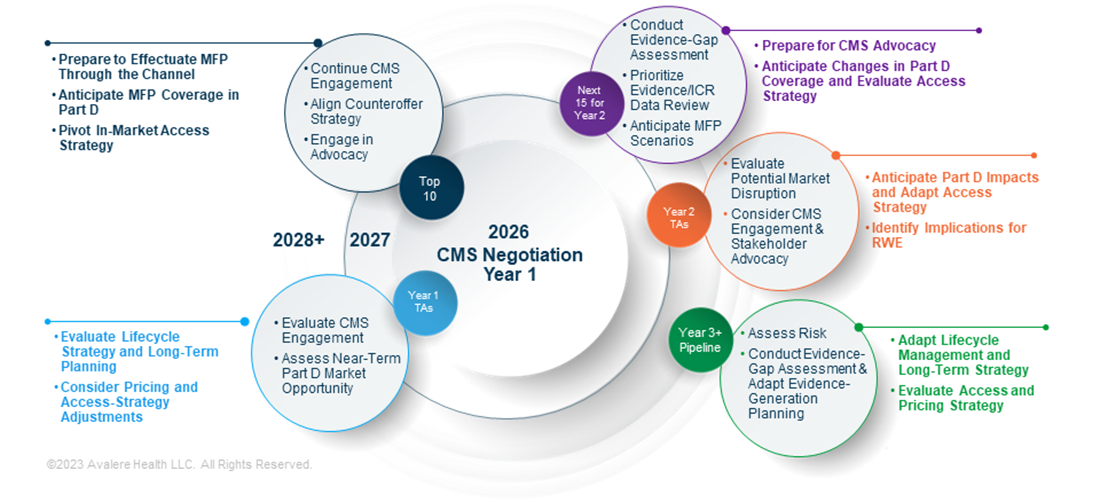

Medicare negotiation has ripple effects across therapeutic markets, requiring manufacturers to reassess strategies to stay ahead of the changing drug landscape.As the Centers for Medicare and Medicaid Services (CMS) implements Year 1 of the Inflation Reduction Act’s (IRA) Medicare Drug Negotiation Program through initial meetings with selected manufacturers and patient-listening sessions, stakeholders are already anticipating some of the downstream implications across therapeutic markets and implementation years. For manufacturers, the policy introduces new direct and indirect market impacts and requires both near-term assessment and longer-term planning across product portfolios, as demonstrated in Figure 1.

MFP: Maximum fair price; TA: Therapeutic area; ICR: Information collection request; RWE: Real-world evidence.

Manufacturers of selected products and manufacturers with products in implicated therapeutic areas need to evaluate key components of their access, advocacy, and lifecycle strategies in the near term to prepare for policy implementation and market effects.

2026: Year 1 Implementation

Among the list of 10 Part D drugs selected for 2026 negotiation, products for the treatment of cardiovascular disease, autoimmune conditions, diabetes, and chronic kidney disease are heavily represented in the selected drug list and sit in highly competitive therapeutic areas. A range of near-term activities is important for manufacturers to prepare for 2026.

Most immediately, manufacturers of selected products for initial price applicability year 2026 are focused on CMS engagement, stakeholder advocacy, and counteroffer strategy within the negotiation process to arrive at a favorable MFP. As part of this process, manufacturers, CMS, and other stakeholders will need to identify a path to effectuate MFP through the channel, including through a Medicare transaction facilitator entity. Manufacturers will also need to consider access strategies as Part D plans and pharmacy benefit managers work to cover and manage a product at the MFP.

Manufacturers in the broader TA will need to anticipate how selected competitors are evolving their Part D market strategies and identify access risks or opportunities for non-selected products. This will help inform potential changes in Part D contracting strategy and broader lifecycle planning.

2027: Year 2 Implementation

CMS will announce the selection of 15 Year 2 Part D drugs on February 1, 2025, and require manufacturers of selected products to submit their market data and value dossiers within 30 days. Manufacturers anticipating selection for Year 2 should begin preparing their strategy and ensuring internal alignment soon.

Manufacturers with products expected for Year 2 selection have the near-term opportunity to evaluate the strength of their existing evidence and adapt evidence development strategies to better position their products. Manufacturers will also be able to translate learnings from 2026-selected products and TAs to create an effective CMS engagement and advocacy strategy, develop mock MFP scenarios, and review their market data and evidence package in advance. Manufacturers not selected for Year 2 but with products in those TAs should start to anticipate market impacts, prepare advocacy plans, and consider potential changes to their Part D access strategy.

2028+: Year 3 and Beyond Implementation

Beginning in 2028, Part B drugs will be eligible to be among the 15 products selected for Year 3 negotiation. Despite selection for Year 3 and beyond being several years away, manufacturers have an opportunity for near-term assessment and decision-making that that can substantially influence risk and eventual market impact.

For example, manufacturers may consider adapting lifecycle management strategies—including the pursuit of new indications or formulations—to manage risk. A significant opportunity also exists to shape evidence generation strategies to address and prepare for the requirements of a future negotiation selection. Manufacturers can incorporate the negotiation pressures into their long-term planning and access strategies.

Similarly, manufacturers making early pipeline decisions should use an IRA-specific framework that can inform value assessment in TAs subject to negotiation, route of administration and packaging, and clinical development strategies.

Looking Ahead

The IRA’s ripple effects will be long lasting, and manufacturers will need to adopt a product-specific approach to stay ahead of the changing drug landscape. Avalere experts in policy, CMS engagement, market access, and evidence assessment have completed more than 100 strategic projects for clients in the first year since the passage of the IRA and can help you understand what the law’s drug-pricing provisions mean for your organization.

To better prepare for and shape the changing healthcare landscape in 2023 and beyond, connect with us.