IRA Question of the Week: How Does the Law Impact Patients?

Summary

The IRA will reduce out-of-pocket drug costs (especially in Medicare Part D), increase the availability of marketplace plans, and expand access to vaccines.The Inflation Reduction Act (IRA) is bringing landmark policy changes to the pharmaceutical and healthcare industries, raising important questions about drug pricing, health plan design, and investment. In this new series, Avalere will be answering the pressing questions shaping healthcare stakeholders’ strategic decision making as the IRA is implemented.

The IRA is expected to lower Medicare beneficiaries’ out-of-pocket (OOP) drug spending, increase access to and affordability of plans available on the Affordable Care Act (ACA) insurance marketplaces, and expand access to vaccines.

Reduced OOP Drug Costs in Medicare Part D

The IRA redesigns the Part D benefit in several ways that will reduce beneficiaries’ OOP costs:

- In 2023, caps insulin cost sharing at $35/month and eliminates cost sharing for all vaccines recommended by the Advisory Committee on Immunization Practices (ACIP)

- In 2024, eliminates beneficiary cost sharing in the catastrophic portion of the benefit ($8,000 in 2024) and expands the low-income subsidy (LIS) to 150% of the federal poverty level (FPL), meaning that all enrollees that currently only qualify for partial subsidy will become eligible for the full LIS

- In 2025, implements an OOP spending cap of $2,000 and allows enrollees to spread payment for OOP costs incurred below the cap over the course of the plan year

- Beginning in 2024, establishes a premium stabilization program to limit the growth of the base beneficiary premium to 6% per year in 2024–2029 and recalculates the base beneficiary premium percentage for 2030 and beyond

Decreased cost sharing will likely lead to higher utilization of Part D drugs and improved medication adherence, which may lead to improved health outcomes and could increase healthcare savings for Medicare in the future. However, plans will also face higher financial liability due to the Part D benefit redesign provisions, which could lead to changes in plan formulary and benefit designs that may present new access considerations for patients.

Decreased Cost Sharing Due to Inflation-Based Rebates and Medicare Drug Price Negotiation

Medicare drug price negotiation will likely result in lower drug prices for beneficiaries. Beginning in 2026, Medicare will negotiate the prices for select Part D drugs; in 2028 and beyond, Medicare will negotiate prices for select Part B drugs. Avalere estimates that the 100 Part B and Part D drugs most likely to be selected for negotiation in 2026–2031 accounted for 45% ($106 billion) of Medicare drug spending in 2020, indicating that patients using drugs selected for negotiation may have lower OOP costs in the future. In Part D, the prices negotiated by the Secretary will become the new Part D negotiated price, which is the basis for beneficiary cost sharing when the deductible or coinsurance applies. In Medicare Part B, inflationary rebates are expected to lower beneficiary cost sharing.

However, drug price negotiation may negatively impact the profitability of providers administering Part B drugs, which could lead to reduced patient access to these drugs. For example, the negotiated price for Part B drugs will directly reduce physician payments: Avalere estimates that the add-on payment across all providers would drop by an average of 47.2%, exposing many to financial risk. Because providers will be acquiring drugs at a higher price and would be reimbursed at the maximum fair price, providers may face payment reductions, cash flow challenges, and new operational complexities for products subject to negotiation. These changes could impact prescribing, treatment, and inventory management decisions shaping patients’ care. For example, providers may be incentivized to consolidate, prefer alternatives to buy and bill, or change the medications that they prescribe.

Increased Access to Marketplace Plans

The IRA includes several provisions intended to increase access to coverage through ACA marketplaces. Through the ACA, the federal government provides premium tax credits to qualified individuals with incomes 100–400% FPL who are buying plans on the individual health insurance market. In 2021 and 2022, the American Rescue Plan Act temporarily increased the premium tax credits available to some individuals; the IRA extends these subsidy enhancements through 2025. It also grants fully subsidized Silver-plan premiums to those up to 150% FPL, increases premium subsidies for people with incomes up to 400% FPL, and makes subsidies available to those earning over 400% FPL. Marketplace subsidies have a substantial impact on access to affordable coverage and may reduce the number of uninsured people, lower OOP spending on premiums, and allow consumers to choose plans based on value rather than cost.

Broader Vaccine Access and Uptake

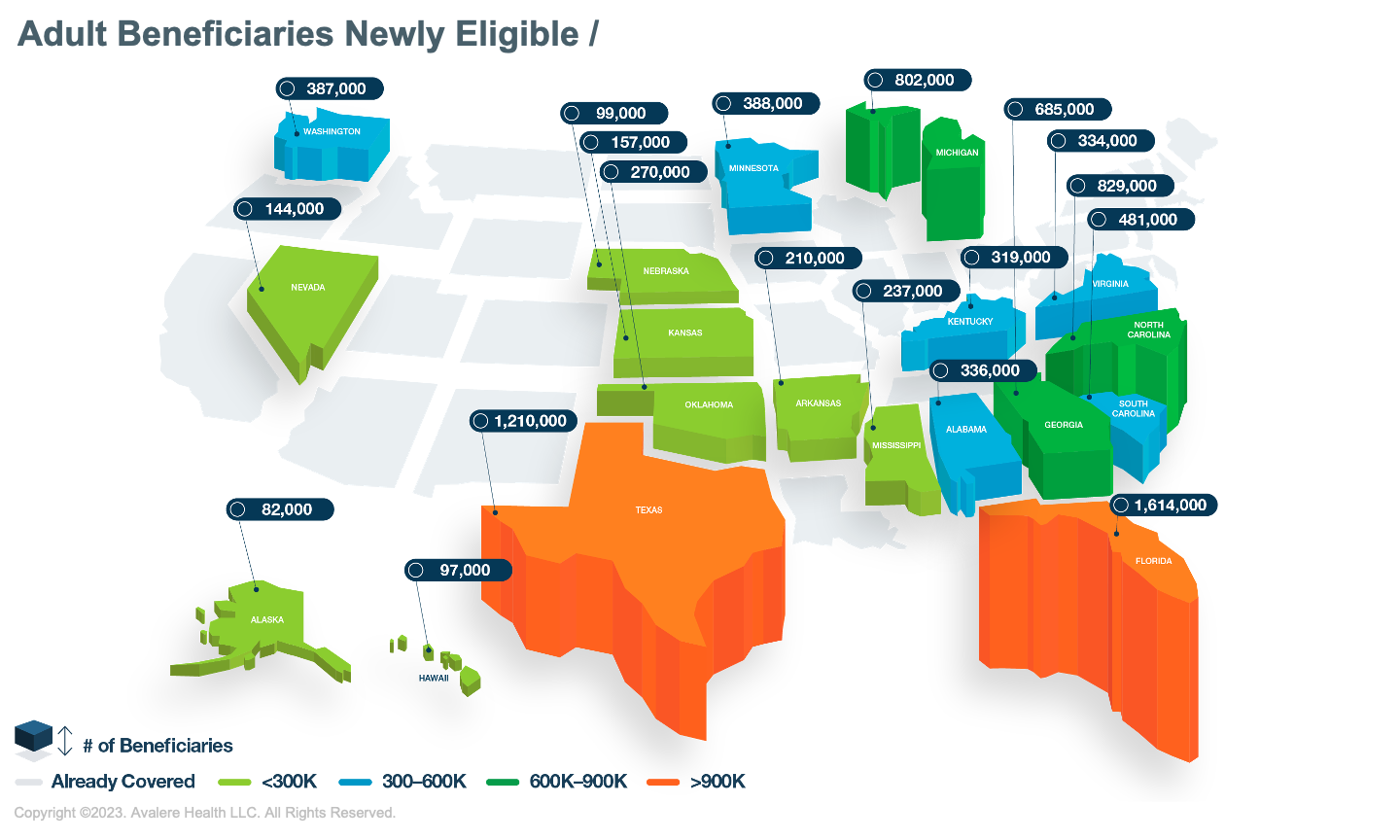

Through the IRA, nearly 75 million adults in Part D and state Medicaid plans will have no-cost access to vaccines. The law requires coverage of ACIP-recommended adult vaccines with no cost sharing in Part D starting January 1, 2023, and in state Medicaid plans starting October 1, 2023. An estimated 8.7 million adults in 19 states are expected to be newly eligible for this benefit.

Dive Deeper

The IRA is one of the most significant pieces of healthcare legislation to be passed in the last decade, with broad implications across healthcare sectors and therapeutic areas. Avalere experts in drug pricing, Medicare, and plan design can help you understand what specific IRA provisions will mean for your organization, your patients, and your industry. To better prepare for the changing healthcare landscape in 2023 and beyond, connect with us.

January 23, 11 AM ET

Learn More