Formulary Coverage and Access Shifts in 2024 PDPs

Summary

Avalere analysis shows that there are substantial changes and variations in PDP formularies at the therapeutic area and regional levels from 2023 to 2024.Between 2023 and 2024, the number of standalone prescription drug plans (PDPs) and low-income subsidy (LIS) benchmark plans decreased, and Part D premiums increased for PDPs.¹ These changes in premiums and plan offerings may shift access and affordability for prescription drugs for those with Medicare.

To assess the impact of PDP and LIS benchmark plan market changes, Avalere evaluated PDP and LIS benchmark plan formularies from 2023 and 2024. The analysis focused on 24 of the most frequently used, single-source brand drugs across five select therapeutic areas:

- Anticoagulants

- Asthma/chronic obstructive pulmonary disease (COPD)

- Autoimmune

- Multiple sclerosis

- Pulmonary hypertension

Avalere conducted two sets of comparisons to evaluate PDP and LIS benchmark plan formulary changes, respectively:

- PDP Comparisons

- Changes between 2023 and 2024 PDP formularies for PDPs offered in both years.

- Differences between 2023 formularies for plans that exited the market in 2024 and 2024 formularies for plans that remained in the market.

- LIS Benchmark Plan Comparisons

- Changes between 2023 and 2024 formularies for LIS PDPs that maintained benchmark status.

- Differences between 2024 formularies of PDPs that were LIS benchmark plans in 2023 but lost benchmark status in 2024 and 2024 formularies for LIS benchmark plans that maintained benchmark status.

The Number of PDPs Decreased by 12% from 2023 to 2024. Of the 801 PDPs offered in 2023, 95 were no longer offered in 2024. These 95 PDPs represented 12% of all PDPs available in 2023 and covered 2% of PDP enrollees (about 400,000 enrollees) that year.

PDP Coverage Changes Vary by Therapeutic Area and Region. When comparing 2023 vs. 2024 PDP formularies for plans available in both years, coverage remained relatively stable for the anticoagulant and multiple sclerosis drugs analyzed. Meanwhile, coverage increased for asthma/COPD and autoimmune drugs, and coverage decreased for pulmonary hypertension drugs in 2024 (Figure 1).

Figure 1: Coverage by Therapeutic Area, 2023 vs. 2024 PDP Formularies, Among Plans that Remained in the Market in Both Years

When comparing formularies of 2023 plans that exited the market vs. 2024 plans that remained, there were minimal differences in coverage across the five therapeutic areas, except for pulmonary hypertension. For highly utilized pulmonary hypertension drugs, coverage was six percentage points lower among 2024 plans that remained in the market vs. the 2023 plans that exited the market. In other words, for beneficiaries that were enrolled in PDPs that exited the market in 2024, coverage options among available 2024 plans remained similar for some therapeutic areas but was worse for highly utilized pulmonary hypertension drugs.

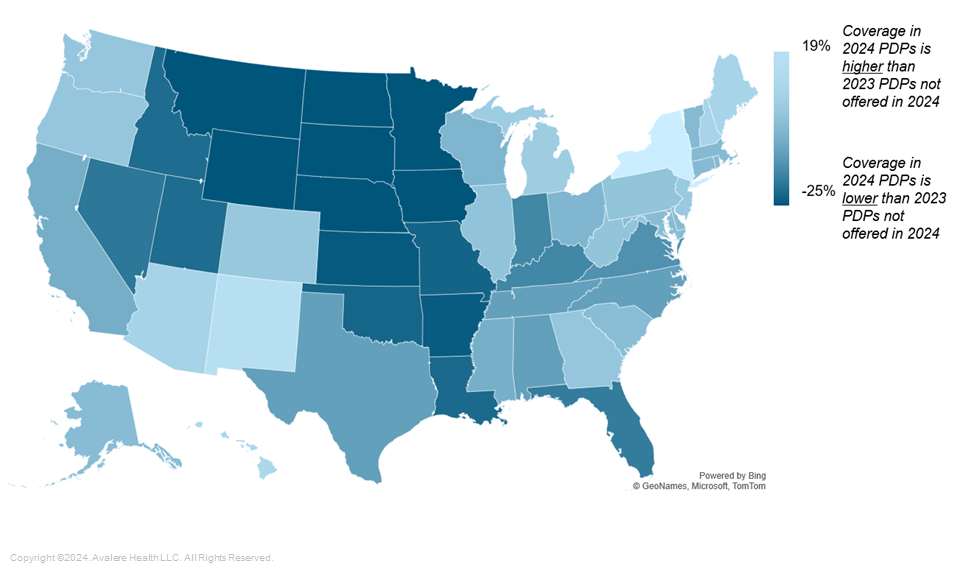

For some analyzed therapeutic areas, there were also regional variations in coverage between 2024 PDPs and 2023 PDPs that were not offered in 2024. For example, for highly utilized multiple sclerosis drugs, coverage was higher by at least five percentage points in 13 regions for plans that remained in the market in 2024. Meanwhile, coverage of multiple sclerosis drugs was lower among plans that remained in the market in 2024 in 11 regions (Figure 2).

Figure 2: Difference in Coverage for 2024 PDPs Offered vs. 2023 PDPs Not Offered in 2024, Multiple Sclerosis

Use of Coinsurance Changed Most for Blood Thinners and Asthma/COPD Therapies. Across analyses, cost-sharing changes were limited for autoimmune, multiple sclerosis, and pulmonary hypertension drugs. However, use of coinsurance for anticoagulants and asthma/COPD drugs increased substantially for all PDP comparisons. For example, among PDPs that remained in the market in both years, use of coinsurance increased by 26 percentage points for anticoagulants and 31 percentage points for asthma/COPD drugs from 2023 to 2024. This increased use of coinsurance was largely driven by more PDPs implementing coinsurance on the preferred brand tier in 2024 rather than due to changes in tier placement.

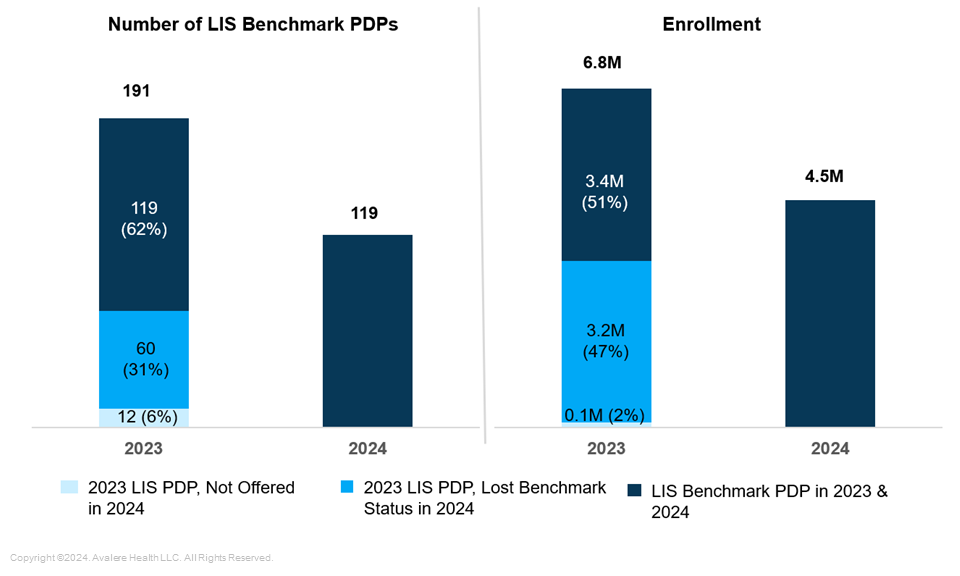

Almost Half of Enrollees in LIS Benchmark Plans in 2023 Were in Plans that Lost Benchmark Status in 2024. The number of LIS benchmark plans decreased substantially from 2023 to 2024, from 191 plans to 119 plans. In 2023, 6.8 million enrollees were in the 191 LIS benchmark PDPs. In 2024, 60 plans lost benchmark status and those plans represented nearly half (3.2 million) of 2023 LIS benchmark plan enrollees (Figure 3). Due to this loss in benchmark status, these enrollees had to choose a new plan or pay a premium in 2024.

Figure 3: Number of LIS Benchmark PDPs and Enrollment in 2023 and 2024

Coverage Changes for LIS Benchmark Plans Were Limited to Certain Analyzed Therapeutic Areas. Coverage was largely stable between 2023 and 2024 for LIS PDPs that maintained benchmark status. However, there was a slight increase in coverage for multiple sclerosis drugs (three percentage points) and a decrease in coverage for pulmonary hypertension drugs (eight percentage points).

Meanwhile, when comparing 2024 PDPs that lost benchmark status and 2024 LIS PDPs that maintained benchmark status, plans that maintained benchmark status largely had higher coverage for most therapeutic areas (asthma/COPD, multiple sclerosis, pulmonary hypertension). The only therapeutic area where coverage was lower in plans that maintained benchmark status was for autoimmune drugs (five-percentage-point difference).

More Substantial Regional Variation in Utilization Management (UM) Changes Exist for Certain Therapeutic Areas. For PDPs that lost benchmark status compared to 2024 LIS PDPs that maintained benchmark status, there were few national differences in use of UM (including prior authorization and step therapy), but there were substantial regional differences for anticoagulant drugs. In fact, in five regions, there was a 20-percentage-point or more difference in UM among plans that lost benchmark status compared to plans that maintained benchmark status (Figure 4). There were no differences in UM for the four other therapeutic areas.

Figure 4: Difference in Utilization Management Between 2024 LIS PDPs that Maintained Benchmark Status vs. 2024 LIS Plans that Lost Benchmark Status, Anticoagulants

Note: Wisconsin does not have any plans that lost benchmark status.

Implications for Patient Access

Across all analyzed therapeutic areas in aggregate, shifts to measures of formulary access may appear rather minimal. At the same time, variations by therapeutic area and by region indicate that individual patients could experience major impacts due to year-to-year changes in plan offerings and formularies. Specifically, shifts in formularies can lead to differences in patient access and affordability based on a beneficiary’s medication needs and where they live.

Additional changes in plan formulary and benefit offerings are likely in 2025 and beyond, when Part D redesign shifts significant cost liability to health plans. Such changes could further influence beneficiary access and affordability for beneficiaries in Part D, with varying impacts for different patient populations.

Methodology

Avalere used 2023 and 2024 Centers for Medicare and Medicaid Services (CMS) Part D Public Use Files (PUFs) for this analysis. Monthly Part D PUFs contain formulary, cost sharing, and utilization management information for Medicare PDPs. For the five therapeutic areas included in this analysis, Avalere identified the most frequently used branded, single-source drugs based on the 2022 utilization available in the Medicare Part D Drug Dashboard. All national drug codes for each drug were included in the analysis. Avalere analyzed and summarized coverage at the contract/plan level and averaged across all plans in each PDP region and nationally for each therapeutic area. All results are weighted based on plan enrollment. Avalere utilized the 34 PDP regions established by CMS, to assess regional differences.

Avalere’s experts in formulary design and the Medicare program support clients with qualitative and quantitative analysis of the Part D and Medicare Advantage market to inform their business strategies. To learn more about how Part D market changes could affect your business, connect with us.

Funding support for this research came from the Patient Access Network Foundation (PAN Foundation). Avalere maintained full editorial control over the content in this issue brief.

¹ LIS benchmark plans are standalone PDPs that do not have premiums for Part D enrollees receiving low-income subsidy.

January 23, 11 AM ET

Learn More