MolDX May Be the Norm, but Is It the Future?

Summary

With over 16,000 genetic tests already on the market and thousands more in development, stakeholders cannot ignore the rapidly evolving field of personalized medicine.Manufacturers are simultaneously drawn to and challenged by the “redesign” of therapy, while patients and providers are intrigued by the ability to obtain pivotal diagnostic and prognostic information about various conditions. Despite all the potential, much uncertainty remains regarding how molecular diagnostic tests should be covered and paid for by health plans. In particular, identifying appropriate evidentiary standards to evaluate these tests- whereby the need for manufacturers to generate data regarding the value of their tests is balanced with the importance of fostering future innovation- has proven quite difficult. Recently, though, several groups have started creating standards that foreshadow where the molecular diagnostic market is heading in terms of evidentiary thresholds for market entry.

Evolving Evidentiary Standards

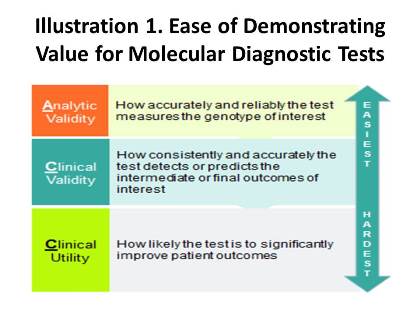

In 2011, after observing an influx of molecular diagnostic laboratories in California, Palmetto GBA, the former Medicare Administrative Contractor (MAC) for the region, launched a program called MolDX (Note: while Palmetto lost its rebid for Jurisdiction E, which covers California, it retained its control over Jurisdiction 11, the Carolinas, and has continued overseeing MolDX through that region), which was designed to produce evidence-based coverage policies for molecular diagnostic tests. As part of the initiative, all manufacturers and laboratories seeking coverage for their tests must provide Palmetto with robust evidence demonstrating not only the baseline of analytic validity, but clinical validity and utility as well. While these standards may sound similar, their definitions and the ability to meet them are radically different. Analytic validity is the simplest criterion to establish and entails assessing how precise a given test is at evaluating the gene(s) of interest; clinical validity refers to how accurately a test detects or predicts the intermediate or final outcomes of interest; and clinical utility involves the probability that test results will change provider behavior and improve patient outcomes. Palmetto performs technology assessments for each test using these standards, and issues positive coverage decisions only for products that demonstrate all aspects of the continuum in Illustration 1.

Some argue that the coverage criteria pioneered by the MolDx program have set the “golden standard” for how the value of molecular diagnostics should be evaluated by all payers. Since the initiative’s inception, several other payers have followed suit in adopting Palmetto’s evidentiary requirements. For example, in Sept. 2013, Noridian Administrative Services announced that it would accept all molecular diagnostic coverage determinations generated by MolDx. Moreover, two other MACs, namely, CGS Administrators and First Coast Services, recently have released coverage decisions that are practically verbatim copies of MolDx policies for the same tests and indications. Private payers will also likely jump on board, citing MolDx analyses to justify their decisions.

What’s to Come

Despite MolDX’s growing momentum among payers, not all health plans are sold on the new evidentiary standards. While Novitas Solutions requires laboratories to provide data supporting use of some of their tests, the thresholds for coverage, based on recent decisions issued by Novitas, seems to be less standardized and rigorous than those used by Palmetto. This presents an interesting forecast for what the future of coverage for molecular diagnostic tests might entail, especially given that the MolDx program may be expanded on a national basis. In fact, language included in the recent “doc fix” legislation allows the Center for Medicare & Medicaid Services to designate a single (or up to four) MAC(s) to generate coverage policies for clinical laboratory services. This could mean that if Palmetto were selected as the single entity, we would be likely to see a “national” MolDx program.

What would this mean for market access of molecular diagnostic tests set to come to market in the near future? Find out at Avalere’s upcoming conference on September 18 at the House of Sweden Hotel in Washington, DC.