Senate Health Bill to Reduce Federal Medicaid Funding to States

Summary

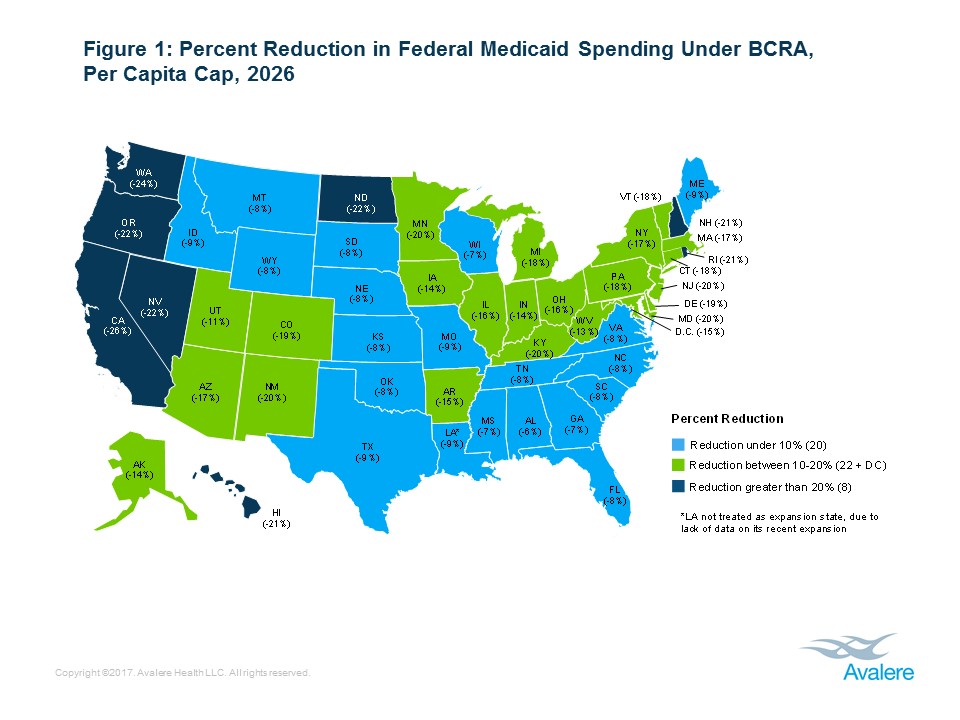

New analysis from Avalere finds that states could see federal funding for their Medicaid programs decline by between 6% and 26% under the Better Care Reconciliation Act (BCRA) by 2026.“Cuts of this magnitude in Medicaid are unprecedented and would undoubtedly also adversely affect the healthcare delivery system,” said Avalere President Dan Mendelson. “Because states typically balance their budgets every year, the inevitable result would be that these cuts would flow downstream to hospitals, nursing homes, and physicians, as well as health plans, in the form of payment reductions.”

On average, states that expanded Medicaid under the Affordable Care Act (ACA) would see a 19% reduction, compared to 8% for states that chose not to expand. Over a 10-year period, state funding reductions could range from $152 million to $93 billion, depending on the state (Table 1). These figures represent direct effects of proposed BCRA provisions and as a result do not take into account further reductions in funding that could occur as a result of state decisions to decrease enrollment.

“Expansion states would be most affected by the Medicaid provisions in the Better Care Reconciliation Act,” said Elizabeth Carpenter, senior vice president at Avalere. “In addition to taking steps to control costs, states are also likely to decrease eligibility for the Medicaid program.”

BCRA repeals the enhanced federal funding provided by the ACA for Medicaid expansion enrollees over a three-year period, beginning in 2021. In addition, the legislation transitions Medicaid to a capped financing structure, which would provide states a fixed amount of funding per person (per capita cap) or for a group of Medicaid beneficiaries (block grant).

Each year, the per capita caps or block grants in BCRA grow by a set inflation factor or growth rate. In 2025, BCRA transitions from a per capita growth rate set at medical inflation (CPI-M or CPI-M + 1% for certain populations), to economy-wide inflation (CPI-U). Economy-wide inflation typically grows slower than medical inflation. As a result, this transition would lead to dramatic changes in federal funding for the Medicaid program over the long term (Figure 2).

“The Senate bill may encourage states to reduce benefits for Medicaid beneficiaries,” said Caroline Pearson, senior vice president at Avalere. “If not designed carefully, changes in coverage could reduce quality and increase spending in other parts of the healthcare system, including Medicare.”

Methodology

State reductions represent direct changes in federal Medicaid funding and do not estimate additional funding decreases that result from changes in enrollment or changes in State Medicaid spending. Avalere estimates include the effect of the legislation’s ‘Equity Adjustment’ to state caps by assuming the HHS Secretary chooses mid-point positive and negative adjustments that achieve budget neutrality.

Avalere used a combination of CMS’ Medicaid Statistical Information System (MSIS) and Medicaid Budget and Expenditure System (MBES) data to estimate current Medicaid spending and enrollment by State. For future Medicaid spending and enrollment, Avalere relied on the 2016 CMS Medicaid Actuarial Report to forecast per-enrollee spending by basis-of-eligibility group and U.S. Census Bureau state population projections by age group to forecast enrollment growth by state and basis-of-eligibility group. Avalere used CBO assumptions for projections of national baseline federal Medicaid spending and enrollment, as well as medical and economy-wide inflation.

Avalere’s forecast period for this analysis aligns with the most recent CBO budget window, 2017–2026 and also includes longer term analysis through 2036. For 2027–2036, Avalere extended CMS per enrollee growth projections and Census Bureau state population projections, and used CBO’s long-term budget projections for national baseline federal Medicaid spending.

January 23, 11 AM ET

Learn More