How May the IRA Shift Part D Market Dynamics?

Summary

IRA policies and growing enrollment in Medicare Advantage could begin to destabilize the standalone PDP and LIS benchmark plan market.The Inflation Reduction Act (IRA) is bringing landmark policy changes to the healthcare industry, raising important questions about drug pricing, plan economics, and negotiation. In this series, the IRA Question of the Week, Avalere answers the pressing questions shaping healthcare stakeholders’ strategic decision-making as the IRA is implemented.

In this installment, Avalere experts consider the impacts of the IRA on drug coverage for the roughly 45% of Medicare Part D beneficiaries enrolled in standalone Prescription Drug Plans (PDPs).

Shifting Part D Landscape

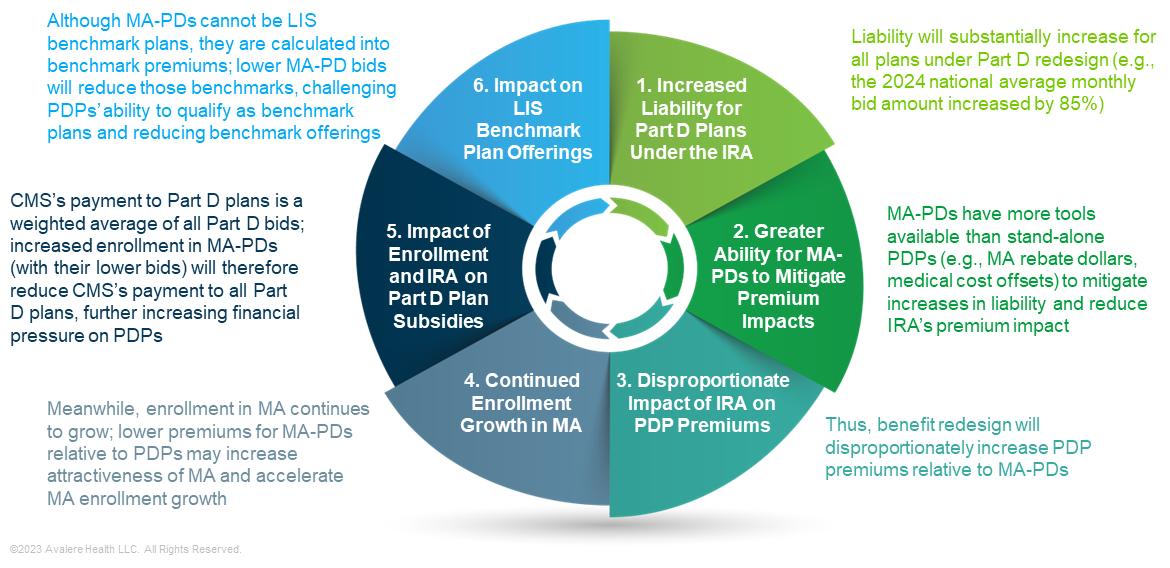

The IRA will substantially shift liability for all stakeholders, including increased costs for Part D plans. Medicare Advantage Prescription Drug Plans (MA-PDs) have more tools than standalone PDPs to mitigate premium increases, likely leading to a larger difference in premiums between the two plan types than in the current market.

Compounding this dynamic is the underlying payment methodology for Part D that favors MA-PDs in a variety of ways. This, too, will add financial pressure on PDPs and could cause some plans to exit the market. Premium and plan availability changes would likely lead to enrollment shifts and potential disruptions for fee-for-service (FFS) enrollees who rely on PDPs for prescription drug coverage (Figure 1).

Increased Liability for Part D Plans Under the IRA

Under the IRA, the Part D benefit will be restructured and liability for all Part D plans will significantly increase. This change in liability will shift plan costs into Part D plan bids, as opposed to costs being primarily paid through reinsurance, as under the benefit today.

For 2024 alone, the average Part D plan bid—also known as the National Average Monthly Bid Amount or NAMBA—is increasing by 85%. This increase reflects some changes to the Part D benefit under the IRA for the 2024 plan year, including the elimination of beneficiary out-of-pocket (OOP) costs in the catastrophic coverage phase.1 The most considerable changes to the Part D program will become effective in 2025, affecting plan bids even more substantially than the 2024 increase. These 2025 changes include the addition of a $2,000 OOP cap, an increase in plan liability in the catastrophic phase from 15% in 2023 to 60%, and new plan liability for low-income subsidy (LIS) enrollees.

Disproportionate Increases in Liability for PDPs

MA-PDs have more tools available to both offset higher liability under the IRA and mitigate the policy changes’ effects on bids and premiums. Because MA-PDs are responsible for both medical and pharmacy benefits, MA-PDs can manage spending across benefits and leverage medical spending offsets. MA-PDs with high quality ratings and that bid below their county benchmark also receive MA rebate dollars. These rebates can be used to further enhance coverage for Part D beneficiaries, such as by “buying down” the Part D premium or offering supplemental benefits not covered by FFS. With the use of rebate dollars, many MA-PDs can offer Part D benefits with no Part D premium. In 2023, almost all (99%) of Medicare beneficiaries have access to a $0-premium MA-PD.

PDPs, in contrast, do not have these tools available to offset increases in Part D premiums due to changes in policy. As a result, benefit redesign is likely to disproportionately increase PDP bids and premiums relative to MA-PDs. Lower premiums for MA-PDs relative to PDPs may increase the attractiveness of MA-PDs for enrollees and continue to accelerate enrollment growth in MA.

The Impact MA Enrollment Growth on Part D Plan Subsidies and LIS Benchmarks

Enrollment in MA-PDs has grown considerably in the past few years, with MA-PDs now comprising approximately 55% of all Part D enrollment (Figure 2). This continued enrollment growth impacts the Center for Medicare and Medicaid’s (CMS) subsidy payments to plans, since the Part D direct subsidy is calculated based on an enrollment-weighted average of Part D plan bids.

Note: Enrollment in cost plans, Medicare-Medicaid Plans, and Program of All-Inclusive Care for the Elderly plans not shown.

Source: Avalere Health analysis using February 2023 enrollment data released by CMS.

Lower MA-PD bids under the IRA coupled with accelerated enrollment growth in MA-PDs due to more attractive premiums will exacerbate the impact of MA-PD enrollment on the Part D direct subsidy. This will result in reduced payment amounts to plans under the IRA relative to what the direct subsidy would be with lower MA enrollment growth. A lower direct subsidy is unlikely to adequately cover costs for PDPs with higher bids. This will create financial pressure on PDPs and may cause some PDPs to reconsider their level of participation and potentially exit the market over the coming years.

Additionally, while MA-PDs cannot be LIS benchmark plans by statute, MA-PD bids are included in the calculation of the LIS benchmark by CMS.2 Lower MA-PD bids and growing enrollment in MA will reduce the LIS benchmark premium amount relative to what the benchmark would be without MA-PD enrollment growth. This will make it more difficult for PDPs to achieve LIS benchmark status. If fewer PDPs qualify as benchmark plans, this could create significant instability in the LIS benchmark market and leave fewer plan options for beneficiaries with LIS who are currently enrolled in benchmark plans.

Prepare for a Changing Landscape

The IRA’s Part D benefit redesign combined with growing enrollment in MA—which is likely to accelerate due to Part D redesign dynamics—may create instability in PDP and LIS benchmark offerings. These dynamics are likely to affect Part D formulary design and beneficiary enrollment patterns, with the greatest implications for enrollees in standalone PDP plans, including beneficiaries in LIS benchmark plans.

For more information on how the IRA may impact the Part D market and to ensure your organization is ready for the changing landscape in 2024 and beyond, connect with us.

Notes

- 2024 changes under the IRA include the elimination of beneficiary cost sharing in the catastrophic phase, expanding the partial LIS to full subsidy benefits, capping monthly insulin cost sharing at $35, and implementing $0 cost sharing for Advisory Committee on Immunization Practices-recommended vaccines. Although the last two provisions were effective in 2023, the policies were not enacted in time to be reflected in 2023 plan bids.

- PDPs with bids below a benchmark set by CMS qualify as LIS benchmark plans. LIS beneficiaries can enroll in these benchmark plans without paying a premium.

Webinar | 2026 Part D Plan and Manufacturer Contracting Strategies

On Wednesday, October 30, at 1 PM ET, join our webinar to learn how Part D redesign and drug price negotiation will shape the Plan Year 2026 market, and what this means for manufacturers and plans.