“Most Favored Nation” EO Creates New Questions on International Prices

Summary

On September 13, the Trump Administration released the much-anticipated “Most Favored Nation” (MFN) Executive Order (EO), calling for models that would cap the price Medicare pays for select Part B and D drugs. The President’s EO underscores the administration’s continued focus on reducing prescription drug price disparities between the US and other developed countries.While the order is aligned with the administration’s priority to reduce drug prices in Medicare, the text of the EO has generated new questions and has created uncertainty for healthcare stakeholders. Almost 2 years after proposing a plan that would tie Medicare prices to an international benchmark, the administration appears to be deviating from the International Pricing Index (IPI) structure laid out in the 2018 IPI advance notice of proposed rulemaking (ANPRM) and for the first time gives formal directive to include Part D drugs.

Beyond the continued lack of clarity around what “price” the model would use (e.g., ex-manufacturer, list vs. net) and how Health and Human Services would collect it, there are 2 new fundamental questions as to how the updated MFN proposal would work.

- How would the “Most Favored Nations” eligible for inclusion in the model be selected?

- How would international prices be adjusted by differences in volume and per-capita gross domestic product (GDP)?

Selecting the “Most Favored Nations” for Inclusion

Previous proposals to introduce international reference pricing in the US, such as the IPI or the House Democrats Lower Drug Costs Now Act (H.R.3), sought to peg Medicare reimbursement to an average across a set of foreign prices within an established set of countries. However, the MFN approach instead anchors to the lowest price for a product sold across member countries of the Organization for Economic Cooperation and Development (OECD) with a comparable per-capita GDP, after adjusting for volume and differences in GDP. The EO does not clarify how volume would be defined or how the adjustment would be made, leaving that as a major outstanding question.

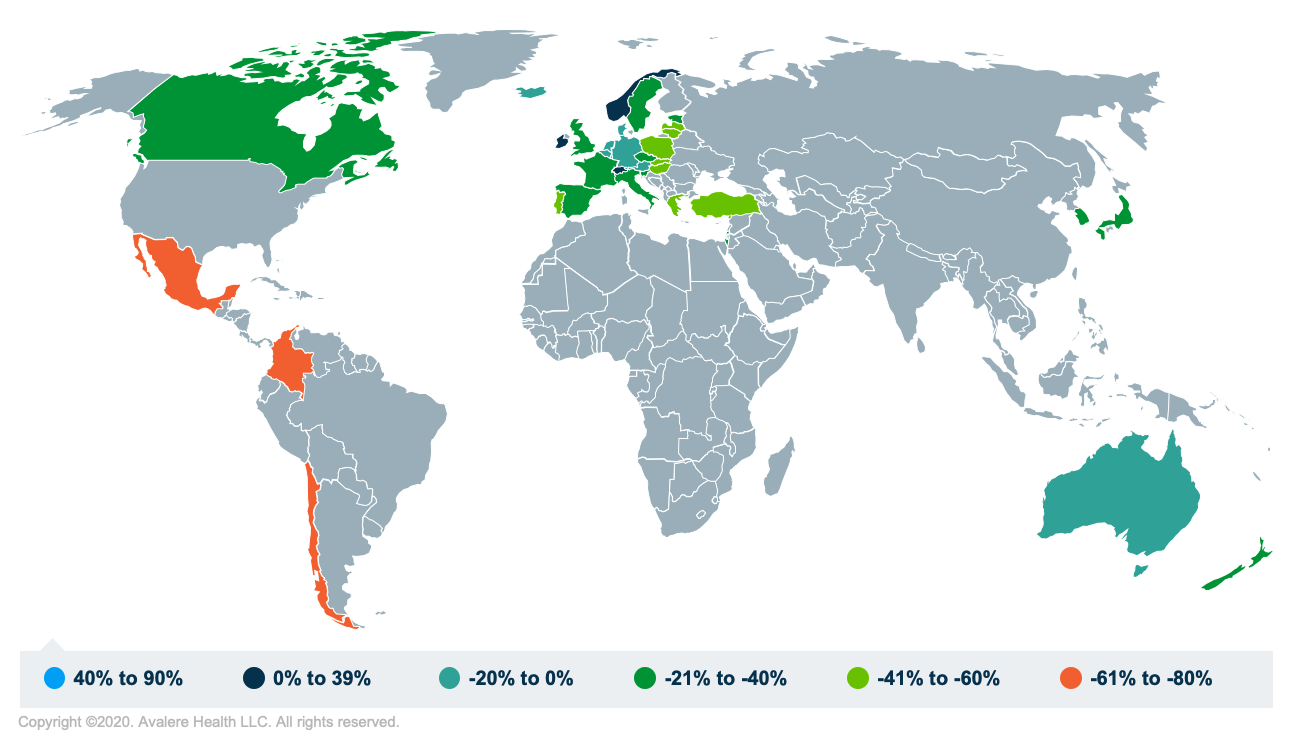

Avalere analysis reviewed the disparities in per-capita GDP among OECD members to better understand which OECD countries could be included in this potential model. Among a total of 37 OECD countries with a wide range of per-capita GDPs, a MFN approach may significantly increase the potential target countries from the 14 countries proposed in the 2018 IPI ANPRM and the 6 countries included in H.R.3.

Note: 0% means the estimated GDP per capita is equal to the US

* OECD (2020), GDP (indicator). doi: 10.1787/dc2f7aec-en (Accessed on 15 September 2020)

^Avalere assessment of OECD (2020) per capita 2019 GDP data

As highlighted in Figure 1, per-capita GDP across OECD members ranges from 75% lower to 86% higher than that of the US. Depending on the definition of “comparable per-capita GDP,” as many as 24 countries come within +/- 40% of US per-capita GDP.

Adjusting Prices in the “Most Favored Nation” Model

Key questions about the MFN proposal are around the use of GDP not only to determine target countries but also in adjusting prices. To attempt to develop a methodology for adjusting international prices by the relative differences between the US and OECD per-capita GDPs, Avalere determined the percentage change that would be required to align a country’s per-capita GDP with that of the US.

When adjusting based on these differences, Avalere estimates that OECD member country prices could be adjusted upward by as much as 305% (Colombia) or down by 46% (Luxemburg) to align per capita GDPs with the US (Table 1) and serve as the MFN price. A prescription drug in a lower per-capita GDP country like France could be adjusted to a higher price for purposes of determining the new US benchmark. Conversely, a prescription drug in a higher per-capita GDP country like Ireland could, though this is much less certain under the current language of the EO, see its price “decreased” for the purposes of the benchmark.

In short, per-capita GDP differences among the countries selected could materially drive the selected MFN and the prices reimbursed by Medicare.

The second part of the adjustment—volume—remains significantly less clear. Adjusting for volume at a country-specific level will be subject to the selected weighting and formulas employed by the administration. For instance, how the administration weights a small-population, low-volume country will meaningfully influence the model.

Conclusion

In summation, the MFN EO leaves significant questions, and any further administrative action implementing it would need to better define how the model would identify the range of per-capita GDPs considered “comparable,” what drugs volumes would be used for adjustment, and what pricing sources would be used for calculating MFN. Any of these parameters could significantly affect the impact and potential savings from the MFN proposal in Medicare.

To learn more about Avalere’s work related to drug pricing policy and international reference pricing, connect with us.

Appendix

Note: Avalere’s analysis in Table 1 does not account for the variation in drug prices across countries. The analysis assesses the variation of per-capita GDP relative to the US and estimates a price adjustment for each country.

| Country | GDP (Total, US Dollars Per Capita)* | Per-Capita GDP Relative to the US^ Note: 0% means the estimated GDP per capita is equal to the US |

Estimated Required Percentage Change to Prescription Drug Prices in Each Country to Align with US Per-Capita GDP^ | Included in IPI ANPRM | Included in H.R.3 |

|---|---|---|---|---|---|

| United States | $65,143 | 0% | 0% | — | — |

| Luxembourg | $120,980 | 86% | -46% | — | — |

| Ireland | $88,496 | 36% | -26% | Yes | — |

| Switzerland | $70,986 | 9% | -8% | — | — |

| Norway | $66,831 | 3% | -3% | — | — |

| Iceland | $60,180 | -8% | 8% | — | — |

| Denmark | $59,646 | -8% | 9% | Yes | — |

| Netherlands | $59,512 | -9% | 9% | Yes | — |

| Austria | $59,120 | -9% | 10% | Yes | — |

| Germany | $56,305 | -14% | 16% | Yes | Yes |

| Australia | $55,962 | -14% | 16% | — | Yes |

| Sweden | $55,856 | -14% | 17% | — | — |

| Belgium | $54,545 | -16% | 19% | Yes | — |

| Finland | $51,414 | -21% | 27% | Yes | — |

| Canada | $51,342 | -21% | 27% | Yes | Yes |

| France | $49,145 | -25% | 33% | Yes | Yes |

| United Kingdom | $48,745 | -25% | 34% | Yes | Yes |

| Italy | $44,140 | -32% | 48% | Yes | — |

| New Zealand | $43,774 | -33% | 49% | — | — |

| Czech Republic | $43,301 | -34% | 50% | Yes | — |

| Japan | $43,279 | -34% | 51% | Yes | Yes |

| Korea | $42,925 | -34% | 52% | — | — |

| Spain | $42,193 | -35% | 54% | — | — |

| Israel | $42,162 | -35% | 55% | — | — |

| Slovenia | $40,640 | -38% | 60% | — | — |

| Estonia | $38,968 | -40% | 67% | — | — |

| Lithuania | $38,136 | -41% | 71% | — | — |

| Portugal | $36,411 | -44% | 79% | — | — |

| Slovak Republic | $34,183 | -48% | 91% | — | — |

| Hungary | $33,975 | -48% | 92% | — | — |

| Poland | $33,844 | -48% | 92% | — | — |

| Latvia | $31,194 | -51% | 102% | — | — |

| Greece | $31,413 | -52% | 107% | Yes | — |

| Turkey | $28,270 | -57% | 130% | — | — |

| Chile | $25,041 | -62% | 160% | — | — |

| Mexico | $20,703 | -68% | 215% | — | — |

| Colombia | $16,101 | -75% | 305% | — | — |

* OECD (2020), GDP (indicator). doi: 10.1787/dc2f7aec-en (Accessed on 15 September 2020)

^Avalere assessment of OECD (2020) per-capita 2019 GDP data