Number of Part D Plan Choices Declines for 2025

Summary

The number of PDP and MA-PD options are declining by 26% and 7%, respectively, in 2025.On September 27, the Centers for Medicare and Medicaid Services (CMS) released the 2025 Medicare Advantage (MA) and Part D landscape files. These data show MA and Part D plan offerings and premiums for 2025 and highlight shifts in the Part D market in the first full year of Part D benefit redesign implementation.

Background

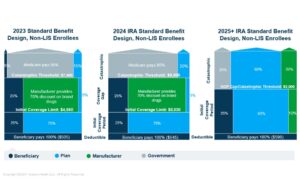

The Inflation Reduction Act (IRA) significantly redesigns the Part D benefit in 2025 and changes liability between stakeholders (Figure 1). These changes increase plan liability in the Part D benefit and likely led Part D sponsors to shift their strategies in 2025.

Figure 1. Pre-IRA vs. IRA Benefit Design

Note: Pre-2025, enrollee out-of-pocket costs and manufacturer coverage gap discounts counted toward costs to reach the catastrophic threshold. In 2025 and beyond, manufacturer discounts will not count towards costs to reach the catastrophic threshold. The graphics reflect benefit design for applicable drugs (brands, biologics, and biosimilars).

Plan Premiums

The premium stabilization program under the IRA and CMS’s voluntary premium stabilization demonstration for standalone Part D Prescription Drug Plans (PDPs) are contributing to the limited premium increases for 2025. From 2024 to 2029, the premium stabilization program subsidizes increases in the average basic Part D premium beyond 6%. CMS’s demonstration program for standalone PDPs provides further stability to PDP premiums by reducing the average Part D premium for basic benefits and capping individual plan premiums increases to $35 from 2024 to 2025.

Across all PDPs, Avalere estimates that the enrollment-weighted average PDP premium—which includes both basic and supplemental premiums—is increasing by 4% from 2024 to 2025. However, the discontinuation of a higher proportion of enhanced PDPs relative to basic PDPs in 2025, along with how the premium stabilization programs apply to the basic vs. enhanced portion of the Part D premium, are contributing to opposing trends in average premium changes for these two plan types (Table 1).

Table 1: Enrollment-Weighted Average PDP Premiums by Plan Type, 2024 vs. 2025

Note: Data for 2025 reflect the Contract Year (CY) 2025 Landscape file released by CMS in September 2024, which included sanctioned plans. A revised version of the Landscape file released in October 2024 removed these sanctioned plans.

CMS did not release data on which plan sponsors are participating in the voluntary PDP demonstration. However, CMS estimates that about 99% of those enrolled in standalone PDPs are currently in a plan that will participate in the demonstration for 2025. Avalere estimates that before the application of the CMS demonstration, basic PDP premiums were likely between $42 (low-end estimate) and $46.50 (high-end estimate).

Because the IRA premium stabilization program and components of CMS’s voluntary PDP demonstration work to limit average growth in basic plan premiums, some individual plans will have larger changes in premiums for 2025. For example, about a quarter of PDP enrollees are currently in a plan that is increasing its premium by more than 25% in 2025. Meanwhile, MA-PD plans’ premiums remain stable in 2025. 74% of MA-PD enrollees are currently in a $0-premium plan that will continue to be a $0-premium MA-PD in 2025. An additional 4% of MA-PD enrollees are in plans that will have premium change of less than $1.

Part D Plan Offerings

For 2025, the number of PDPs is decreasing by 26%, from 709 plans in 2024 to 524 plans in 2025. This includes sanctioned PDPs that were included in CMS’s September Landscape file. In an updated Landscape file released by CMS in October, these sanctioned plans were removed. With these PDPs no longer being available, there will only be 464 PDPs available in 2025. The number of MA-PDs is also declining, although more moderately at 7%, from 3,507 MA-PDs in 2024 to 3,246 in 2025 (Figure 2).

Figure 2. Number of Part D Plans by Plan Type, 2023–2025

*Data in graphic reflect the CY 2025 Landscape file released in September by CMS, which included sanctioned plans. A revised version of the CY 2025 Landscape file released in October 2024 removed these sanctioned plans. As a result, in 2025, the number of all PDPs will decline to 464 and the number of LIS benchmark PDPs will decrease to 90 plans. The number of MA-PDs in the October landscape file is 3,258.

Changes that made the Part D standard benefit under the IRA more generous (e.g., implementation of the $2,000 out-of-pocket cap) and modifications to how CMS is evaluating enhanced plan benefits beginning in 2025 are also contributing to a reduction in enhanced plan options. Specifically, the number of enhanced PDPs is declining by 33% while the number of enhanced MA-PDs is decreasing by 7%.

Low-Income Subsidy (LIS) Benchmark Plan Availability

Part D market dynamics under the IRA continue to shift the availability of LIS benchmark plans. Following a significant reduction in the number of LIS benchmark plans from 2023 to 2024, the availability of benchmark plans will decrease slightly in 2025 to 120 plans (Figure 2). With the updated Landscape file removing sanctioned plans, this number will decrease to 90 LIS benchmark PDPs in 2025. CMS’s voluntary Premium Stabilization Demonstration for PDPs likely helped prevent even greater reductions in LIS benchmark plans that would have occurred without this demonstration.

Changes in LIS benchmark plan availability will also vary by state (Figure 3). Based on the September Landscape file, in 2025, five states will have only two LIS benchmark plan options. However, based on the updated October Landscape file that removes sanctioned plans, four out of these five states (FL, IL, NV, and TX) will now have only one LIS benchmark plan option in 2025.

Based on the September Landscape file, Avalere estimates that approximately 500,000 LIS enrollees are currently in plans that will no longer qualify as benchmark plans or that will exit the market in 2025. In 12 states, more than one-third of LIS enrollees in benchmark PDPs would need to switch plans or pay a premium in 2025. However, about 117,000 LIS enrollees will benefit from new benchmark plan options in 2025.

.

Note: Data in graphic reflect the CY 2025 Landscape file released in September by CMS, which included sanctioned plans. A revised version of the Landscape file released in October 2024 removed these sanctioned plans. As a result, numbers may be different for states that previously included sanctioned plans.

Potential Effects on Beneficiary Enrollment Patterns

As the Medicare Annual Election Period (AEP) begins on October 15 and runs through December 7, broader changes to the Part D benefit under the IRA, along with shifts in plan offerings and individual plan premiums, will shape beneficiary enrollment choices. Prior research has indicated that most Medicare beneficiaries don’t compare Part D plans during the AEP. However, given the significant changes to the Part D market, 2025 will be a critical year for beneficiaries to consider their plan options. Stakeholders should prepare for how these market disruptions and enrollment shifts may impact beneficiary access and affordability.

For more information on how plan availability, premiums, and benefits for 2025 and beyond will impact your organization, connect with us.

Methodology

Avalere used the Landscape files released by CMS in September 2023-2025 each year. Except where noted, 2025 data reflect numbers from CMS’s September Landscape file release, which include a sanctioned Part D sponsor. At the time of this analysis, the Part D sponsor was appealing CMS’s decision and data for its plans were included in the September Landscape file. Employer Group Waiver Plans (EGWPs), Special Needs Plans (SNPs), Medicare-Medicaid Plans, Program of All-Inclusive Care for the Elderly cost plans, and plans in US territories are excluded from this analysis. For calculations of enrollment-weighted average premiums, Avalere uses enrollment data from September 2024 for 2024 and 2025 plans. Enrollment-weighted average premium estimates only include plans that were available in both 2024 and 2025. For estimates reflecting LIS enrollees, Avalere derives LIS enrollment at the state level by using the Contract-Plan-State-County level Part D enrollment file released by CMS in March 2024.