2025 a Unique Year for MA and Part D Plans’ Rebate Reallocation

Summary

Given increased plan liability under the IRA and uncertainty from late changes to Star Ratings, plans should strategize for their Rebate Reallocation process.Importance Of the NAMBA Estimate

Health plans offering Medicare Advantage Prescription Drug (MA-PD) and standalone Part D Prescription Drug Plans (PDPs) plans estimate the National Average Monthly Bid Amount (NAMBA) as part of the annual bid process. The NAMBA reflects the enrollment-weighted average of the standardized bids across MA-PDs and PDPs and is key to estimating the Direct Subsidy and the Part D plan premium. The Centers for Medicare & Medicaid Services (CMS) pays the Direct Subsidy to MA-PD and PDP sponsors to subsidize the cost of the basic Part D benefit. The Part D plan premium is the amount paid by the beneficiary for the Part D benefit.

Plan actuarial teams are skilled at estimating the NAMBA during the initial bid submission process in early June ahead of the final NAMBA release in July. When plans properly estimate the NAMBA such that their Part D plan premium is within fifty cents of the premium submitted in the June bid, their MA-PD bids and plan benefit designs remain intact. When plans under- or overestimate the NAMBA, they must compensate for the difference by adjusting their Part D plan premium or their allocation of MA rebates through the rebate reallocation process.

Drivers of Uncertainty in the 2025 Bid Year

The 2025 plan year has been extraordinarily tumultuous and there are multiple reasons a health plan’s estimate of the NAMBA may be less precise than in other years. 2025 is the first year of the full implementation of the Inflation Reduction Act (IRA) Part D benefit redesign provisions, which will increase plan liability through substantial changes to Part D benefits. These changes include an annual limit on beneficiary out-of-pocket spending of $2,000, updates to the manufacturer discount program, and a reduction in Medicare’s share of total cost in the catastrophic phase.

Secondly, 2025 is also the first year that separate normalization factors for MA-PDs and PDPs will be used to calculate Part D risk scores. The separate normalization factors are expected to increase MA-PD premiums. The new normalization calculations will lower risk-adjusted payments to MA-PDs at the same time the IRA increases the percentage of plan payments that are risk-adjusted.

Furthermore, certain plans were allowed to resubmit their bids after a judge ruled that CMS did not fully adhere to the Administrative Procedure Act (APA) in finalizing the Tukey outlier methodology for calculating Star Ratings. CMS used the Tukey methodology to remove outliers from the 2023 cut-points before applying the 5% guardrails, resulting in lower 2024 cut-points than had they applied the guardrails to the actual 2023 cut-points. SCAN Health Plan challenged CMS methodology in district court and won the case; CMS was required to recalculate the 2024 Star Rating cut-points and allow affected plans to resubmit their bids. The resubmitted bids will be used in calculating the final NAMBA, further complicating prior estimates. further complicating prior estimates.

Each year, plans’ estimates of the NAMBA rely on their expectation of how their non-benefit expenses will compare to those of other plans in the Part D market. Plans’ non-benefit expenses include costs for administering utilization management programs and their margin for taking on the risk of the Part D benefit. Given the expected volatility in the Part D market in 2025, plans’ estimate of the non-benefit expense portion of the NAMBA will be more uncertain than prior years.

MA-PDs’ Potentially Difficult Decisions on Rebate Reallocation

During the annual Rebate Reallocation process, plans that under- or overestimate the NAMBA have an opportunity to reallocate MA rebates to adjust for changes in the Part D plan premium. A plan’s MA rebates are a function of their bid, the county level fee-for-service (FFS) benchmark, and the plan’s Star Rating. The MA rebate dollars retained by the plan can be used to “buy-down,” or reduce, Part D premiums and to fund other plan enhancements that benefit beneficiaries, such as reductions in cost sharing for Medicare Parts A and B services and supplemental benefits (e.g., vision and/or dental coverage and other non-FFS offerings such as food delivery, transportation to medical appointments, and gym memberships).

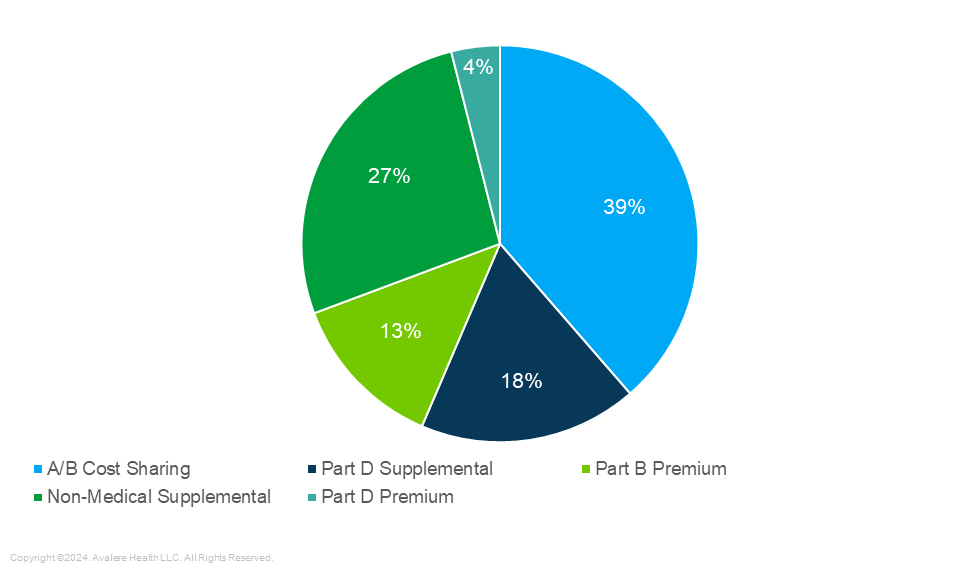

According to the March 2024 MedPAC Report to Congress, the portion of the MA rebate allocated to buying down Part D premiums (previously 13%) is likely to increase as greater plan liability drives up Part D bids and premiums (Figure 1). Greater MA rebates will be needed to cover the higher Part D premiums at a time when the overall level of MA rebates received may be reduced relative to prior years due to slightly negative growth in MA revenue net of MA risk score trend and rising healthcare costs. As such, plans will face internal competition in their allocation of MA rebates between supplemental benefits and Part D premiums. To the extent that a plan overestimates the NAMBA during the initial bid submission in June, their Part D plan premium will increase, requiring a larger allocation of MA rebates to retain the plan’s intended MA-PD premium.

Figure 1. 2024 Average MA-PD Rebate Allocation (MedPAC)

In 2024, the majority (66%) of MA-PDs issued $0 premium plans. For MA-PDs that have offered $0 premium plans in the past, maintaining that status is important for enrollment stability and growth because beneficiaries are highly sensitive to changes in plan premiums. Plans looking to maintain $0 premium status may have to make trade-offs, given expectations of smaller rebates than in prior years.

Conclusions

2025 is an unprecedented year in the Part D market. Between the implementation of the IRA Part D benefit redesign provisions and correction to the Star Ratings after initial bid submission in June, health plans’ estimates of the NAMBA may vary from the final NAMBA published by CMS in July by more than they have in previous years.

After the NAMBA is finalized in late July, plans may adjust their MA rebate allocation or enrollee premium. Given all the uncertainties surrounding the NAMBA estimate in 2025, it is important that plans are prepared for the rebate reallocation process and have considered all possibilities. MA-PDs that lose their $0 premium status may face significant enrollment decreases, but maintaining $0 premium status likely means that 2025 rebate dollars will not stretch as far as they used to in providing other supplemental benefits.

To learn more about how the IRA will impact plan liability and plan bids for MA and Part D plans and how they affect your business, connect with us.

January 23, 11 AM ET

Learn More