Pre-Approval Information Exchange Aids Manufacturer–Payer Engagement

Summary

Clarifications in the PIE Act may shift manufacturer-payer engagement strategy and improve coverage and reimbursement of new drugs and devices.The Pre-approval Information Exchange (PIE) Act, signed into law as part of the Consolidated Appropriations Act of 2023, contains provisions that clarify the types of data that drug and device manufacturers can share with payers before US Food & Drug Administration (FDA) approval/clearance. PIE may improve how quickly payers consider FDA-approved products for coverage given that the act allows manufacturers to share certain clinical and economic data with payers while providing a safe harbor from misbranding laws that govern the dissemination of product claims.

Manufacturers’ interest in proactively communicating healthcare economic information with payers led to guidelines for pre-approval information exchange enacted in Section 114 of the FDA Modernization Act of 1997 (FDAMA). However, due to the potential for scrutiny and concern of perceived off-label promotion, manufacturers remained hesitant to operationalize these provisions. In 2018, the FDA finalized guidance on FDAMA 114 that aimed to define and direct appropriate pre-approval manufacturer–payer engagement. However, stakeholders in general found the guidance too vague and expressed a need for guardrails to ensure compliant communication between manufacturers and payers.

The PIE Act seeks to remedy the uncertainty that remained following FDAMA 114 guidance. It amends the Federal Food, Drug and Cosmetic Act misbranding provisions to:

- Include new drugs and devices as well as new indications for already approved drugs

- Identify the specific types of information that can be shared, including product descriptions, timelines for approval, indications, patient utilization projections, and factual results of study findings that do not draw conclusions about safety and efficacy

- Define the covered entities eligible to receive product information from manufacturers to include payers, formulary committees, drug information centers, technology assessment committees, or pharmacy benefit managers that are responsible for (1) the selection of drugs or devices for coverage or reimbursement or (2) other population-based healthcare management tasks

How the PIE Act May Shape Stakeholder Behaviors

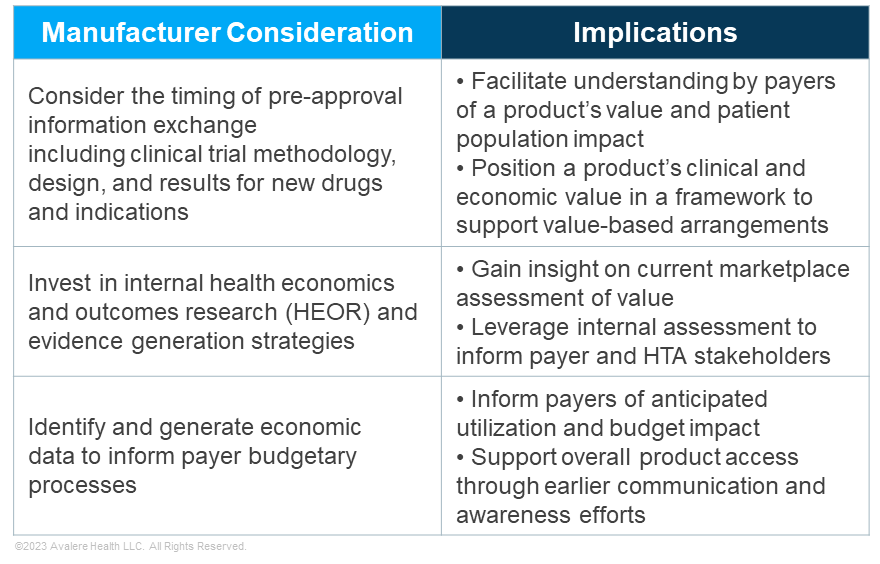

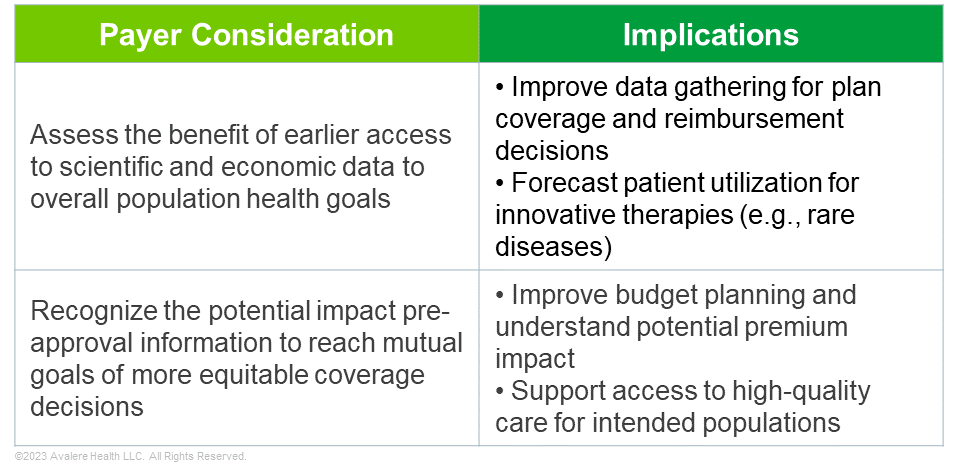

As manufacturers consider their payer strategy under the PIE Act, there are likely new opportunities for targeted dissemination of scientific and economic data to communicate a product’s value story and facilitate patient access to innovative drugs and devices. As payers weigh clinical and economic evidence in making coverage and reimbursement decisions, PIE may facilitate earlier payer acceptance and even expectation of such information. When applying PIE provisions, manufacturers and payers should take into account several key considerations, detailed in the tables below.

How Avalere Can Help

As PIE policies and oversight shift, so will payer conversations and overarching value messages. Manufacturers will need to understand the recent legislative changes and evaluate their evidence generation strategy, while identifying potential gaps for targeted value messaging. Manufactures should assess their market access timeline and approach to align clinical development and regulatory strategies with payer coverage dynamics.

Avalere’s clinical, regulatory, and commercial expertise supports stakeholders across the healthcare industry in communicating value to various decision makers. To learn more about how Avalere can help develop or refine your value messaging and payer engagement strategy, connect with us.