Inflation Reduction Act Renews Focus on Value Assessment in the US

Summary

Government price-setting provisions in the IRA have highlighted the diverse nature and interpretation of value across the US healthcare system.Starting in 2026, the Inflation Reduction Act (IRA) requires the Secretary for Health and Human Services (HHS) to negotiate maximum prices for select brand-name drugs that are covered under Medicare Part B (physician-administered drugs) and Part D (retail prescription drugs). Manufacturers will be required to submit information relating to each of their particular products (e.g., manufacturing and distribution costs, financial support from the government, patent information) and evidence about alternative treatments (e.g., comparative data, prescribing information, comparative effectiveness, unmet need) to HHS before entering negotiations.

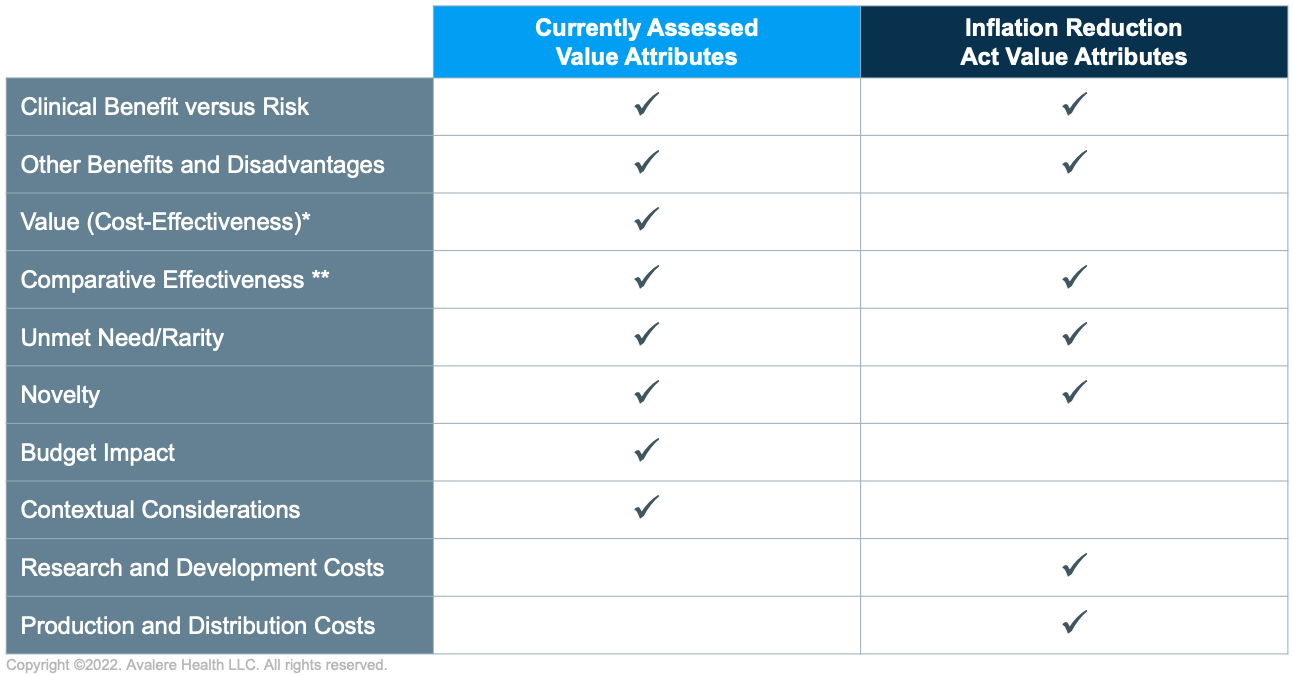

The passage of the IRA adds complexity to a fragmented but increasingly formalized value landscape. Traditional value assessment has focused on demand-side dimensions of value, such as value to patients and health systems. The IRA negotiation process is likely to introduce supply-based considerations, such as research and development costs and the degree to which those costs have been recouped—factors not currently considered by most third-party health technology assessment (HTA) bodies, which conduct structured assessments to inform recommendations related to payment and coverage for health technologies and services.

Current Landscape

In contrast to other major pharmaceutical markets, the US does not have a single arbitrator of value. Lacking a central HTA body, policymakers and public payers tend to rely on third-party value assessors to inform coverage decisions. Policymakers and public payers use tools such as minimum rebate percentages, inflationary rebates, and coverage with evidence requirements to reflect “value” in public policy decisions. Private payers tend to rely on internal value assessment functions and pursue more defined coverage limits or prior authorization requirements. Each value assessor differs in its methods and perspective, and value measurement approaches have grown more divergent over time. This fragmentation has required manufacturers to present their value story at the payer level.

This dynamic is changing, however. The lack of centralized HTA has allowed the Institute for Clinical and Economic Review (ICER) to play an increasingly central role in the value landscape. ICER’s comparative- and cost-effectiveness assessments have achieved modest impact in the commercial market but may be growing in importance in the Medicaid and Medicare markets. Further, ICER’s influence has grown to extend beyond traditional HTA and includes the Unjustified Price Increase Report and policy whitepapers. Manufacturers’ evidence and value generation strategies need to account for ICER’s efforts to establish itself as the central value influencer in the US market.

Life Cycle Value Assessment

The IRA will require manufacturers to develop strategies that span the product life cycle. Value and related evidence requirements are payer and disease specific and have historically been applied at product launch when therapeutic effectiveness may remain uncertain. Although payers differ in their tolerance for uncertainty, high uncertainty (e.g., regarding therapies approved via the Food and Drug Administration’s Accelerated Approval Pathway) typically poses more significant risks to manufacturers.

The IRA’s introduction of government price negotiation will formalize value assessment during later life-cycle stages and require manufacturers to develop an evidence generation program to support the entire product life cycle and shifting value requirements. Life-cycle value assessment will create opportunities for manufacturers to address uncertainties present at market launch, potentially by leveraging real-world evidence to address outstanding questions. However, these later life-cycle advantages may be offset by the inclusion of supply-side considerations, such as production cost and research and development recoupment.

Future Outlook

Implementing regulations associated with IRA drug-pricing negotiation provisions will continue to influence the value landscape. The IRA’s negotiation provisions both broaden and limit the evidence types that manufacturers may use in developing their value strategies. Anti-discriminatory language regarding older-age groups establishes strict parameters for what is permissible in pharmacoeconomic benefit assessment, whereas the inclusion of supply-side dynamics (e.g., production and development costs) adds new elements to the value landscape.

Stakeholders are discussing how HHS’s price justifications—which will likely be made public—could have spillover impact beyond Medicare and across the therapeutic class. In that context, stakeholders are considering how the maximum fair price formula outlined in the IRA statute will define the price ceiling and developing data and evidence strategies to avoid pricing below that ceiling.

The Centers for Medicare & Medicaid Services is likely to release more information in 2023 about how it will complete comparative- and cost-effectiveness assessments as it enters negotiations with manufacturers in 2026 and beyond. As manufacturers, plans, and patient groups prepare for these developments, closer assessment of the existing HTA landscape may clarify how various assessment methodologies could impact maximum reimbursement rates.

How Avalere Can Help

Avalere’s value policy and strategy team can help manufacturers, payers, providers, and patients interpret the impacts of emerging drug negotiation policies and regulations and assess specific impacts on inline and pipeline products. Additionally, Avalere can support clients in their response to value policy proposals and evolutions in the HTA landscape. To see how we can help, contact us.