Understanding the Seasonality of Part D Expenditures Under the OCM

Summary

In the OCM, a total cost-of-care model, episode-level Part D expenditures include the amount the government pays for low income cost-sharing subsidy and reinsurance for beneficiaries who reach the catastrophic portion of the benefit once they have accumulated sufficient OOP costs. The latter leads to a seasonality effect in how Part D payments are captured in OCM episodes, which may have implications for how trends in OCM performance are assessed over time and how the OCM benchmark price is constructed.Analysis

The Oncology Care Model (OCM) is a voluntary, episode-based oncology-focused payment model from the Centers for Medicare & Medicaid Services (CMS) that aims to improve care coordination and reduce costs for Medicare fee-for-service (FFS) beneficiaries. The model evaluates the total cost of care for 6-month episodes initiated by chemotherapy treatments that are attributed to oncology practices participating in the model. Starting in July 2016, in each performance period (PP), the CMS measures practice performance based on its total expenditures relative to a benchmark price. Practice performance and the elected risk track for the PP determines whether the practice earns a performance-based payment or owes a recoupment.

Under the OCM, the benchmark price takes into account government expenditure on Part D drugs incurred during each episode, measured as the sum of low-income cost sharing and reinsurance, or 80% of the gross drug costs above the catastrophic threshold. Reinsurance is only observed in the data once a beneficiary has accumulated sufficient out-of-pocket (OOP) costs to exceed the annual catastrophic threshold. Other Part D expenditures are not included because they are paid on a capitated basis (e.g., the monthly prospective direct subsidy). This method creates seasonal variation in Part D spending since, on average, episodes with fewer months overlapping with catastrophic coverage (particularly those that include earlier calendar months) will have fewer Part D expenditures reflected in their episode cost.

Avalere assessed how differential timing of entry into catastrophic coverage during the calendar year leads to seasonality in the Part D oncolytic spending captured within OCM episodes. Avalere analyzed Part D oncolytic spend as a percentage of benchmark price for PP3–PP6 by month of episode start. The analysis was limited to episodes that were initiated by a Part D chemotherapy or immunotherapy drug among Part D enrollees. Episodes were further restricted to Part D enrollees who did not receive a low-income subsidy (LIS) to focus exclusively on the effect of seasonality created in Part D payments due to timing of entry into catastrophic coverage. The remaining episodes after applying both of these restrictions represented 25% of PP3–PP6 OCM episodes. Solid and hematologic tumors were analyzed separately to understand how the magnitude of Part D seasonality varied by costliness of the tumor type. Among this population, episodes for solid tumors averaged $11,700 in Part D oncolytic spend compared to $38,750 for hematologic tumors.

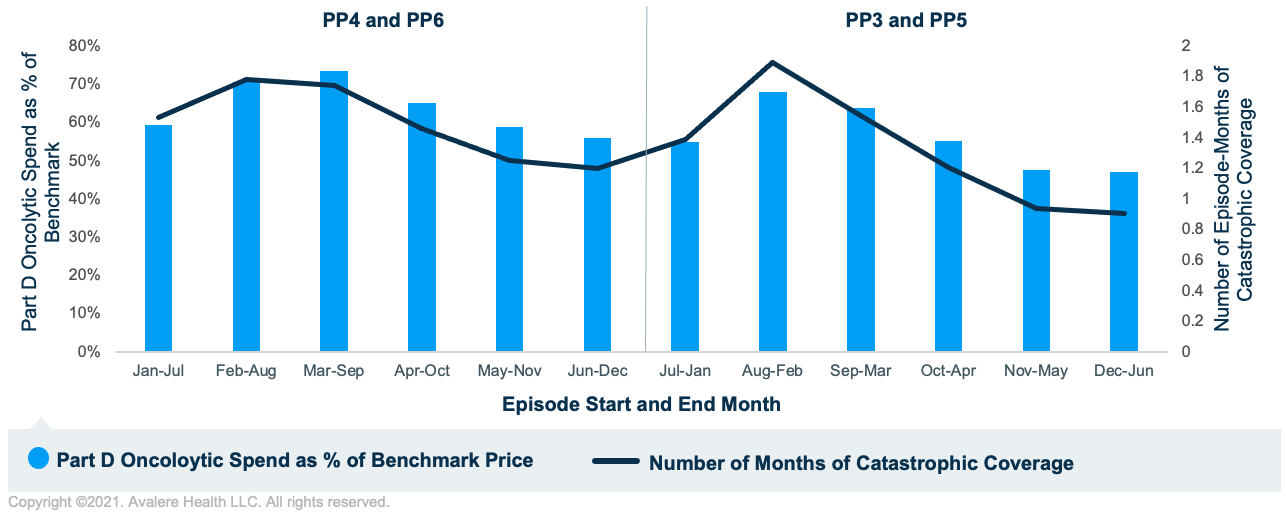

As shown in Figure 1, Part D oncolytic spend for solid tumors as a percentage of benchmark price varied considerably based on the month the episode initiated. Episodes that spanned February to August and March to September had the highest Part D oncolytic spend as a percentage of benchmark. These groups of episodes also tended to have the most episode-months overlapping catastrophic coverage. In contrast, episodes that spanned November to May and December to June had the lowest Part D oncolytic spend as a percentage of benchmark and also had the lowest number of episode-months overlapping with catastrophic coverage.

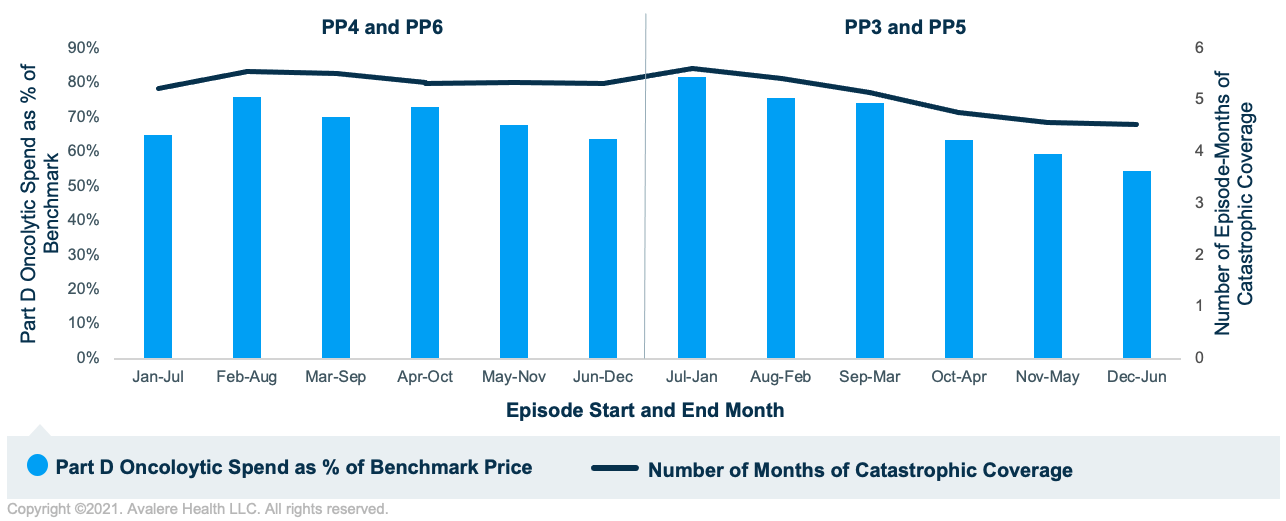

Figure 2 shows analogous results for hematologic tumors. The relationship between the number of episode-months in catastrophic coverage and Part D oncolytic spend as a percentage of benchmark price continues to persist for hematologic tumors. However, there is less variability in Part D oncolytic spend as a percentage of benchmark price since for these higher-cost episodes, the majority of episode-months overlapped with catastrophic coverage. This contrasts with episodes for solid tumors, which had considerably fewer episode-months overlapping with catastrophic coverage since those beneficiaries likely entered the catastrophic phase later in the calendar year.

Implications

Stakeholders should be aware of how seasonality in Part D expenditures may contribute to variation in OCM performance over time. The benchmark price under the OCM may not reflect Part D seasonality in a manner symmetric to actual expenditures. As a result, when comparing actual expenditures to benchmark price to measure performance, the magnitude of Part D spending captured in actual expenditures will vary according to PP and the timing of episode initiation. Thus, episodes with very similar treatment patterns and beneficiary profiles may have different expenditures simply based on which PP the episode was initiated.

Furthermore, how Part D expenditures are used to construct the benchmark price must also be considered. Under the OCM, a historical baseline price is trended forward to construct the benchmark price; the trend factor is calculated using expenditures (inclusive of Part D) for non-OCM participants and is adjusted to the case mix of each OCM participant. This adjustment does not account for potential differences in the mix of plan benefit types in non-OCM practices relative to each OCM participant. Since Part D plan benefit design can influence timing of entry into catastrophic coverage, the benchmark price constructed for an OCM practice may not capture whether non-OCM patients are enrolled in plan benefit designs that result in faster or slower entry into catastrophic coverage relative to the OCM practice. This may have implications for how the benchmark price is constructed and how Part D payments are measured in future iterations of the model.

To learn more about changes in Part D, connect with us.

Methodology

Avalere performed this analysis using Medicare Part A/B FFS claims and Part D prescription drug event data under a CMS research data use agreement. All OCM-eligible Medicare FFS cancer patients receiving cancer treatment were included, which represented less than 20% of total Medicare beneficiaries. Avalere replicated the OCM methodology to calculate episode expenditures and benchmark prices for PP3–PP6. Hematologic tumor types were defined as Acute Leukemia, Chronic Leukemia, MDS, and Multiple Myeloma. All other tumor types were classified as solid tumors. Analyses were limited to episodes for beneficiaries enrolled in Part D and not receiving a LIS, to explore patterns in seasonality of payments. To identify month of Part D catastrophic entry in the calendar year, Avalere used the benefit phase field reported within the prescription drug event (PDE). Avalere excluded beneficiaries enrolled in employer-sponsored or PACE plans as their benefit phase information is not reported in the PDE.