Part D Premiums Increasing Despite Stabilization Program

Summary

While the premium stabilization program under the IRA limits the growth of the base beneficiary premium, individual plan premiums vary.Overview of Premium Stabilization

The Inflation Reduction Act (IRA) implements a premium stabilization program beginning in 2024 and running through 2029.1 The program limits increases in the Part D base beneficiary premium (BBP) to 6% growth each year. In a recent analysis, however, Avalere found that premiums for standalone prescription drug plans (PDPs) are increasing by 21% on average for the 2024 plan year.

Why are so many PDP premiums increasing by double digits when premium stabilization is supposed to limit annual premium growth to 6%? Under premium stabilization, the 6% limit is applied to the BBP, not each individual plan’s premium. Each year the Centers for Medicare & Medicaid Services (CMS) calculates the national average monthly bid amount (NAMBA) and the BBP. The NAMBA is an enrollment-weighted average of all Part D plan bids for basic benefits.2 The BBP without premium stabilization is calculated as 25.5% of the sum of the NAMBA and projected CMS reinsurance payments.

Under premium stabilization, the BBP is calculated as the lesser of:

- The BBP calculated without premium stabilization

- The BBP from the prior year increased by 6%

Varying Impacts of Premium Stabilization on 2024 Part D Plan Premiums

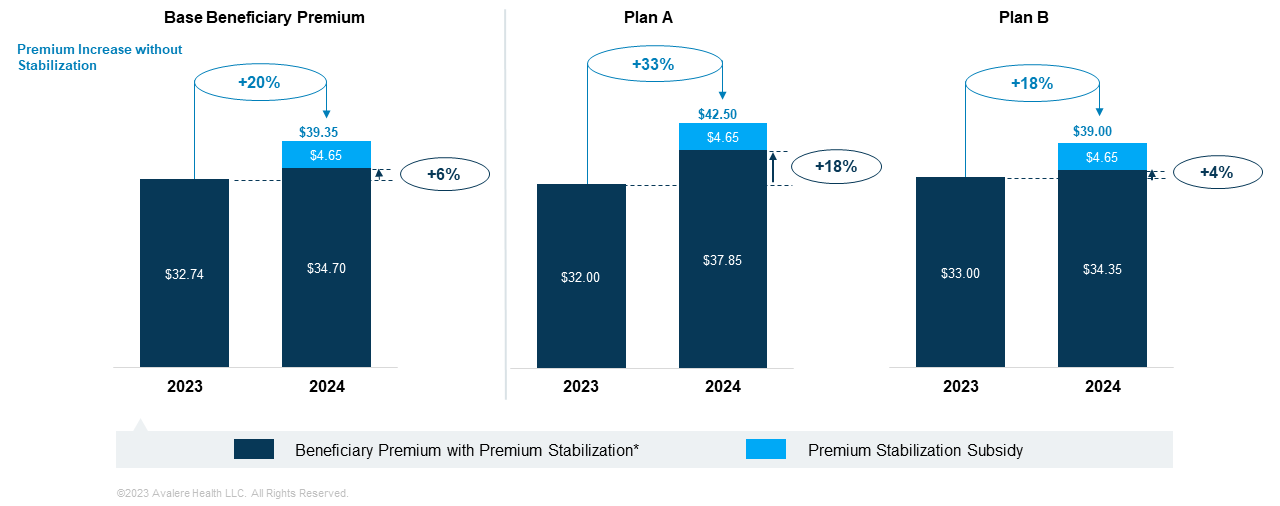

Across all Part D plans, 2024 Part D bids increased by 85% in 2024 due to various market factors. Without premium stabilization, the BBP would have increased by 20%. With premium stabilization, the BBP for 2024 will only increase by 6%. Under the program, CMS will subsidize the increase in the BBP beyond the 6% growth. The value of this subsidy will be applied equally across all plans.

The additional premium stabilization subsidy will mitigate premium growth, but the subsidy will not entirely offset premium growth for plans with large premium increases. Because the BBP represents the enrollment weighted average premium for basic Part D benefits across all plans, an individual’s plan premium amount will be different if their premium was higher or lower than the BBP.

For example, Figure 1 shows two plans with varying degrees of premium increases in 2024. The premium stabilization subsidy in 2024 will be equal to $4.65—the difference between the actual increase in the BBP without stabilization ($39.35) and the BBP with premium stabilization ($34.70). This premium stabilization subsidy will be applied to each plan.

The premium stabilization subsidy affects Plans A and B differently, however, depending on whether their premiums were higher or lower than the BBP. For example, Plan A’s premium would be $42.50 without premium stabilization, which is higher than the BBP of $39.35. Therefore, even with the $4.65 premium stabilization subsidy, enrollees in Plan A will still experience an 18% premium increase. Conversely, Plan B has a lower premium than the BBP ($39.00 vs. $39.35). As such, enrollees in Plan B will only face a 4% premium increase with the premium stabilization program.

*Premium stabilization not in effect in 2023.

As illustrated above, while the premium stabilization program aims to protect beneficiaries against substantial premium increases under the IRA, the impact on individual plans’ premiums will vary. 2024 plan premium data highlights how the stabilization program may further exacerbate differences between MA-PDs and PDPs under the IRA. These market dynamics may lead to enrollment shifts and have implications for beneficiary access in 2024 and beyond.

For more information on how the changing Part D market under the IRA may impact your organization in 2024 and beyond, connect with us.

Notes

- In 2030 and beyond, the base beneficiary premium percentage will be calculated based on the lesser of the base beneficiary premium in 2029 increased by 6% or the base beneficiary premium if the premium stabilization program had not been in place.

- The NAMBA calculation does not include Medical Savings Account plans, Medicare Advantage private fee-for-service plans, Special Needs plans, Cost plans, or Programs for All-Inclusive Care for the Elderly plans.