Avalere Analysis: Most Popular Exchange Plans Are Increasing Price

Summary

New analysis from Avalere Health finds that the most popular exchange plans* in 2014 increased premiums by 10 percent on average in 2015.In 2014, 28 percent of all exchange enrollees selected the lowest cost silver plan available. These consumers will be automatically reenrolled, if they do not select a new plan by December 15. A previous Avalere analysis found that if consumers do shop they are likely to find a lower cost plan.

“This is a competitive market dynamic and many plans that priced attractively last year are playing catch up for 2015,” said Dan Mendelson, CEO at Avalere Health. “Consumers who care about costs need to shop.”

Plans participating in the federal exchange have the ability to renew customers automatically in the same exchange plan in 2015. When this occurs, consumers’ tax credit subsidies are not updated to reflect the new benchmark, and they are not presented with new, lower cost premium options.

In addition, federal premium subsidies are tied to the second lowest cost silver plan (“benchmark plan”) in a given region. Subsidized exchange enrollees who are enrolled in a more expensive plan must pay the difference-dollar for dollar-between the benchmark plan premium and their selection. An analysis released last week by Avalere found that the benchmark plan will remain the same in only 13 percent of regions served by the federal exchange in 2015.

“Consumers who return to healthcare.gov to shop will find lower-cost alternatives available,” said Elizabeth Carpenter, director at Avalere Health, “However, based on experience from other markets, we expect that many people will not return to the exchange website and will remain in the same plan.”

Scenarios 1 and 2 below provide two examples of how consumers in Florida and Pennsylvania could be affected by the premium changes, if they automatically reenroll.

Scenario 1: Jane (Florida)

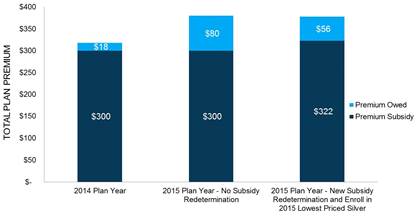

• In 2014, Jane enrolled in the lowest cost silver plan in her region with a $318 monthly premium. Jane earns approximately $17,500 a year (150 percent of the federal poverty level) and qualifies for a subsidy that caps her monthly premium at 4 percent of income. Because the plan she purchased was priced below the benchmark used to calculate subsidies, Jane pays only $18 a month for insurance in 2014.

FLORIDA SCENARIO: INDIVIDUAL AT 150% FPL IN THE 2014 LOWEST PRICED SILVER PLAN, 2014 TO 2015

• In 2015, Jane does not go back to the exchange to re-enroll in coverage and instead is renewed automatically in her existing plan, which has a new premium of $380. While her premium has increased, Jane’s monthly subsidy will be the same as in 2014, $300. This means Jane will pay $80 a month for insurance, a nearly 400 percent increase over 2014. While Jane’s eligibility for premium tax credits will be reconciled when she files her tax returns in April 2016, Jane will experience higher monthly costs until she receives her refund.

• However, had Jane gone back to the exchange to enroll in coverage and picked the new lowest cost silver plan in her region, she would have received $322 in subsidies in accordance with the new benchmark plan and pay $56 a month in premiums. This is still a significant increase over 2014, but a savings of $24 per month over the automatic re-enrollment scenario.

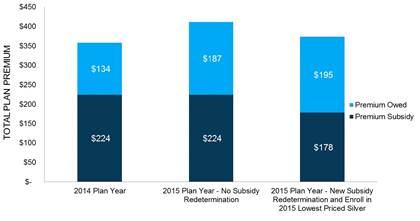

Scenario 2: Bob (Pennsylvania)

• In 2014, Bob enrolled lowest cost silver plan in his region with a $358 monthly premium. Bob earns approximately $29,000 a year (250 percent of the federal poverty level) and qualifies for a subsidy that caps his monthly premium at 8.05 percent of income. Because the plan he purchased was priced below the benchmark used to calculate subsidies, Bob pays only $134 a month for insurance in 2014.

PENNSYLVANIA SCENARIO: INDIVIDUAL AT 250% FPL IN THE 2014 LOWEST PRICED SILVER PLAN, 2014 TO 2015

• In 2015, Bob does not go back to the exchange to re-enroll in coverage and instead is renewed automatically in his existing plan, which has a new premium of $411. While his premium has increased, Bob’s subsidy will be the same as in 2014, $224. This means Bob will now pay $187 a month for insurance.

• However, had Bob gone back to the exchange to enroll in coverage, the exchange would have recalculated his subsidy based on the new benchmark plan, which is significantly lower in 2015 when compared to 2014. As a result, the value of Bob’s subsidy decreases from $224 in 2014 to $178 in 2015. Under the automatic re-enrollment scenario above, Bob could have to pay back more than $550 when he files his taxes because of premium subsidy overpayments.

Methodology

Premium data based on the 2014 HHS Individual Market Landscape file, updated as of August 2014, and the 2015 HHS Individual Market Landscape file, updated as of November 14, 2014. Analysis includes 31 FFM states. 3 FFM states are unable to be included in this analysis as the plan IDs for the selected plans have changed from 2014 to 2015. Analysis excludes state-based exchanges, including those states that use healthcare.gov for their exchange portal (NM, ID, OR, NV). Analysis relies on comparing the premiums of the 2014 lowest and second lowest silver plans, by rating region, to the premiums for those same plans in 2015. To ensure the plans are the same for the comparison, Avalere tracks the lowest and second lowest silver plan IDs that remain the same from 2014 and 2015.

Exchange enrollment data based on “Premium, Affordability, and Choice in the Health Insurance Marketplace, 2014,” Assistant Secretary for Planning and Evaluation, Department of Health and Human Services, June 18, 2014. http://aspe.hhs.gov/health/reports/2014/Premiums/2014MktPlacePremBrf.pdf

For more information about Exchange Plans, contact Caroline Pearson at CPearson@Avalere.com.

Download Avalere’s full release attached.

* The most popular exchange plans in the federally-facilitated marketplace was the lowest cost silver plan in each region. Sixty-five percent of all enrollees selected a silver plan, and 43 percent of those chose the lowest cost plan available to them.