IRA Question of the Week: How Will the Law Impact Plans and PBMs?

Summary

Part D redesign and OOP smoothing shift financial liability from beneficiaries to plans, incentivizing utilization and formulary management.The Inflation Reduction Act (IRA) is bringing landmark policy changes to the healthcare industry, raising important questions about drug pricing, health plan design, and investment. In this new series, Avalere will be answering the pressing questions shaping healthcare stakeholders’ strategic decision making as the IRA is implemented.

In this installment, Avalere experts discuss how Part D redesign and out-of-pocket (OOP) smoothing will improve patient affordability and shift liability from beneficiaries to other stakeholders, including Part D plan sponsors and their pharmacy benefit manager (PBM) parent organizations.

Part D Redesign and OOP Smoothing Increases Plan and PBM Liability

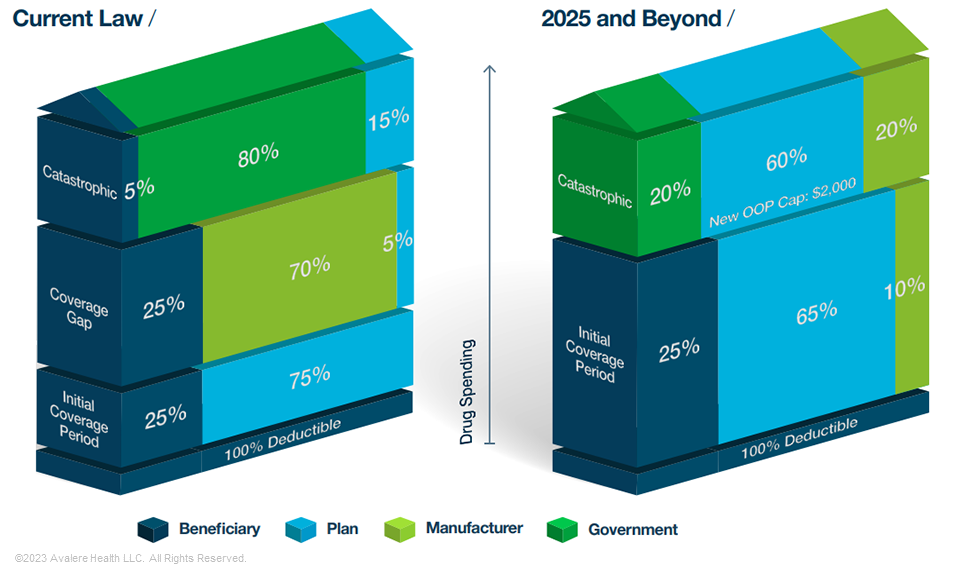

The IRA’s Part D benefit redesign will bring several changes to the program in plan years (PYs) 2024 and 2025 that will impact the economics of health plans and PBMs. OOP costs at the catastrophic threshold will be capped starting in 2024, and plans will cover a higher share of expenses in the catastrophic phase of the benefit, from 15% before IRA implementation, to 20% in PY 2024, and to 60% in PY 2025 and beyond (see Figure 1). Additionally, beginning in PY 2025, the IRA’s smoothing policy will allow all Part D beneficiaries to spread their OOP costs over the course of the year.

Note: Standard benefit under current law applies to non-Low-Income Subsidy (LIS) beneficiaries only. Under the IRA, manufacturer discounts would apply to both LIS and non-LIS beneficiaries.

Plans will take on significant costs when beneficiaries’ spending is in the initial and catastrophic phases of the benefit. They may seek to reduce these costs through plan management formulary redesign, rather than transferring costs to beneficiaries via premiums.

The OOP cap and smoothing mechanism are also expected to increase beneficiaries’ drug adherence and usage, especially for higher-cost or specialty drugs. Manufacturers will benefit from this increase in utilization, while plans will take on additional costs. These changes will amplify the importance of the Part D risk adjustment model, which predicts the cost of drug treatment for different conditions, with variations in its predictive accuracy. Part D redesign shifts liability from the government to health plans through changes to reinsurance programs and to direct subsidies that are adjusted based on health status and other demographic factors. Thus, the accuracy of the risk-adjustment model will be even more influential in determining whether plan payments will reflect actual enrollee costs, especially for those with high drug spending.

Plans Have Several Tools to Mitigate Increased Liability

Plans in the Part D market face several challenges through Part D redesign, but they can use various strategies to mitigate increased liability and address premium pressure. Tighter formulary and network management may change more substantially for health conditions and therapeutic areas where payments may not cover costs. Plans may opt to change their tiering structure, increase the use of utilization management, or change formulary access to respond to these market changes.

Each plan’s ability to absorb the costs of Part D redesign will vary. For example, the environment could be more challenging for standalone Prescription Drug Plans, given that many of these plans enroll a disproportionately high share of the Low-Income Subsidy population, a group whose costs will have the largest relative shift in liability under redesign. At the same time, Medicare Advantage Prescription Drug (MA-PD) plans can benefit from medical cost offsets associated with improved adherence to high-value drug treatment. Additionally, higher-performing MA-PDs can use quality-related rebate dollars for bidding under their benchmark to offset Part D redesign-driven premium pressure, offering more financial flexibility to absorb higher costs.

Next Steps

If plan payments are inadequate, the higher plan liability could create incentives for plans to design formularies in a way that limits coverage for certain beneficiaries and therapeutic areas where plan risk is higher. Recalibrating the risk-adjustment model could address these concerns. Plans and PBM should anticipate guidance on this as the Centers for Medicare and Medicaid Services implements Part D redesign.

The IRA is one of the most significant pieces of healthcare legislation to be passed in the last decade, with broad implications across healthcare sectors and therapeutic areas. Avalere experts in drug pricing, Medicare, and plan design can help you understand what IRA provisions mean for your organization and your industry. To better prepare for the changing healthcare landscape in 2023 and beyond, connect with us.

January 23, 11 AM ET

Learn More