Biden Orders HHS to Test Medicare, Medicaid Drug Pricing Models

Summary

President Biden’s executive order directs HHS to identify CMMI model options that could lower drug costs and promote access for Medicare and Medicaid enrollees.Executive Order Overview

President Biden’s recent executive order instructs the Health and Human Services (HHS) Secretary to prioritize models that could lower cost sharing for commonly used drugs and include value-based payment for drugs. The order requires the Secretary to submit a report on model options by January 12, 2023. This action builds upon drug pricing reforms recently enacted under the Inflation Reduction Act, which includes Part D redesign, Medicare price negotiation, and rebates for Part B and D drugs whose costs outpace inflation.

Background

The Center for Medicare and Medicaid Innovation (CMMI) was established under the Affordable Care Act in 2010 with the goal of testing new demonstrations and models for service delivery, coverage, and payment. The CMMI evaluates model performance based on its ability to reduce healthcare spending while preserving or improving quality of care or on its ability to improve quality of care without increasing spending. The HHS Secretary has authority to expand the scope or duration of a successful model through the formal rulemaking process.

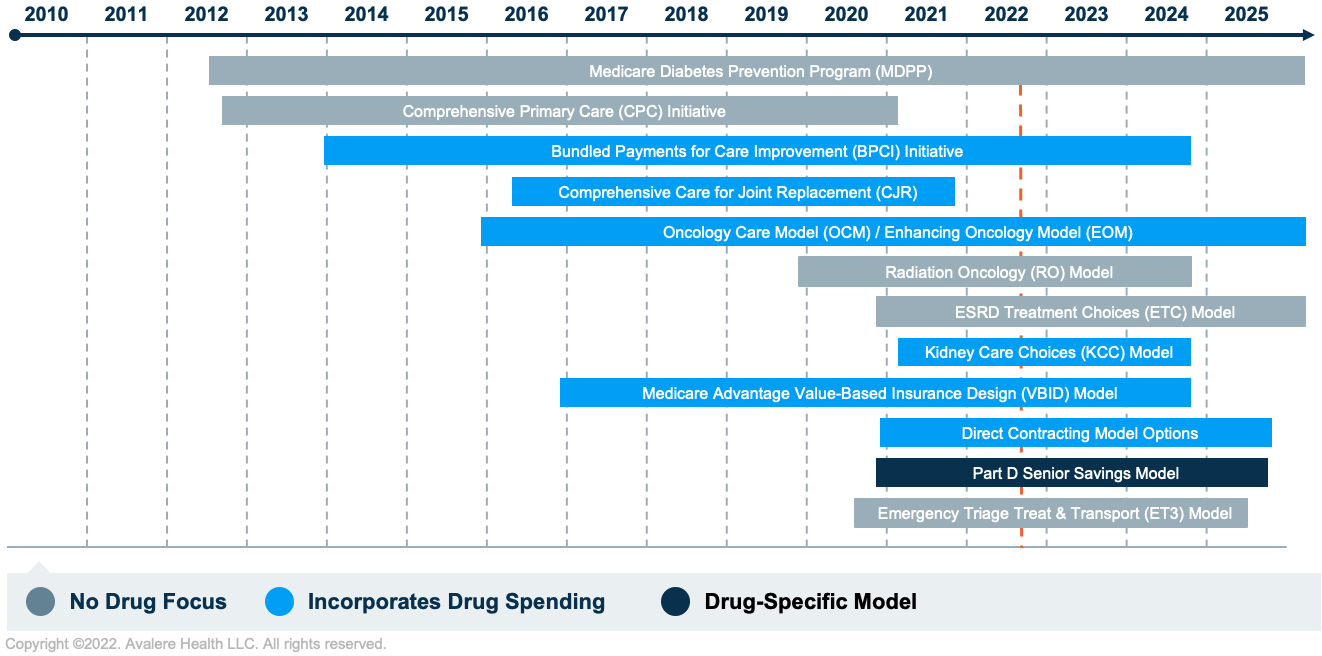

Starting in 2010, the CMMI began experimenting with a variety of models and quality programs. To date, the CMMI has launched over 60 models/demonstrations, with 32 still active. The models vary in terms of their implications for prescription drug utilization and costs, as shown in Figure 1.

Key Questions

As stakeholders prepare for the potential for new CMMI models focused on drug costs, they should consider the following key questions.

Would these be entirely new demonstrations or could the CMMI expand existing demonstrations to add a drug focus?

The broad language in the executive order provides the CMMI the opportunity to either create new models or incorporate a focus on drug costs or value into existing models. While new models would provide more flexibility in design and drug cost control mechanisms, leveraging and building from existing CMMI models could prove more efficient and be quicker to implement.

A January Medicare Payment Advisory Commission meeting explored opportunities for the CMMI to build upon the Senior Savings Model, which tests the impact of alternative Medicare Part D plan options that offer lower insulin out-of-pocket costs as a supplemental benefit. For example, the CMMI could potentially consider expanding this model to other high-cost therapeutic areas that may continue to present affordability challenges for beneficiaries even after Part D redesign is implemented.

Alternatively, the CMMI may specifically focus on new models to better understand the relationship between rebates and competitive dynamics in the Part D market, an issue that some policymakers have suggested may require further exploration. For example, the CMMI could test new approaches of applying manufacturer rebates to beneficiary cost-sharing at the point of sale to assess the overall impact on utilization and program spending. Additionally, the CMMI may target similar models toward specific conditions or certain drug categories (e.g., generics, biosimilars) to assess the role of rebate reform on utilization patterns, Part D spending, and broader program incentives.

Might demonstrations focus on total cost of care (TCOC) or accountable care more broadly, or be specifically focused on drugs?

To date, most CMMI models have been broader provider-focused payment models that look at TCOC. Some of these models, such as the Oncology Care Model and subsequent Enhancing Oncology Model, include prescription drug spending, though few have been exclusively drug-focused.

The CMMI may choose to test TCOC models that carve-in Part D drug spending to benchmarks that today are largely focused on Medicare Part A and B spending only. Such models could assess changes in drug utilization, reductions in total spending, improvements in patient outcomes, and the use of high-value drugs. For example, this approach may include building on CMMI’s Accountable Care Organization framework to assess the impact of drug spending on conditions such as hepatitis C, HIV/AIDS, opioid use disorder, or diabetes.

Would the models be mandatory or voluntary?

Most CMMI models are voluntary, but the CMMI has implemented a limited number of mandatory models over time. In June 2021, CMMI director Liz Fowler expressed interest in exploring more mandatory models in the future to avoid risk selection that can occur in voluntary models.

If voluntary, the CMMI would need to provide sufficient incentives in order to gain interest among potential participants, such as offering providers the opportunity to earn shared savings by reducing the discount to the benchmark that the Centers for Medicare & Medicaid Services (CMS) retains upfront; adding financial incentives, including investment payments or bonuses for small/rural providers; and reducing reporting burden by supporting practices with tools for data collection and reporting.

To which markets would the models apply?

While most CMMI models to date have focused on the Medicare program, the executive order directs CMMI to contemplate models that could also reduce drug costs in Medicaid. The CMMI has some experience advancing models in Medicaid, such as the Maternal Opioid Misuse Model or the Financial Alignment Initiative for Medicare-Medicaid Enrollees, though these models do not focus on drug spending.

Further, through the Value-Based Purchasing regulation that became effective earlier this year, CMS sought to provide new opportunity for state Medicaid programs to access and engage with manufacturers in value-based contracting for prescription drugs, signaling an area of priority that could be further expanded upon.

How might the CMMI align drug payment with value in any new drug-focused demonstration?

As the CMMI contemplates new models under the directive of value-based payment, stakeholders should consider how a new demonstration may assess or measure value for prescription drugs. To date, CMS has not considered value and outcomes for the purpose of Medicare payment, but Medicare negotiation under the Inflation Reduction Act (IRA) will set this precedent as it requires HHS to evaluate clinical and economic data when determining a maximum fair price.

Building on that, the CMMI may follow recommendations presented in a recent report from the HHS Office of the Assistant Secretary for Planning and Evaluation, such as testing small-scale models that directly link a drug’s payment to its clinical value, patient outcomes, and affordability. Such models may incentivize the use of high-value therapies or outcome-based arrangements with manufacturers, but these may also raise challenges in selecting appropriate comparators and accounting for impact on various subpopulations.

MedPAC has previously debated the use of comparative clinical data specifically for Part B drug payment, since Part D plans already consider evidence in formulary decisions. The commissioners reviewed policy options to use reference pricing for physician-administrated drugs in disease areas with therapeutic alternatives or cap payments and require additional evidence generation for innovative products with high degree of uncertainty.

How could the CMMI leverage new prescription-drug-focused models to advance its priorities related to health equity?

In its 2021 Strategy Refresh, the CMMI identified health equity and improved access and affordability as two of the five strategic objectives. In particular, CMMI acknowledged that the full diversity of Medicare and Medicaid beneficiaries had not been included in many of its innovation models and signaled plans to embed health equity in all future demonstration models. The agency aims to include beneficiary populations and provider types not often seen in previous models, including beneficiaries enrolled in Medicaid, people who are dually eligible, and safety-net providers.

What’s Next

As the IRA drug-pricing provisions continue to be implemented, there are a range of projected cascading effects that may challenge CMMI’s ability to implement sweeping drug models. However, the executive order signals that the administration continues to view drug pricing as a political priority and will likely seek to implement new demonstrations prior to the next general elections in 2024.

To learn more about drug pricing reform and CMMI models, connect with us.