Redefining D-SNP Look-Alikes Would Impact Enrollment

Summary

If CMS lowers the dual-eligible enrollment threshold it uses to define D-SNP look-alikes, the demographics in look-alike plan enrollment will likely change.Since 2022, the Centers for Medicare and Medicaid Services (CMS) has not initiated or renewed contracts with Dual Eligible-Special Needs Plan (D-SNP) “look-alike” Medicare Advantage (MA) plans. The agency defines these plans as non-D-SNPs in which 80% or more of the beneficiaries enrolled are dually eligible for Medicare and Medicaid. These D-SNP “look-alikes” are not subject to federal and state D-SNP contracting requirements.

Currently, plans that pass the look-alike threshold must transition enrollees into other MA Prescription Drug Plans (MA-PDs)—including D-SNPs—offered by the same parent organization and meeting certain criteria. Beneficiaries have the option to choose another MA plan or Medicare fee-for-service (FFS).

Proposed Changes

In the Calendar Year (CY) 2025 MA and Part D proposed rule, CMS proposed lowering the current look-alike threshold from 80% to 60% by 2026. It also proposed to change the beneficiary transition process such that plans may use the procedure only to transition dual-eligible beneficiaries into D-SNPs (beneficiaries would still have the option to choose another MA plan or FFS coverage). CMS also requested comment on the following alternatives:

- Lowering the threshold to 50%

- Maintaining the 80% threshold through plan year 2025 and limiting the ability to transition beneficiaries into non-SNPs beginning in plan year 2026

In the proposed rule, CMS noted the additional number of plans that would qualify as look-alikes and their associated enrollment, under different thresholds, segmented by threshold (e.g., 50–60%) (Table 1). For 2023, the agency found that lowering the threshold to 60% would have identified an additional 70 plans as look-alikes, affecting almost 100,000 dual-eligible beneficiaries. Lowering the threshold to 50% would have identified another 58 plans as look-alikes, with over 150,000 dual-eligible beneficiaries affected in total.

Table 1*: Dual–Eligible Enrollment in Non-SNP MA Plans, Segmented by Levels of Dual–Eligible Enrollment, January 2023

| Dual–Eligible Enrollment Segment | Number of Plans Within the Segment | Number of Enrollees Within the Segment |

|---|---|---|

| 50–60% | 58 | 57,486 |

| 60–70% | 40 | 58,293 |

| 70–80% | 30 | 40,025 |

| Combined (50–80%) | 128 | 155,804 |

Source: Email communication with CMS regarding the CY 2025 MA and Part D proposed rule

*The table published in the proposed rule is incorrect; CMS plans to issue a correction using the numbers listed here in the future.

Modeling the Impact of Alternative Thresholds on Demographic Composition in Look-Alike Plans

To estimate how lowering the threshold used to define a look-alike plan could impact the demographic composition of beneficiaries enrolled in look-alikes, Avalere modeled the Original Reason for Medicare Entitlement (OREC), full vs. partial dual status, race, and ethnicity of beneficiaries enrolled in look-alikes at the 80% and 50% thresholds (Table 2).

Table 2: Dual-Eligible Enrollment in D-SNP Look-Alike Plans, Defined by Different Dual-Eligible Enrollment Thresholds, September 2021

| Dual–Eligible Enrollment Segment | Number of Plans | Number of Enrollees |

|---|---|---|

| 50% or more | 117 | 372,705 |

| 80% or more | 52 | 241,558 |

| Difference (50–80%) | 65 | 131,147 |

Source: Avalere analysis of September 2021 Master Beneficiary Summary File (MBSF) data

Avalere’s analysis finds that a greater proportion of enrollees in D-SNP look-alikes have an OREC of age (68%), and that a greater proportion are full-dual beneficiaries (88%), compared to the overall dual population (CMS data show that, among the dual-eligible population, approximately 47% have an OREC of age, and nearly 29% of beneficiaries are partial duals). Lowering the threshold to 50% would have identified 65 additional look-alike plans. The resulting set of look-alike plans have more beneficiaries with an OREC of disability or end-stage renal disease (ESRD) than age, relative to the plans defined as look-alike plans at the current 80% threshold. A greater proportion of enrollees in the look-alike plans at the 50% threshold are partially dual eligible (Figures 1 and 2) compared to the plans defined as look-alikes at the current threshold.

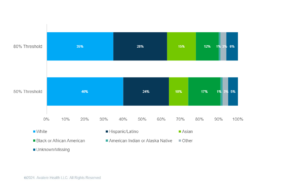

In addition, lowering the threshold would increase the proportion of impacted beneficiaries who are White and Black or African American, while decreasing the proportion of beneficiaries who are Hispanic/Latino or Asian (Figure 3).

Figure 1: OREC of Dual-Eligible Beneficiaries at 80% and 50% Thresholds, September 2021

Figure 2: Dual Status of Dual-Eligible Beneficiaries at 80% and 50% Thresholds, September 2021

Figure 3: Race/Ethnicity of Dual-Eligible Beneficiaries at 80% and 50% Thresholds, September 2021

Conclusion

In the CY 2025 MA and Part D final rule, CMS may implement significant changes to the D-SNP look-alike policy to promote integrated care for dual-eligible beneficiaries. In 2023, approximately five million beneficiaries were enrolled in D-SNPs. Lowering the threshold used to identify look-alike plans could shift the demographic composition of affected dual-eligible beneficiaries and, potentially, the demographic composition of D-SNPs if beneficiaries are transitioned to these plans. Looking ahead, CMS may continue to monitor plan trends and propose additional changes after 2026, with the aim of aligning policy and oversight with the needs of a diverse and often vulnerable group of beneficiaries. CMS is expected to publish the final rule in the Spring of 2024.

Methodology

This analysis utilized the 100% Medicare FFS claims, accessed by Avalere via a research collaboration with Inovalon, Inc., and governed by a research-focused CMS Data Use Agreement. Using CMS contract, enrollment, and landscape files and MBSF data, Avalere identified dually eligible beneficiaries enrolled in MA-PD plans in September 2021. Plans in states with no integrated plan contract (D-SNP or Medicare-Medicaid Plan [MMP]) were excluded (AK, NH, ND, SD, VT, WY). Plans were limited to Care Coordinated Plans, Medicare Savings Accounts, and private FFS plans. MMPs, Employer Group Waiver, Cost, and Program of All-Inclusive Care for the Elderly plans were not included. For this analysis, plans were required to have at least 200 enrollees.

January 23, 11 AM ET

Learn More