Part D Risk Adjustment Will Have New Importance Under IRA

Summary

Analysis of data in the CMS VRDC shows that MA-PD utilization has steadily increased in therapeutic areas likely to have large increases in plan liability under Part D redesign.Background

The Inflation Reduction Act (IRA) is bringing major changes to the entire healthcare industry with effects on beneficiaries, manufacturers, and plans. Starting in 2025, the out-of-pocket (OOP) cap designating the start of the catastrophic phase will be lower ($2,000) and plan liability for beneficiaries in the catastrophic phase will be higher (from 15% to 60%). In anticipation of increased liability in 2025, plans have already increased 2024 bids and premiums, though the impact was not the same for standalone Part D plans (PDPs) and Medicare Advantage Part D plans (MA-PDs). This differential impact can be attributed to inherent differences between the types of plans that allow MA-PDs to offset premium increases. MA-PDs can use medical costs and Medicare Advantage (MA) rebates to offset Part D increases and lower Part D premiums.

In addition to greater plan liability overall, the IRA changes will shift Centers for Medicare & Medicaid Services (CMS) payments to Part D plans from majority reinsurance payments to majority risk-adjusted direct subsidy payments, placing a new importance on the Part D risk adjustment (RxHCC) model. Plans need to carefully examine how the model performs for their beneficiary populations. In previous analyses, Avalere found the RxHCC model underpredicted plan liability overall, and the difference between predicted and actual liability was as high as 70% for some therapeutic areas (TAs).

CMS released the recalibrated RxHCC model in the 2025 Advance Notice to accommodate changes to plan liability under the IRA. While the model is calibrated across all drugs, the predictive power may vary for beneficiaries with certain medical conditions or drug utilization. In earlier work, Avalere found that predicted plan liability under the IRA benefit redesign increased quite drastically for some TAs (up to 250% increases for some TAs relative to pre-IRA liability). In light of the updated risk adjustment methodology’s potential for differential impacts on MA-PDs vs. PDPs, coupled with the large expected impact of IRA benefit redesign on specific TAs, Avalere analyzed patterns in utilization among MA-PD enrollees for select TAs with large expected increases in plan liability under IRA.

Methodology

This analysis utilized the 100% Prescription Drug Event (PDE) data from 2018 through 2022 which reflect both PDP and MA-PD enrollee drug utilization. Avalere accessed the data via the Chronic Condition Warehouse Virtual Research Data Center (VRDC Data) through a data use agreement with CMS.

For this analysis, Avalere identified Medicare beneficiaries enrolled in an MA-PD plan taking one or more drugs classified under one of the following TAs: autoimmune, breast cancer, HIV, or multiple sclerosis. These TAs were selected based on previous work estimating an estimated increase in gross plan liability of over 200% compared to before the IRA.

Findings

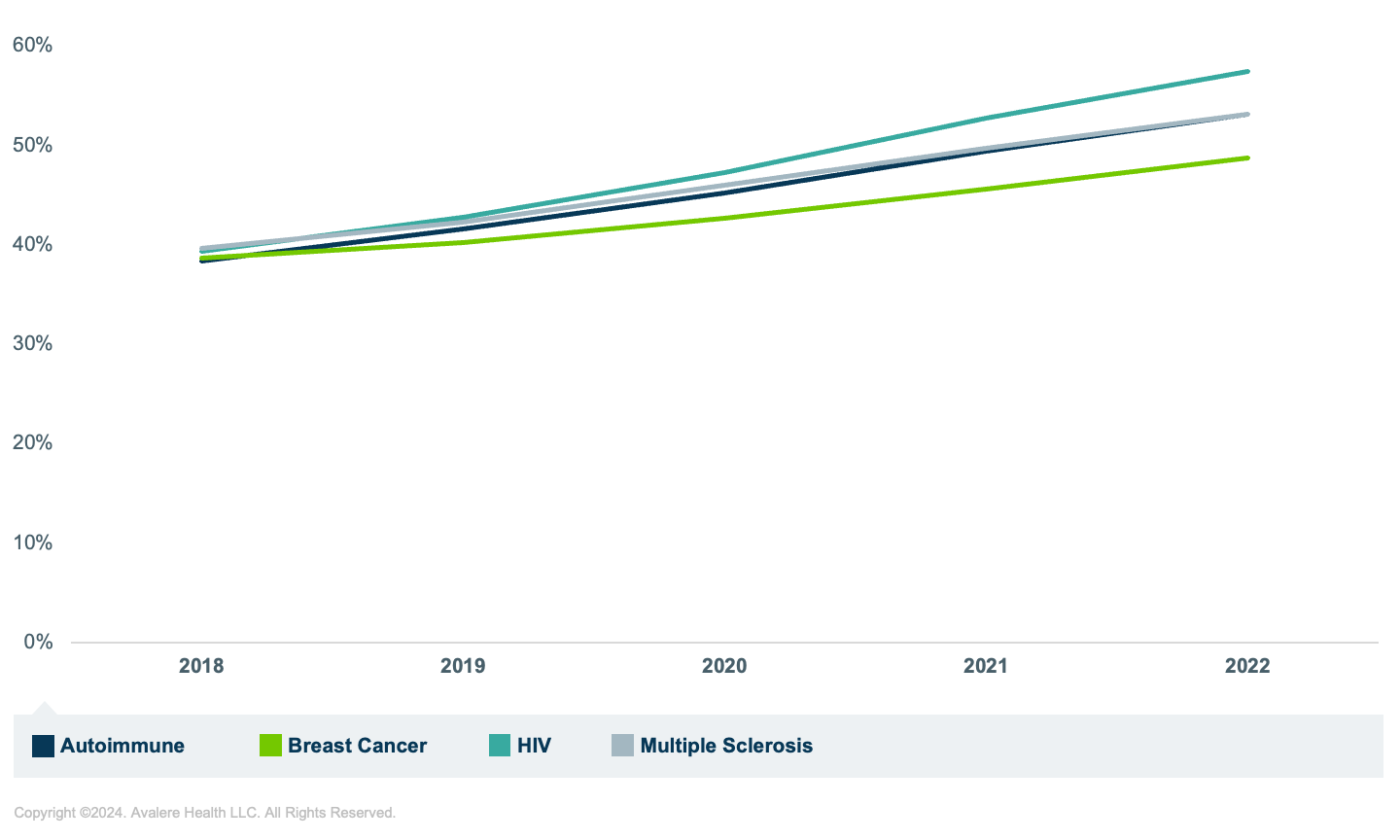

Across all 4 TAs, Avalere found a steady increase in the proportion of beneficiaries in an MA-PD over the period 2018 – 2022. The largest increase was in beneficiaries using HIV drugs—in 2018, 39% of beneficiaries using HIV drugs were in an MA-PD compared to 57% in 2022, a 46% increase. The smallest increase in the proportion of beneficiaries in an MA-PD was for those using breast cancer drugs (an increase of 10% between 2018 to 2022) (Figure 1).

These findings align with general trends in Medicare enrollment, with MA enrollment growing relative to Fee-for-Service (FFS) Medicare. In 2023, 51% of beneficiaries were enrolled in an MA plan compared to FFS (up from 48% in 2022) and the CMS Advance Notice stated that 56% of Part D enrollment was through an MA-PD in 2023. The Congressional Budget Office projects that MA enrollment will keep growing over the next decade projecting 62% of beneficiaries to be in an MA plan in 2033.

Figure 1: Percentage of Unique Enrollees in an MA-PD Across Four TAs, 2018 – 2022

Conclusions

Conclusions

All Part D plans will need to examine how the new RxHCC risk adjustment model will predict liability for their members as a higher proportion of plan payments will be risk adjusted than prior to implementation of the IRA. For the TAs with the largest expected increase in plan liability, our analysis shows a steady increase in the relative proportion of MA-PD utilizers. This highlights the increasing importance of understanding how changes to the IRA and the RxHCC model will impact MA-PDs and PDPs differently—for example, the introduction of separate normalization factors.

Avalere has access to data on 100% of Medicare covered lives through the Chronic Condition Warehouse VRDC, which includes MA encounter data, FFS Medicare Parts A and B claims data, and PDE data. Access to these data is critical for replicating the RxHCC model, which is based on diagnosis data from medical claims. To learn more about how Avalere can use the VRDC to support plans in exploring how the proposed risk adjustment model will predict liability for their case mix of beneficiaries, connect with us.