2024 Part D Bid Cycle Introduces New Considerations for Stakeholders

Summary

As Part D plans and manufacturers begin to prepare for the upcoming calendar year (CY) 2024 bid cycle, the evolving Part D market and policy landscape may significantly shape plan bid and formulary management strategies.Background

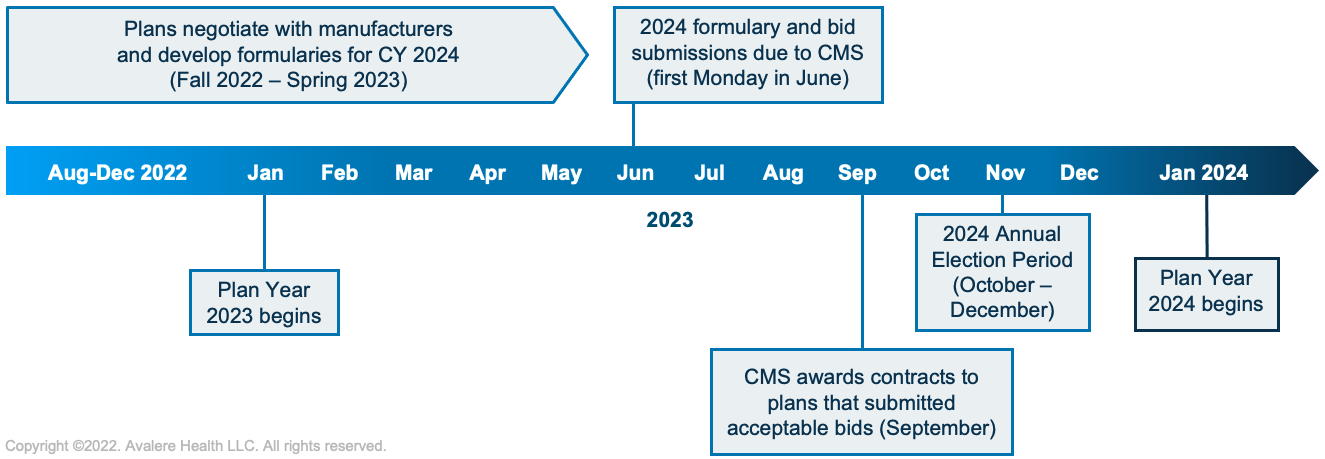

Every year, Part D plans submit bids, formularies, and benefit designs to the Centers for Medicare & Medicaid Services (CMS) for the plans they will offer enrollees for the next calendar year. The bids estimate the average cost of providing Part D benefits based on the interplay of factors such as expected plan membership (including patient demographics and conditions treated), the impact of federal subsidies (based on anticipated utilization), drug costs, manufacturer rebates, and the overall impact on net plan liability.

Part D bids, formularies, and benefit designs are due on the first Monday in June prior to the applicable coverage year; however, formulary negotiations between plans and manufacturers begin much sooner—typically late-summer or early fall in the year before the June submission deadline. For the CY 2024 bids and formularies, manufacturers and plans will be preparing for negotiations over the next several months in anticipation of the June 2023 submission deadline.

In the current Part D bid cycle, a dynamic and uncertain legislative environment will converge with evolving Part D program trends to introduce new risks and opportunities for stakeholders as they prepare for their CY 2024 bids. In particular, 4 key trends will likely inform plan and manufacturer contracting strategies for 2024 and beyond.

1. Program-wide enrollment trends raise new considerations for patient access.

Overall enrollment in Medicare Advantage (MA) has grown significantly in recent years. In 2022, for the first time, a majority of Part D enrollees (52%) are enrolled in a Medicare Advantage Prescription Drug Plan (MA-PD). As recently as 2018, nearly 60% of Part D enrollment was in standalone Prescription Drug Plans (PDPs). Additionally, enrollment patterns have shifted notably among individuals receiving the Low-Income Subsidy (LIS). In 2013, 75% of Part D LIS enrollees were in PDPs, but in 2021 the share dropped to 47%. Similarly, enrollment in Special Needs Plans (SNPs, i.e., MA plans for certain beneficiaries based on the presence of a specific chronic condition, the setting of care, or dual-eligibility status) has grown substantially. Between 2018 and 2022, enrollment in SNPs grew by over 175% (from 2.6 million in 2018 to 4.6 million in 2022).

These enrollment trends could have distinct impacts on access to care. For example, MA plans may offer a more integrated approach across medical and pharmacy benefits but have differences in provider networks compared to traditional Medicare. Additionally, distinct program requirements, payment structures, and benefits for MA-PDs vs. standalone PDPs create differences in plan benefits and formulary designs that impact patient access to therapies. Manufacturers should therefore consider customized contracting strategies for each Part D plan segment.

2. Part D policies in the Senate Finance Committee’s newest drug pricing plan could increase plan liability and change the way formularies are managed in 2024 and 2025.

Key drug pricing provisions included in the most recent draft of the Build Back Better Act released by the Senate Finance Committee on July 6 would be relevant to the next 2 Part D bid cycles. Under the most recent text, Part D enrollee out-of-pocket (OOP) costs would be capped at the catastrophic threshold amount in 2024, and the low-income subsidy program would be expanded to enrollees with income up to 150% of the federal poverty level, which means the upcoming bid cycle would account for these provisions. Full Part D benefit redesign would begin in 2025, which would include an increase in plan liability in the catastrophic phase, a cap on beneficiary OOP costs at $2,000, the elimination of the coverage gap, and the creation of a new manufacturer discount throughout the benefit.

As plans consider the impact of a cap on beneficiary costs in the catastrophic phase and the likely increase in financial liability, they may reevaluate how they manage certain specialty treatments with high catastrophic-phase spending. The extent to which these changes may impact formulary management is likely to vary by therapeutic area. Manufacturers will need to evaluate how lower beneficiary OOP costs due to these provisions may increase treatment adherence and weigh increases in adherence against other changes to formulary and benefit designs that may impact beneficiary access. Multi-year contracting initiated in the upcoming bid cycle will need to take these complexities into account. With legislative activity on drug pricing unfolding in parallel with the 2024 bid cycle, manufacturers should prepare for how plan liability and formulary management could change in response.

3. CMS’s new pharmacy DIR policy in 2024 could create secondary effects for channel stakeholders.

In the recently finalized CY 2023 MA and Part D final rule, plans will be required to include all pharmacy price concessions in the Part D negotiated price and pass these price concessions through to beneficiaries at the point of sale beginning in 2024. Because pharmacy price concessions would no longer be included as direct and indirect remuneration (DIR) in plan bids, CMS estimated that the rule would increase premiums by $13.8 billion over the 10-year budget window (ranging from $0.89 to $2.47 each year).

The estimated premium effect may compel plan sponsors to reevaluate their approach to pharmacy reimbursement, administration fees, network strategy, and drug rebates as part of the CY 2024 bid development process. Channel stakeholders, including pharmacies, manufacturers, and plans, should evaluate the implications of this new policy by therapeutic area and drug type to prepare for potential changes to CY 2024 formularies, plan designs, and financial liability.

4. Plans and manufacturers can pursue health equity priorities in the upcoming Part D bid cycle.

Improving health equity continues to be a high priority for the Biden administration, as demonstrated through recent initiatives such as the Department of Health and Human Services’ Equity Action Plan and as outlined in the Center for Medicare and Medicaid Innovation’s (CMMI) 10-year strategy white paper. Additionally, a recent Avalere analysis found that medication adherence in Part D is linked to race and socioeconomic factors, with differences in adherence levels among beneficiary groups by plan type, LIS status, and plan Star Ratings. Another Avalere analysis found that underrepresented groups had higher OOP costs compared to White beneficiaries. At the same time, the Biden administration continues to be interested in ensuring health equity is addressed in the development of new models through the CMMI, which may include Part D models.

These initiatives and research highlight opportunities to improve health equity and patient access among various enrollee groups, including by beneficiary race, ethnicity, income, geography, and other social determinants of health factors. Understanding where opportunities exist to improve formulary access and adherence rates for certain beneficiary groups will be important for manufacturers when considering their 2024 contracting strategies and broader health equity goals.

As stakeholders begin to prepare for the 2024 bid cycle, being aware of the implications of these trends and environmental factors on formulary decisions and negotiations is particularly important. Understanding economic drivers for all parties will inform preparation, forecasting, and market strategy.

Avalere has deep policy and market access knowledge of the Part D landscape, expertise with Part D modeling, a proven history assisting a range of clients with analytics and research, and proprietary data sets that Avalere leverages to help clients navigate the Part D bid cycle. To learn more about how Avalere can support you in understanding impacts from recent trends and developments in Part D, connect with us.

Methodology

Overall trends in enrollment growth between MA-PDs and PDPs were derived from an Avalere Health analysis of enrollment data released by the Centers for Medicare & Medicaid Services. Estimates of the percentage of LIS lives enrolled in MA-PDs vs. PDPs were derived from the Medicare Payment Advisory Commission March Report to Congress. Trends in SNP enrollment growth were derived from an Avalere Health analysis of enrollment data released by the Centers for Medicare & Medicaid Services.