Most Significant Healthcare Legislation Since ACA Possible this Fall

Summary

As Congress considers the bipartisan infrastructure package and budget reconciliation agenda, the coming months are likely to include debate on what could be the most significant federal healthcare legislation in over a decade. Additionally, the Biden administration is expected to release several important healthcare rules this fall, including the details necessary to implement the new law banning surprise billing and regulations to protect and strengthen Medicaid and the Affordable Care Act (ACA).It’s fall—time for pumpkin spice lattes and a lot of healthcare policy activity. In the next few months, federal policymakers will be considering a variety of legislative and regulatory proposals that address issues affecting insurance coverage, drug pricing, and public health. As these policy proposals will likely have a substantial impact on the healthcare market, stakeholders should be prepared to adapt to the changing ecosystem.

Congressional Timing

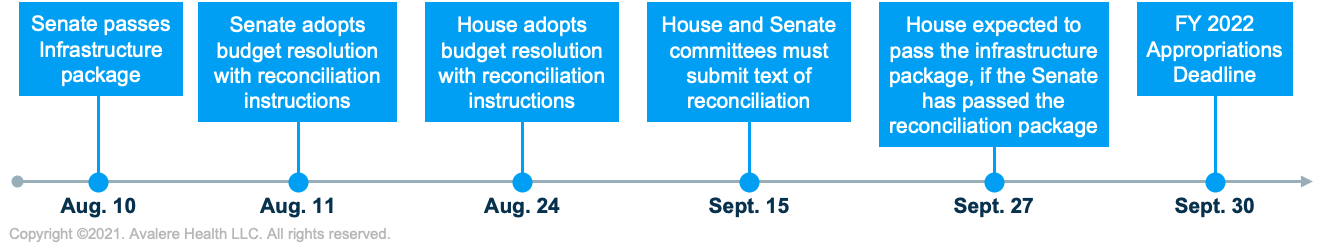

In an effort to ensure Democratic support for both the Infrastructure Investment and Jobs Act and the budget reconciliation bill, House leadership chose to tie the vote on the Infrastructure Investment and Jobs Act to the development of the reconciliation bill. The Senate passed the Infrastructure Investments and Jobs Act on August 10, and then began working on the budget reconciliation package, which includes healthcare policies. House leaders promised to vote on and pass the bipartisan infrastructure package by September 27 with the hope that the Senate will be able to pass the reconciliation bill prior to this date.

The first step of the budget reconciliation process is a budget resolution. On August 9, Senate Democrats released the text of their $3.5 trillion fiscal year 2022 budget resolution, which contains reconciliation instructions to Senate committees that will draft the final spending bill’s provisions. This resolution was adopted by the Senate on August 11 and the House on August 24.

By September 15, the Senate committees will contribute to drafting the reconciliation bill, which is then sent to the Congressional Budget Office to estimate the costs or savings of the included policies. The Senate parliamentarian must then determine whether the bill’s provisions meet the requirements of the budget reconciliation process before the bill is considered by the House and Senate.

Congressional Democrats hope to advance these proposals quickly and seek to pass reconciliation legislation this fall, leaving a short window for stakeholders to engage Congress on the policies that are included and how those policies are designed.

Healthcare Policies in Budget Reconciliation

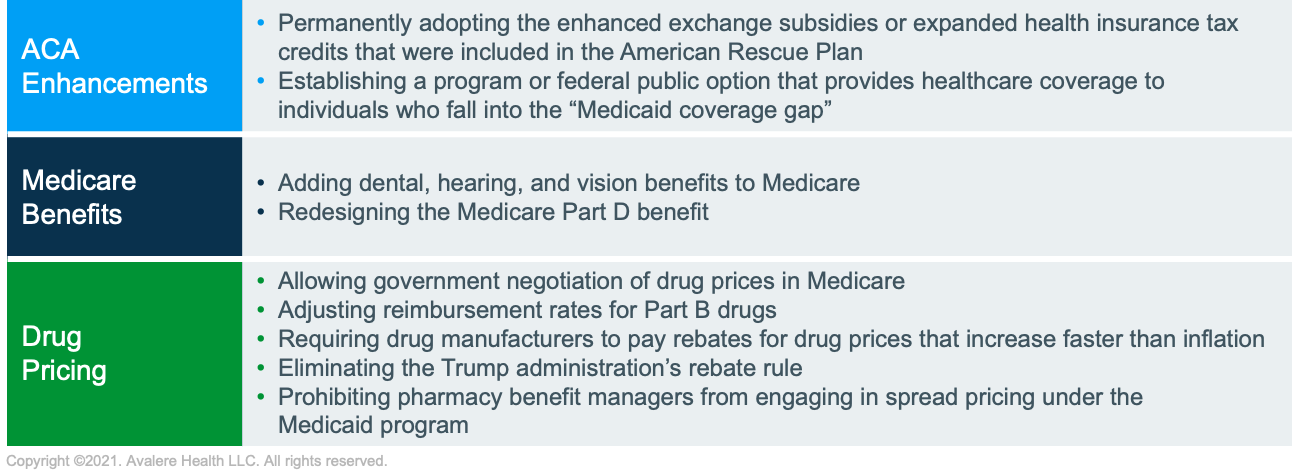

The budget reconciliation package will likely include a broad range of healthcare policies (Figure 2).

Other Upcoming Congressional Activity

Stakeholders should also be aware of other opportunities for healthcare-related legislation.

- 2022 Appropriations: By September 30, Congress must pass appropriations bills to fund the government for 2022 or pass a continuing resolution to avoid a government shutdown.

- Sequestration: Congress has until December 31 to extend the temporary moratorium on the 2% Medicare reimbursement sequester cuts. Legislative action is needed to prevent cuts such as Part B drug reimbursement returning to average sales price plus 4.3%.

- Physician Payment: On January 1, Medicare payments to physicians would reflect a reduced conversion factor and the expiration of the 3.75% payment increase provided for calendar year 2021. Congress may be pressured to extend the current payment increase to address the physicians’ pay cut.

Regulatory Agenda

In addition to the significant legislative activity taking place in Congress, agency and regulatory actions are expected through the end of the year on other issues.

- Exchange Policies: ACA Section 1332 waivers, special enrollment periods, open enrollment periods, and the return of standardized plans

- Drug Price Reduction Plan: Recommendations from the Department of Health and Human Services to “combat high prescription drug prices and price gouging” and enhance domestic pharmaceutical supply chains

- Commercial Drug Costs Reporting Requirements: Implementation of the drug cost reporting requirements in the Consolidated Appropriations Act Section 204, and modification of the separate Transparency in Coverage requirement that plans begin posting public files with negotiated prescription drug prices and historical net prices beginning in 2022

- No Surprises Act Implementation: Defining the independent dispute resolution process and plan disclosure requirements related to surprise billing

- Center for Medicare and Medicaid Innovation (CMMI): With increased funding for models allocated in the President’s budget, the CMMI plans to focus on value-based care, explore more mandatory models, increase access to cost-effective behavioral healthcare, and improve health equity

- Medicare Advantage and Part D: Regulations governing plan year 2023, final rule on the Risk Adjustment Data Validation program

Conclusion

Given the strong impetus in both Congress and in the Biden administration for changes to drug pricing and public healthcare programs, stakeholders can expect significant changes to the healthcare market and the regulatory environment through the end of 2021. The precise legislative and regulatory provisions that will be enacted may be unknown until later this year, but stakeholders should consider an engagement strategy with legislative and administrative policymakers and prepare for the potential impact of policies under consideration. Avalere’s expertise and analytical capabilities can assist with strategic planning for the various policy scenarios that may be a part of the above-mentioned legislative and regulatory proposals and in analyzing the impact that such reforms may have.

To learn more about updating policy issues, connect with us.