Series of Changes to Drug Pricing Metrics Will Interact in Coming Years

Summary

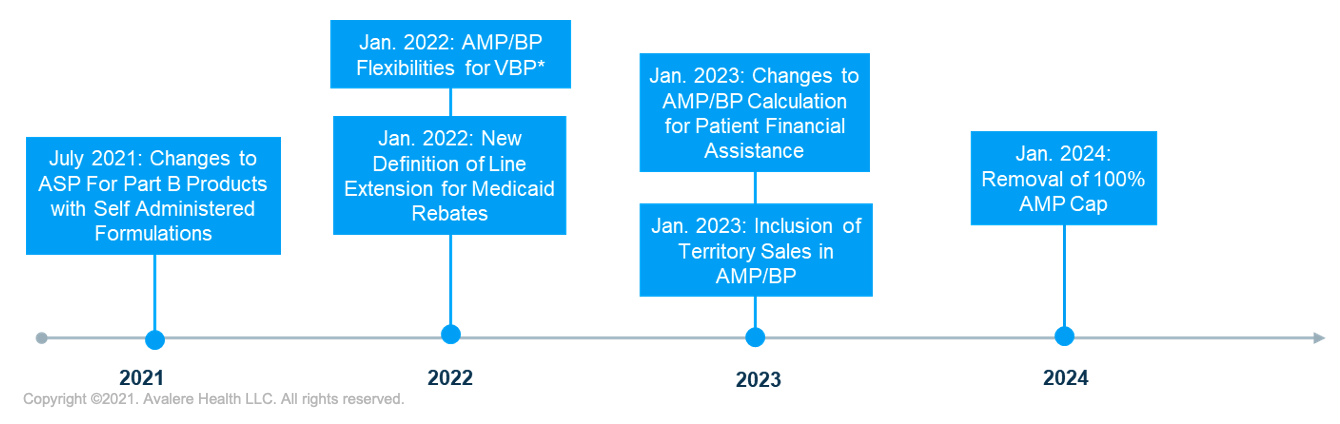

The intersection of upcoming changes to drug pricing metrics will require new methods of calculating and reporting government pricing with implications for net pricing and contracting strategies.As a result of policy changes enacted over the last year, several key drug-pricing metric changes are set to take effect in the next 3 years, with potential impacts on manufacturer drug pricing, price reporting, and rebate liability. As manufacturers and other stakeholders advance pricing strategy planning for the years ahead, it will be important to prepare for the various pricing changes outlined below and the interactions that these changes may have in aggregate.

*Potential for delay of BP flexibilities until July 2022.

1. Changes to ASP for Part B Products with Self-Administered Formulations

Part B products affected by the update could see significant changes—and likely decreases—to average sales price (ASP) calculations for certain products. However, the updated statute creates an opportunity to file an Supplemental Biologics License Application for the subcutaneous formulation of a product, thus allowing for differential pricing.

2. New Definition of Line Extension for Medicaid Rebates

Under the December 2020 Value-Based Purchasing (VBP) Final Rule, the Centers for Medicare and Medicaid Services (CMS) finalized new definitions for “line extension,” “new formulation,” and “oral solid dosage form,” which will take effect January 2022. Current law requires that the inflation component of rebates under the Medicaid Drug Rebate Program (MDRP) for line extensions be tied to price increases of the original product. Since the new definition for line extension is likely to be more inclusive than previous interpretations, manufacturers could be subject to increased rebate liability under the MDRP for a wide set of current and future products.

3. AMP/Best Price Flexibilities for VBP

The VBP Final Rule also introduced new pricing flexibilities related to VBP arrangements set to take effect in January 2022. Specifically, the rule allows manufacturers to report multiple best prices (BPs) under VBP arrangements without impacting BP for sales outside of the arrangement. Furthermore, the rule revised BP and average manufacturer price (AMP) reporting requirements to allow manufacturer updates beyond the current 12-quarter limit for VBPs. The pricing changes are intended to help remove certain disincentives to VBP adoption. If CMS’s May revised Medicaid VBP Rule is finalized, the implementation of multiple BPs provision will be delayed to July 2022.

4. Inclusion of Territory Sales in AMP and BP

As early as January 2023, the US territories will have the option to join the MDRP. However, the recent proposed VBP rule would delay inclusion until April 2024, if finalized as proposed. The inclusion has previously been delayed 2 times. Puerto Rico has signaled its intent to join the MDRP and recently released a request for proposal seeking a rebate vendor for the territory’s Medicaid program. The degree of impact from this policy will depend on the volume of product in the territories relative to the states, as well as on the discounts that are offered. Given that manufacturers often sell drugs at steeper discounts in the territories than in the states, manufacturers should consider how the inclusion of these sales will impact AMP and potentially set a lower Medicaid BP.

5. Changes to AMP/BP Calculation in the Context of Manufacturer Patient Financial Programs

The 2020 VBP rule finalized changes to require manufacturers to reflect the value of patient financial programs (e.g., copay coupons) in BP and AMP calculations if the manufacturer is unable to ensure that the full value is passed through to patients. Implementation of this new requirement is delayed until 2023. The changes to Medicaid BP and AMP protection for manufacturer patient financial assistance programs could have significant operational and financial implications. Absent new operational or contractual approaches, manufacturers may ultimately be unable to ensure that the full value of their assistance accrues to patients. Recent legal action challenging the lawfulness of the provision could impact implementation, but manufacturers should consider how AMP and BP calculations will change based on the final rule.

6. Removal of 100% AMP Cap (January 2024)

Enacted in March 2021, the American Rescue Plan removes the cap that limits mandatory Medicaid rebates to 100% of the drug’s AMP beginning January 1, 2024. The Affordable Care Act limited mandatory rebates to 100% of AMP, enabling manufacturers to raise prices without the impact of higher inflationary rebates. Upon removal of the AMP cap in 2024, manufacturers may see a significant increase in Medicaid rebate liability, particularly for products with high inflation penalties that will increase the total rebate to more than 100% of AMP. Assessing how AMP cap removal affects individual products and the downstream effects across the portfolio will be crucial for manufacturers to understand ahead of implementation in 2024.

Additional Factors Influencing Drug Pricing Decisions

Beyond the enacted legislative changes to price reporting metrics, recent legal and regulatory action related to the 340B program and health plan transparency is also likely to impact manufacturer drug pricing strategy.

Discussion about whether the Health Resources and Services Administration (HRSA) has the authority to enforce its longstanding guidance on extension of 340B discounts to contract pharmacies has sparked a series of lawsuits that are likely to have significant impact on drug pricing in future years. Several drug manufacturers have separately filed lawsuits against the Department of Health and Human Services (HHS) over extension of 340B drug prices to contract pharmacies. Organizations representing hospitals and other 340B covered entities are suing HHS for failure to enforce its guidance and penalize drug manufacturers that have stopped providing 340B prices for drugs dispensed through contract pharmacies. Stakeholders should monitor the outcomes of these and related lawsuits as they will determine HHS authority to implement and enforce regulations related to the 340B program. In addition, the extent of regulatory authority granted to HRSA is likely to impact stakeholders’ 340B exposure.

Another regulation that is likely to impact drug pricing decisions in the long-term is the Transparency in Coverage Final Rule. The final rule aims to increase transparency in commercial insurance, not only in drug prices but also in healthcare services more broadly via 2 avenues. The first is through public disclosure of in-network negotiated rates, out-of-network paid amounts, and the negotiated and historical price for prescription drugs beginning on January 1, 2022. The second avenue is requiring plans to report price and cost-sharing data beginning January 1, 2023, that enrollees may view using internet service tools. The public disclosure of negotiated and historical prices for prescription drugs may impact the negotiation of prices for drugs covered by commercial plans and could affect patient and provider treatment choices.

Furthermore, the Department of Labor, HHS, and the Office of Personnel Management (OPM) released a joint request for information (RFI) on July 8 regarding transparency provisions in the Consolidated Appropriations Act of 2021. In particular, the departments and OPM seek input from stakeholders to inform implementation considerations around collecting information on prescription drug costs from health plans and health insurance issuers offering group or individual health insurance coverage. By taking steps to address reporting logistics, the administration signals its commitment to pursuing greater cost transparency in healthcare. Therefore, it is important for stakeholders to be able to provide well-informed input when the departments and OPM request feedback.

Looking Forward

As manufacturers evaluate and prepare for the series of policy changes above, stakeholders should also consider future drug pricing reforms that could be enacted. On June 22, Senate Finance Committee Chairman Ron Wyden (D-OR) released a white paper outlining principles for drug pricing reform, which called for both Medicare price negotiation and rebates for drug price increases above inflation. The proposed policy reforms are similar to those in the Democrats’ H.R.3, Elijah E. Cummings Lower Drug Costs Now Act, which was reintroduced in April. In addition to the potential legislative reforms being considered, stakeholders should also monitor for the introduction of new Center for Medicare and Medicaid Innovation models that could seek to test drug pricing reforms, such as Medicare price negotiation and value assessments with optional or mandatory demonstrations.

Avalere is well positioned to support life sciences and other stakeholders who will be impacted by upcoming drug price calculations (or changes) with understanding implications and establishing response strategies and broader revenue implications, as well as assisting with responses to the transparency RFI.

To learn more about how Avalere can support you with these efforts, connect with us.