Some Enrollees May Face Affordability Challenges Under Part D Redesign

Summary

An Avalere analysis finds that about 800,000 beneficiaries in 2024 and 200,000 in 2025 will have OOP costs that exceed 10% of their annual income.The Inflation Reduction Act (IRA) includes several changes to the Part D benefit design that improve affordability for Part D enrollees. Beginning in 2024, the IRA establishes a beneficiary out-of-pocket (OOP) cap at the catastrophic threshold, estimated to be about $3,233 in OOP costs (not including manufacturer coverage gap discounts). In 2025, the act redesigns the Part D benefit to cap beneficiary OOP costs at $2,000 and changes plan and manufacturer liability throughout the benefit (Figure 1). Part D plans will also be required to allow any Part D enrollee to spread their OOP costs over the course of the plan year (known as “OOP smoothing”) beginning in 2025.

*2024 benefit parameters represent projections from the 2022 Medicare Trustees report. In 2023 and 2024, manufacturer discounts count toward the amount needed for an enrollee to reach catastrophic. Beginning in 2025, manufacturer discounts will not count towards enrollees’ OOP costs to reach the $2,000 OOP cap. Graphics reflect benefit design for applicable drugs (i.e., brand drugs, biologics, and biosimilars).

Even with these reforms, some beneficiaries may still face affordability challenges resulting from the timing of their prescription fills and their income. Those most at risk of continued affordability challenges could include beneficiaries:

- With limited income who do not receive cost sharing support through the low-income subsidy (LIS)

- Who, in 2024, have high OOP costs in a short period of time before the OOP smoothing program launches

- Who, in 2025, incur most of their OOP costs later in the plan year (e.g., due to a new diagnosis) when the horizon of time for smoothing OOP costs is reduced

Key Findings

2024

Avalere’s analysis finds that 1.5 million non-LIS enrollees are projected to have OOP spending high enough to reach the OOP cap at the catastrophic threshold for 2024. Furthermore, almost 800,000 non-LIS beneficiaries are projected to have OOP spending on Part D drugs that represents more than 10% of their annual income in 2024, even with their OOP costs capped at the catastrophic threshold. Most of these beneficiaries (80%) have income between 150% and 300% of the federal poverty level (FPL), just above the LIS eligibility threshold.

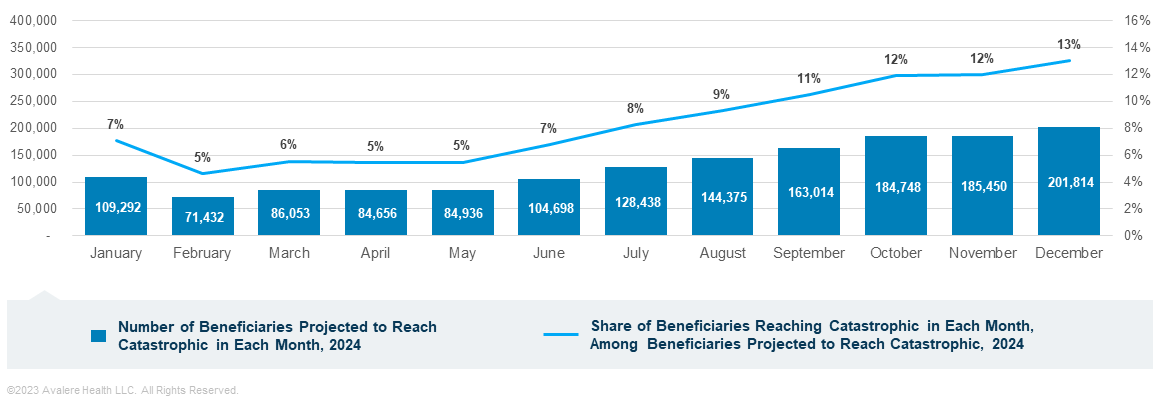

Of the 1.5 million non-LIS beneficiaries projected to reach the OOP cap in 2024, about 270,000 enrollees (18%) are expected to incur their OOP costs in the first 3 months of the year (Figure 2). Because OOP smoothing will not yet be implemented, these beneficiaries may face affordability challenges due to incurring high OOP costs (more than $1,000 per month) in a short period of time.

Greater shares of enrollees who qualify for Medicare based on disability (24%), beneficiaries who are younger than 65 years old (29%), and beneficiaries who are Black (23%) or Hispanic (26%) are projected to reach catastrophic in the first three months of the year compared to the average across all non-LIS enrollees who reach catastrophic (17%; Figure 3).

The highest number of non-LIS beneficiaries who are projected to reach the OOP cap at the catastrophic threshold in 2024 include those taking asthma drugs (482,000 beneficiaries), blood thinners (458,000 beneficiaries), immunology therapies (316,000 beneficiaries), cancer therapies (240,000 beneficiaries), and HIV drugs (216,000 beneficiaries).1 Additionally, 62% of non-LIS enrollees taking passive immunizing agents (i.e., immune globulins that help the body fight infections), 60% of non-LIS beneficiaries taking miscellaneous respiratory agents (which include drugs used to treat conditions such as idiopathic pulmonary fibrosis and cystic fibrosis), and 43% of non-LIS beneficiaries taking cancer therapies are projected to reach the OOP cap at the catastrophic threshold in the first three months of the year in 2024 compared to 18% of all non-LIS enrollees.

2025

For 2025, Avalere’s analysis projects that 2.6 million non-LIS beneficiaries will have OOP spending high enough to reach the $2,000 OOP cap (Figure 4). Even with the $2,000 OOP cap, over 200,000 non-LIS beneficiaries are projected to have OOP spending in excess of 10% of their annual income in 2025.

Similar to 2024, blood thinners (887,000 beneficiaries), Asthma drugs (850,000 beneficiaries), immunology therapies (459,000 beneficiaries), HIV drugs (274,000 beneficiaries) cancer therapies (260,000 beneficiaries) represent the therapeutic areas with the highest number of non-LIS beneficiaries who are projected to reach the OOP cap at $2,000 in 2025.

Since the OOP smoothing program allows beneficiaries to spread costs over the remaining months of the plan year, Avalere examined instances where enrollees may have more limited benefit from smoothing because they incur a majority of their OOP costs in the last few months of the plan year. Avalere found that of the roughly 4.2 million non-LIS beneficiaries projected to have greater than $1,500 in OOP spending in 2025, around 20,000 enrollees are projected to have large OOP spending (i.e., more than $1,250) in the last three months of the year.

Across all non-LIS beneficiaries projected to have OOP spending of more than $1,500 in 2025, greater shares of racial/ethnic minority groups, including Asian, Black, and Hispanic beneficiaries, are projected to incur the majority of their OOP costs in the last 3 months of the year (Figure 5).

Funding for this research was provided by the Patient Access Network (PAN) Foundation. Avalere retained full editorial control.

To learn more about Medicare changes under the IRA, connect with us.

Methodology

Avalere used 2020 Medicare PDE data, accessed via a research collaboration with Inovalon, Inc. and governed by a research-focused data use agreement (DUA) with the Centers for Medicare & Medicaid Services, to project beneficiary utilization and spending under the IRA benefit redesign changes for 2024 and 2025. Numbers are based on a 20% sample, as required under the DUA. For data cuts including income level, Avalere used the 2019 data from the Acxiom database. Avalere’s analysis only estimates effects of Part D benefit redesign under the IRA and does not include interaction effects with other IRA provisions.

Notes

- Although diabetes drugs were also a top therapeutic area for beneficiaries projected to reach the OOP cap in 2024 and 2025 based on 2020 Part D claims, the IRA caps insulin OOP costs at $35 per month beginning in 2023, which Avalere did not incorporate into its analysis. Numbers of beneficiaries taking drugs in each therapeutic area are rounded to the nearest thousand.

January 23, 11 AM ET

Learn More