Cruz Amendment to BCRA Would Lead to Coverage Losses and Increased Premiums for Individuals with Higher Medical Expense

Summary

Affordable Care Act-compliant plan market would see 39% higher premiums, while non–ACA-compliant plans would have much lower premiumsNew analysis from Avalere finds that the Cruz Amendment included in the July 13, 2017, version of the Better Care Reconciliation Act (BCRA) would lead to 4.1M fewer people with individual insurance plans. Under the Amendment, insurers that offer individual exchange plans in certain metal levels that comply with Affordable Care Act (ACA) market rules would also be permitted to offer off-exchange plans in the same region that are exempt from some ACA rules (including guaranteed issue, prohibition on pre-existing condition exclusions, and essential health benefits).

If BCRA were approved with the Cruz Amendment, premiums for ACA-compliant plans (i.e., plans meeting specific benefit requirements required by the law) would be approximately 39 percent higher compared to current law by 2022; premiums for the non–ACA-compliant plans would be approximately 77 percent lower than current law. The individual market would also become segmented-with high-risk, subsidized, and sicker individuals staying in the ACA-compliant plan market, while the younger, healthier, and unsubsidized population shifts to the non–ACA-compliant plan market.

“The Cruz Amendment would lead to fewer Americans with insurance in the individual market,” said Elizabeth Carpenter, senior vice president at Avalere. “In addition, individuals who want benefits that comply with Affordable Care Act standards would see premiums increase significantly.”

Effect on Individual Market Enrollment

Compared to current law, BCRA with the Cruz Amendment would lead to 4.1 million fewer individual market enrollees by 2022, largely due to the combination of significant premium increases in the ACA-compliant plan market, premium and cost sharing subsidy reductions under BCRA, and medical underwriting in the non–ACA-compliant plan market.

Effect on Individual Market Enrollment

Under the proposed bill, premiums would begin to grow rapidly in the ACA-compliant plan market due to the problem of adverse selection, where sicker individuals who need care remain in the comprehensive ACA-compliant plans, while healthier individuals with lower health needs shift to the less expensive non–ACA-compliant plans. The modeling projects that the rising premiums mean that by 2022, the majority of ACA-compliant plan enrollment would be from individuals with significant healthcare needs and low-income individuals who rely on subsidies.

Importantly, subsidized enrollees on the ACA-compliant plan market are largely protected from premium increases, though the value of their subsidized plans will decrease. As premiums rise in the ACA-compliant market, federal spending for low-income individuals will increase.

Importantly, the state stability fund has a very large impact on the premiums in the ACA-complaint plan market under BCRA. In 2022, the stability funding mitigates the premium increase for ACA plans from 86 percent without stability funding to 39 percent under the current legislative draft. Without that funding, ACA-compliant plan enrollment weighted premiums would average approximately $1,348 per month, compared to $1,012 in the current draft.

“By allowing off-exchange plans to avoid the ACA’s rating rules, the Cruz Amendment creates perverse incentives for healthy individuals who need less care to enroll off exchange, while sicker patients need to stay in the ACA-compliant plans, raising their premiums,” said Caroline Pearson, senior vice president at Avalere.

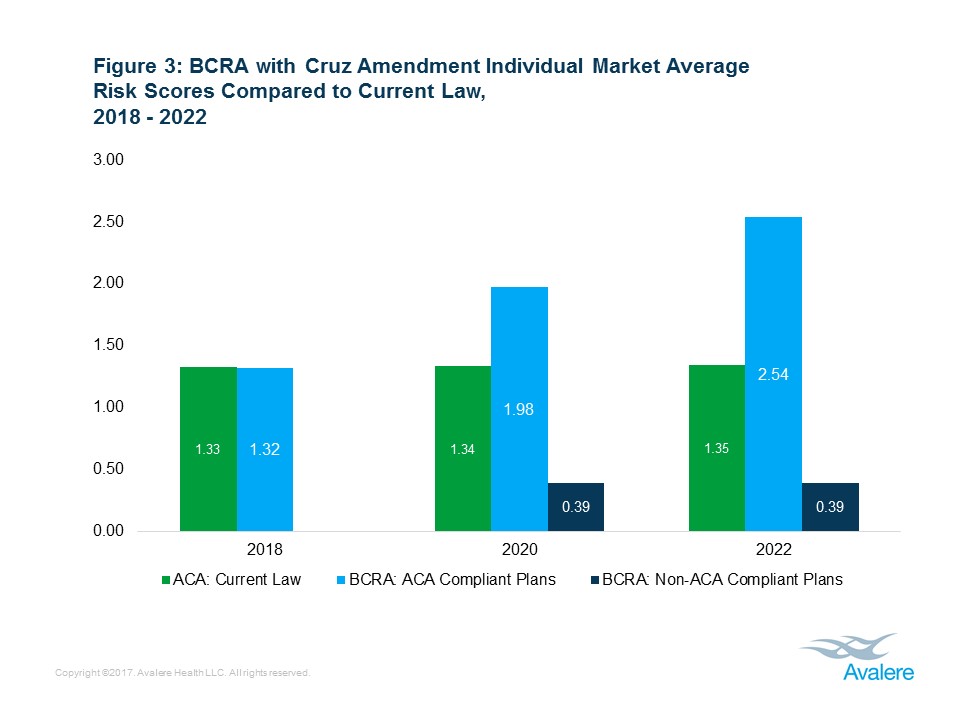

Average Risk Scores

Risk scores are a measure of the “risk” of the insured population. Higher risk scores indicate individuals who are likely to need more healthcare spending, while lower scores indicate those individuals who are less likely to need to use healthcare. BCRA segments market risk, with healthier individuals in non–ACA-compliant plans, and sicker individuals in plans that meet ACA standards. As such, the average risk scores in the market are projected to increase by approximately 88 percent for the ACA-compliant plans, relative to current law, while dropping by 71 percent in the non–ACA-compliant plan market compared to current law.

“The Cruz Amendment will primarily benefit healthier individuals,” said Chris Sloan, senior manager at Avalere. “People who have more serious healthcare needs and do not qualify for subsidies will be faced with dramatically higher costs.”

Background

Under the “Cruz Amendment” included in the July 13 version of BCRA, health plans that offer a 58 percent actuarial value (AV) plan as well as a Silver and a Gold plan in a rating region would also be permitted to offer plans off the exchange that are exempt from the ACA’s market rules. These rules include:

- Community rating

- Metal-tier AV requirements

- Guaranteed issue

- Prohibition on exclusions for pre-existing conditions

- Prohibition on medical underwriting

- Essential health benefits (EHBs)

Individuals who enroll in these non–ACA-compliant plans would not be eligible for premium tax credits. The amendment also specifically designates $70 billion of stability funding for the ACA-compliant plans.

Methodology

The “Cruz Amendment” modeling results are the output of Avalere’s proprietary model of individual market health insurance coverage. The underlying data in the model is drawn from the American Community Survey (ACS), Centers for Medicare & Medicaid Services (CMS) exchange enrollment reports, and general exchange market demographic data released by the United States Department of Health and Human Services’ (HHS) Office of the Assistant Secretary for Planning and Evaluation (ASPE). In addition, Avalere utilizes Inovalon’s proprietary MORE² claims database of individual market enrollees. This allows the model to take into account underlying risk, for purposes of calculating risk scores and modeling behavior, as well as risk selection by metal level, age, and gender.

As with any modeling of a policy proposal, Avalere’s model requires assumptions around issuer and consumer behavior. The assumptions underpinning the model are informed by published literature reviews, as well as actuarial and modeling expertise.

Given that the underlying assumptions in any model are key to the results, Avalere strives to be very transparent and have detailed the largest assumptions driving the model discussed below. Avalere is confident that our results provide an accurate directional assessment of the legislative proposal that is backed up by other analytically rigorous analyses and statements in the public domain.

Single Risk Pool

Importantly, the July 13 version of BCRA that includes the Cruz Amendment maintains the single risk pool provision of the ACA. Avalere does not believe that a single risk pool is feasible between ACA-compliant plans and non–ACA-compliant plans that are not subject to standardized benefits, prohibitions of medical underwriting, guaranteed issue, and community rating. Based on that assumption, Avalere modeled the bill as effectively having separate risk pools. Avalere’s assumption about single risk pool is strongly backed up by internal Avalere expertise and public comments from key experts.

State Stability Funding

Under BCRA, the states are given discretion for how to use their state stability funding. For purposes of this modeling, Avalere assumes all of that money, from both the short term and long term funds, aside from those funds specifically earmarked for other purposes (for example, the opioid epidemic funding), are used to stabilize the ACA compliant market. This has a significant impact in holding down premiums, but is likely an overestimate of the amount of money that will be used to stabilize the ACA compliant individual market. As such, Avalere’s estimates of ACA- compliant premiums may be low.

State Behavior

For purposes of this analysis, Avalere assumes that non-ACA compliant markets will exists in all 50 states and Washington, DC, as well as in all rating regions within those states. This does not take into account the potential for states to legislate benefits or rating rules for the non-ACA compliant plans above those contained in this bill.

Shifts into Non-ACA Compliant Plans

To determine those individuals who aggressively shift into non–ACA-compliant health plans in 2020, Avalere assumes that those individuals who are both not subsidized and have risk scores below the average of the given market begin shifting into the non–ACA-compliant plans. Avalere assumes a rapid uptake of these individuals, with the vast majority having shifted out of the ACA-compliant market by 2022. These individuals make up the majority of the non–ACA-compliant market.

Elasticity of Demand

To inform the elasticity of demand assumptions in the model, Avalere uses the Congressional Budget Office’s (CBO) published price elasticity of demand for health insurance assumptions.

Continuous Coverage Incentives

As part of the Avalere underlying model and based on the observed impact over the first four years of the individual mandate, Avalere does not project a materially different impact of the BCRA six-month waiting period compared to the current individual mandate. A more aggressive assumption of the impact of the individual mandate driving coverage decisions would likely lead to greater reductions in individual market enrollment than portrayed in this analysis.

Health Savings Accounts (HSAs) Provisions

Avalere does not model the impacts of the provision in the proposed bill that permits individuals to utilize HSAs to pay for premiums. This provision may incent additional individuals to purchase individual market insurance.

Non–ACA-Compliant Plan Actuarial Values

While comprehensive information for pre-ACA individual market is not readily available, based on Avalere’s review of the existing literature, Avalere assumes an average AV for non–ACA-compliant plans under BCRA with the Cruz Amendment to be 55%.

Learn More