IRA Reforms Will Impact Patient Adherence and Affordability

Summary

With increased patient utilization and plan formulary responses to Part D redesign, many patients may still face affordability challenges under the IRA.Note: This Insight was originally posted on October 18, 2023. It was updated on November 15, 2023, to reflect the latest analysis.

The Medicare Part D redesign component of the Inflation Reduction Act (IRA) will substantially shift the experiences of enrollees, plans, and manufacturers in the program. In 2025, beneficiaries’ out-of-pocket (OOP) costs will be capped at $2,000 annually and beneficiaries will be allowed to spread these costs over the plan year using the Medicare Prescription Payment Plan (MPPP) (previously known as “OOP smoothing”). Both provisions are expected to increase the utilization of prescription medications. In turn, plans may modify their formulary and benefit designs in response to that expected higher benefit liability. Plans are also expected to vary those strategies for each therapeutic area (TA). Manufacturer contracting approaches with Part D plans will further influence the Part D market, including both plan management responses and patient access dynamics.

Avalere previously analyzed the number and type of non-low-income subsidy (non-LIS) beneficiaries who could still face affordability challenges under the IRA. However, beneficiary impacts cannot be fully analyzed without considering changes in beneficiary, plan, and manufacturer behavior resulting from the significant changes to the Part D benefit in 2025 and beyond.

Analysis Details

Avalere examined how behavioral responses by stakeholders may affect beneficiary affordability under the IRA and the varying effects by TA. Specifically, Avalere modeled the impact of Part D benefit design changes on non-LIS beneficiaries taking medications across eight TAs. The analysis includes TAs with the most non-LIS enrollees expected to reach the catastrophic coverage phase in 2025 and those among the highest Part D spending in 2020:

- Asthma and chronic obstructive pulmonary disease (COPD)

- Autoimmune disease

- Blood thinners

- Cancer (includes chronic lymphocytic leukemia, breast, and prostate cancer)

- Diabetes (non-insulin drugs)

- Eye medications

- Human immunodeficiency virus (HIV)

- Multiple sclerosis (MS)

Avalere’s previous analysis incorporated beneficiary utilization based on higher adherence due to prescriptions filled. Avalere’s updated analysis adds utilization for beneficiaries expected to newly start therapy within the TAs analyzed.

Unless otherwise noted, the findings presented below reflect the model’s conservative estimates (i.e., a low level) of beneficiary utilization and plan formulary management responses. However, higher response scenarios (i.e., a medium or high level of plan and beneficiary behavior response) indicate the potential impacts of the policy in future plan years, as stakeholders continue to adjust to the IRA.

Avalere’s analysis reveals continued affordability challenges for many beneficiaries under the IRA, especially when considering increased beneficiary utilization and potential plan formulary management responses. These affordability challenges are likely to be driven by:

- Increased utilization (i.e., number of scripts filled) and additional beneficiaries who will be able to newly start treatment in response to the IRA’s affordability provisions, which may allow beneficiaries to be more adherent or initiate treatment and could lead to higher overall spending

- Potential for increased formulary management over time, which could lead to higher patient cost sharing

- Patients having high OOP costs relative to their income, with disproportionate impacts among lower-income beneficiaries and some beneficiaries from racial/ethnic minority groups (e.g., Black, Native American), and in TAs with higher projected enrollee OOP costs (e.g., autoimmune, MS, and HIV drugs)

- Some patients being unable to benefit from the MPPP due to incurring a large portion of their OOP costs late in the plan year (e.g., due to a new diagnosis)

Key Findings

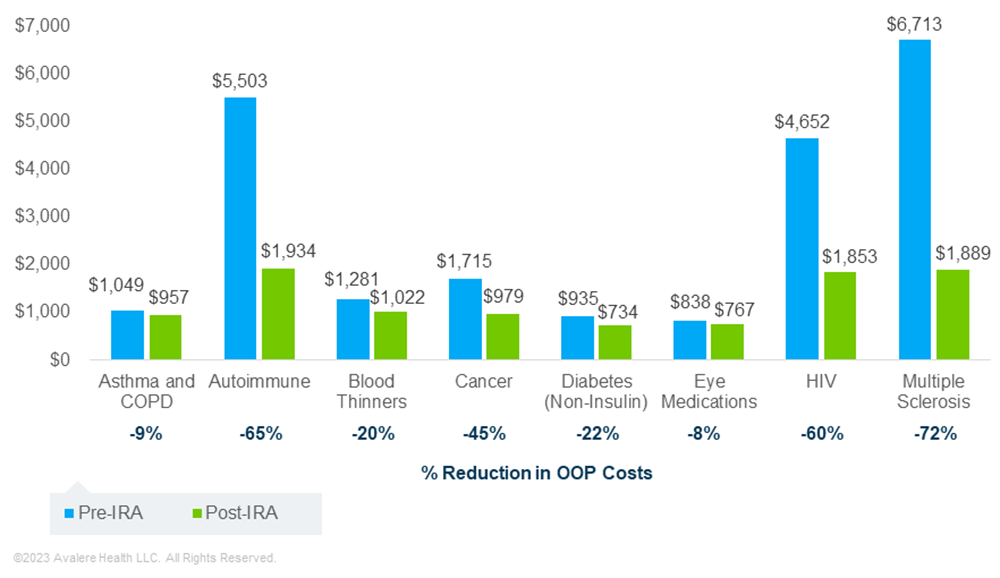

Across the analyzed TAs, Avalere projects that Part D redesign will reduce non-LIS beneficiary OOP costs in 2025 relative to what their OOP costs would have been without the IRA (Figure 1). Savings in the low utilization (which incorporates utilization due to increased adherence and beneficiaries newly starting treatment) and plan formulary response scenario range from 8% for eye medications up to 72% for MS medications.

In contrast, Avalere estimates that in a medium response scenario (i.e., a greater level of plan formulary management and beneficiary utilization response), beneficiary OOP cost savings may be limited. In fact, some enrollees taking medications in certain TAs may see OOP costs after the IRA that are higher than pre-IRA OOP costs. This situation occurs for TAs where patients do not typically have spending above the OOP cap (e.g., in the medium response scenario, there was about a 40%–72% reduction for cancer, HIV, autoimmune, and MS medications vs. a 9%, 12%, and 21% increase in OOP costs for eye medications, asthma/COPD drugs, and blood thinners, respectively).

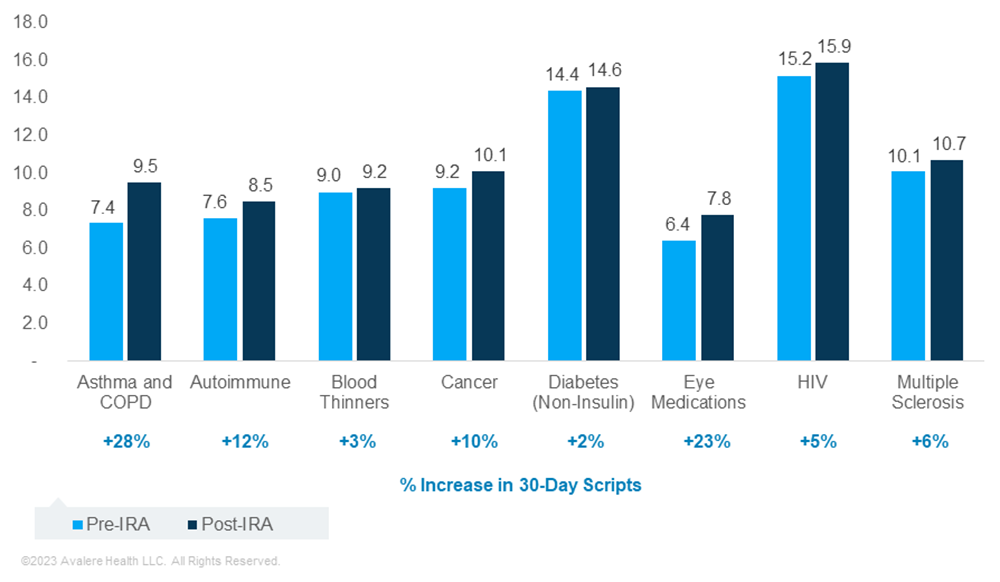

These differences in predicted OOP costs between the low and medium scenarios may be driven by higher beneficiary utilization (including greater adherence and new treatment uptake) for some drugs, combined with plan formulary management changes (e.g., movement of some drugs to higher cost-sharing tiers). For example, in the low beneficiary and plan response scenario, Avalere projects a 2%–28% increase in the number of 30-day scripts under the IRA for the drugs analyzed in each of the eight TAs, when incorporating both increased adherence to current treatment and beneficiaries newly starting therapy (Figure 2). If plans implement more restrictive formulary management, this may limit utilization uptake.

Based on current beneficiary utilization and spending patterns, Avalere estimates that anywhere from 6% (MS) to 86% (autoimmune) more beneficiaries will be on therapy across the analyzed TAs as a result of patients newly starting treatment under the IRA.

*Data on beneficiaries newly initiating therapy for cancer and non-insulin diabetes medications were inconclusive based on historic analysis of beneficiary utilization and spending patterns. As such, Avalere did not assume any changes in beneficiaries newly starting treatment in either of these TAs for this analysis.

Even with the potential for significant savings under the IRA, a large share of enrollees in some of the TAs analyzed are projected to have spending at or just below the OOP cap. Specifically, Avalere estimates that a significant portion of beneficiaries taking drugs for an autoimmune disease (94%), MS (89%), and HIV (87%) in the low behavior scenario will have OOP costs of more than $1,750 in 2025. In addition, some portion of enrollees taking medications for cancer (31%), blood thinners (20%), asthma and COPD (18%), eye medications (13%), and non-insulin diabetes drugs (12%) will experience OOP costs at this level.

High OOP costs are expected to result in many enrollees still facing affordability challenges in 2025. In the eight TAs analyzed, Avalere projects that about 182,000 unique non-LIS beneficiaries will likely spend over 10% of their estimated annual income on OOP costs for Part D drugs. These affordability challenges are estimated to disproportionately affect Medicare beneficiaries with income just above the LIS eligibility threshold (between 150% and 300% of the federal poverty level). Among these lower-income enrollees, a greater proportion of beneficiaries taking autoimmune, HIV, and MS therapies are projected to have OOP costs that represent over 10% of their estimated annual income in 2025 (Figure 3).

Note: Population shown in graphic includes beneficiaries living in zip codes with average income of >150% to ≤300% FPL and with projected OOP costs of >10% of their estimated income in 2025.

Under the medium response scenario, Avalere estimates that approximately 410,000 unique beneficiaries who take medications in these TAs across income levels would spend more than 10% of their annual income on Part D drugs. Across the full Part D population, this group is likely to be much larger.

In particular, some patients from racial/ethnic minority groups may face heightened affordability challenges due to having high OOP costs relative to their income. For example, Black and Native American beneficiaries constitute 3% and 1% of all non-LIS enrollees taking an autoimmune therapy. However, Black and Native American beneficiaries are projected to represent 12% and 4% of the beneficiaries in this TA with OOP costs exceeding 10% of their estimated income in 2025.

Behavioral responses to Part D redesign are likely to determine overall impacts of the policy on beneficiaries, plans, and manufacturers in 2025 and beyond. As such, stakeholders will need to consider the impact of these potential behavioral responses, particularly when combined with other IRA drug pricing provisions (e.g., Medicare negotiation).

Funding for this research was provided by the Patient Access Network Foundation. Avalere retained full editorial control.

To learn more about how Part D changes under the IRA will impact your organization, connect with us.

Methodology

Avalere used 2020 Medicare Prescription Drug Event (PDE) data, accessed via a research collaboration with Inovalon, Inc. and governed by a research-focused data use agreement (DUA) with the Centers for Medicare & Medicaid Services, to model the impact of the IRA’s Part D benefit redesign provisions for the 2025 plan year. Avalere used historical changes in Part D enrollee utilization patterns in response to cost sharing changes to inform assumptions on potential increases in beneficiary utilization (including adherence changes and new treatment uptake) under the IRA. Plan formulary management responses varied by therapeutic area and were based on a comparison of current plan formulary data and alternate management scenarios, informed by actuarial expertise. Manufacturer rebate levels were determined using proprietary data and internal actuarial expertise. Results are based on a 20% sample of the PDE data, as required under the DUA. Avalere used MediSpan to identify drugs within therapeutic areas. For data cuts including income level, Avalere used the 2019 data from the Acxiom database. Avalere’s analysis only estimates effects of Part D benefit redesign under the IRA and does not include interaction effects with other IRA provisions (e.g., Medicare negotiation).