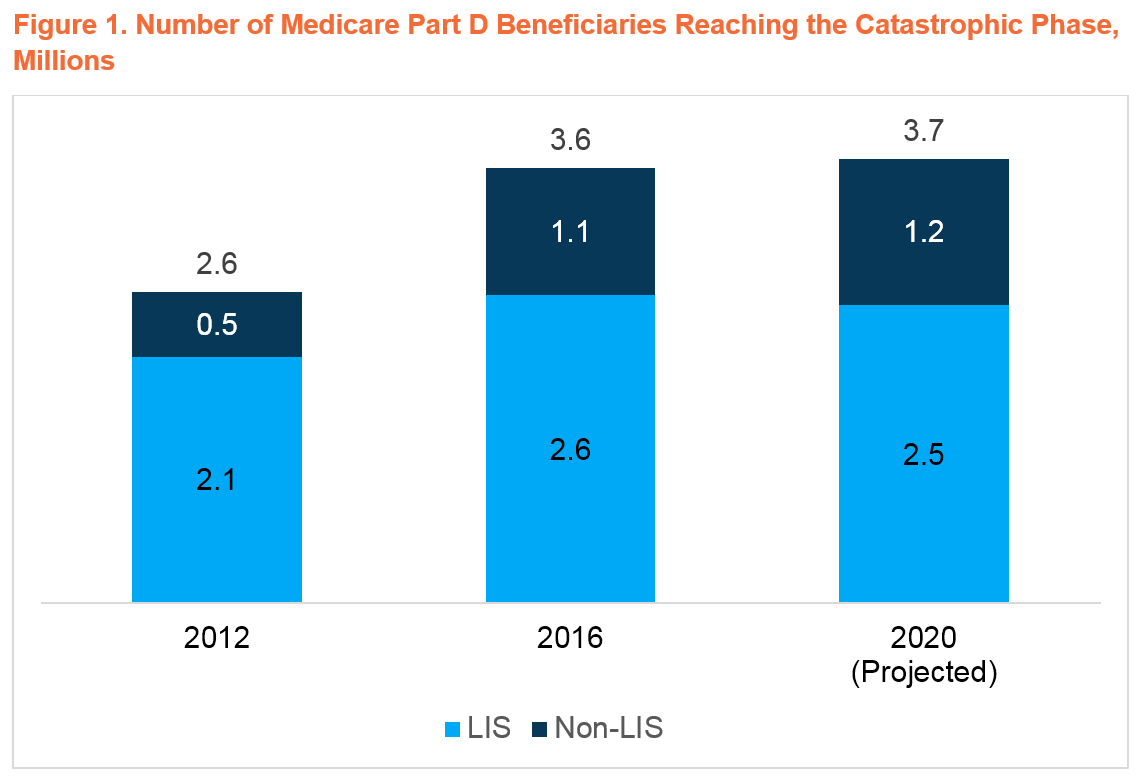

3.7M Part D Beneficiaries Are Projected to Reach the Catastrophic Phase in 2020

Summary

As policymakers consider reforms to Part D, new Avalere analysis shows that congressional proposals to cap out-of-pocket (OOP) costs in the catastrophic phase are likely to reduce OOP for many beneficiariesLawmakers in both the House and Senate are considering reforms to the Medicare Part D benefit’s catastrophic phase. Avalere projects that 3.7M Part D beneficiaries will reach catastrophic in the 2020 plan year.

Standard Medicare Part D coverage includes 4 benefit phases: a deductible, an initial coverage period, a coverage gap, and catastrophic coverage. Beneficiaries move through each phase based on their drug spending with only the highest-cost beneficiaries reaching catastrophic. Spending in catastrophic has grown over time, due in part to an increased number of beneficiaries reaching this phase of the benefit.

Due to the rapid growth in catastrophic spending, policymakers have increasingly focused on ways to manage these costs and limit beneficiary exposure to high cost sharing in Part D. Currently, the catastrophic phase is designed so that beneficiaries who do not receive the low-income subsidy (LIS) pay 5% coinsurance, while plan sponsors pay 15% of costs, and the Medicare program is liable for the remaining 80% through direct reinsurance. Of the 3.7M beneficiaries projected to reach catastrophic in 2020, 1.2M are not expected to receive the LIS, meaning that they are responsible for ongoing cost sharing in the catastrophic phase.

Recently, the House Committees on Ways and Means and Energy and Commerce released a discussion draft proposing to cap beneficiary OOP costs in the catastrophic phase of the Part D benefit, reduce federal reinsurance to 20%, and increase plan liability to 80%. In addition, the Senate Finance Committee recently advanced a proposal to redesign the Part D benefit by eliminating the coverage gap, capping beneficiary OOP contributions at $3,100 beginning in 2022 and shifting federal reinsurance costs onto both plans and brand manufacturers through a new catastrophic discount program.

Establishing an OOP cap would limit exposure to high cost sharing for 1.2M non-LIS beneficiaries—especially those without employer plans offering lower cost sharing than standard Part D coverage. At the same time, it would have little impact on OOP costs for the 2.5M LIS beneficiaries who are projected to reach catastrophic, because these individuals already have no or minimal cost sharing in that phase of the benefit.

Increasing plan liabilities for high-cost, non-LIS enrollees, however, may put upward pressure on premiums. Because Part D plans compete on premiums, plans will have an incentive to limit premium increases and may increasingly use tools like price negotiation and utilization management (e.g., prior authorization, step therapy) to manage drug costs. These techniques could result in lower plan liabilities and impact beneficiary access to therapies.

Although the proposals to redesign Part D are likely to evolve, policymakers will continue to focus on managing costs and affordability for beneficiaries in the catastrophic phase.

Funding for this research was provided by Celgene Corporation. Avalere retained full editorial control.

For Avalere updates, connect with us.

Methodology

Avalere used Part D Drug Event (PDE) data to identify the number of beneficiaries entering the catastrophic phase of the Part D benefit in 2017. Avalere identified these beneficiaries as either LIS or non-LIS (non-applicable or applicable for the purposes of the coverage gap discount program) based on the number of months eligible for LIS.

To project the number of beneficiaries who reach catastrophic from 2018 to 2020 (both with and without the increase in the catastrophic threshold), Avalere accounted for both enrollment growth and policy changes (to the catastrophic threshold and to TrOOP accumulation). Avalere used enrollment projections for the LIS and non-LIS from the 2019 Medicare Trustees Report to account for growing enrollment for each group.

In addition, Avalere conducted additional analysis of the 2017 PDE data to determine how changes to the catastrophic threshold and TrOOP accumulation in the coverage gap could alter the number of beneficiaries reaching catastrophic. Avalere used CMS’s estimates of total covered Part D spending at the OOP threshold for applicable and non-applicable beneficiaries for 2018 to 2020, published prospectively in annual call letters. Avalere adjusted these spending thresholds to 2017 drug cost levels using the published annual percentage increase (API) in per capita Part D benefits. To estimate the spending needed to reach catastrophic in 2020 without the cliff, Avalere recalculated the 2020 spending threshold assuming a lower catastrophic threshold (increasing the 2019 threshold using API from the 2020 call letter). Then, Avalere deflated these spending thresholds using API to 2017 Part D spending levels. Avalere then determined the number of beneficiaries in the 2017 PDE data who would have had spending above and below the deflated spending thresholds for each year.

To learn more about Avalere’s work in this space, connect with us.

Find out the top 2020 healthcare trends to watch.