Payer Survey Finds Opportunities for Renewed Focus on Mental Health

Summary

An Avalere survey of 37 decision-makers at risk-bearing payer entities identified shifting trends and focus for coverage of and access to behavioral health treatments and services.In 2019, more than 1 in 5 US adults experienced mental illness, with 5.2% experiencing serious mental illness. In 2020, the percentage of uninsured adults with mental illness increased to 10.5%, and 57% of all US adults experiencing a mental illness received no treatment. Existing issues with the fractured mental health care system in the US were exacerbated due to the COVID-19 public health emergency (PHE). As of July 2020, over half of US adults reported that the PHE caused at least 1 adverse effect on their mental health. In March 2021, 47% of US adults reported negative mental health impacts due to PHE stress. These statistics highlight opportunity for increased prioritization of access to behavioral health services.

Results from the Assessment of Key Stakeholders Across Behavioral Health Benefit Management

To better understand current stakeholder perspective around behavioral health services, Avalere Health conducted a survey of payers, integrated delivery networks, and behavioral health management organizations. The survey explored perspectives on mental health parity such as network adequacy and provider reimbursement, as well as utilization of telehealth, and value-based payments currently and in the future. Key findings include:

1. Organizational Prioritization of Behavioral Health

Behavioral health did not emerge as a top management priority or area of organizational expenditure, indicating opportunity for greater attention. However, the impact of the COVID-19 PHE on plan member mental health needs and utilization may increase attention and management effort in upcoming plan years.

2. Compliance with Parity Laws

Almost all payers recognized the importance of the Mental Health Parity and Addiction Equity Act. Many, however, revealed a lack of current compliance with all behavioral health parity expectations, creating potential for less-favorable benefit restrictions for behavioral health services as compared to medical and surgical services. Furthermore, although required by law, not all payers are even conducting many of the analyses necessary to compare behavioral health benefit adequacy to medical benefits.

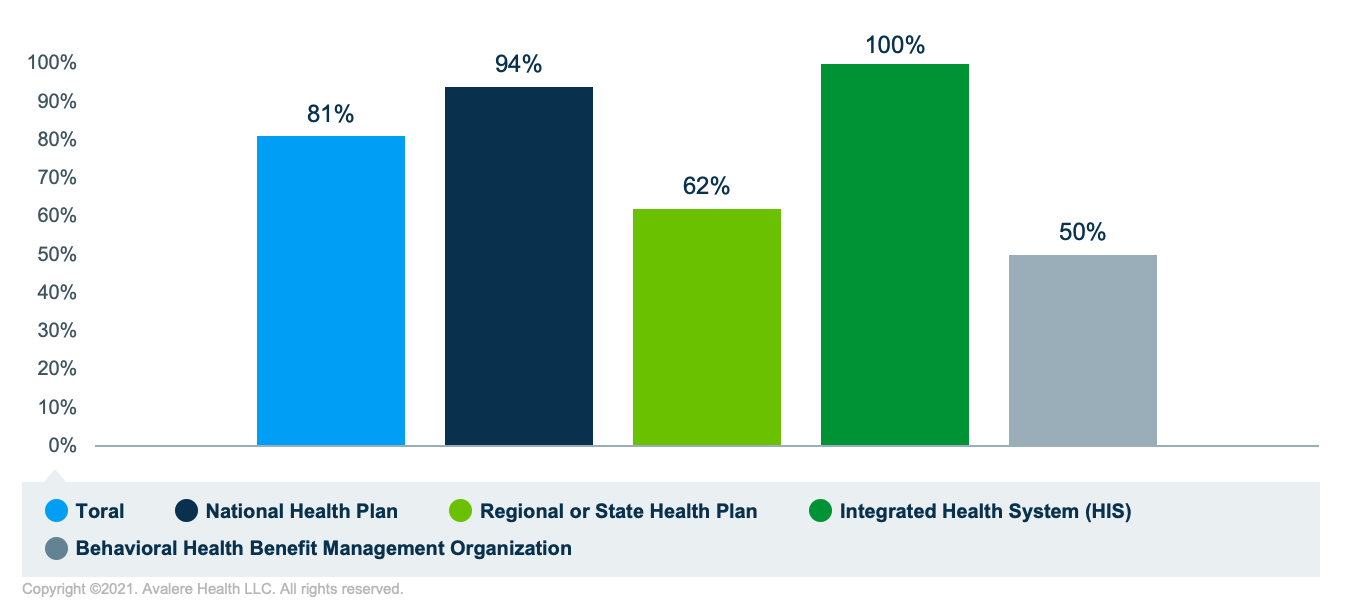

For example, as demonstrated in Figure 1, payers do not universally analyze the provider network adequacy for behavioral health services (including demand for services, wait times, and out-of-network utilization). Rates were significantly lower for regional health plans and behavioral health management organizations than national health plans and integrated delivery systems.

New legislation, the Consolidated Appropriations Act 2021 (CAA) promotes additional plan accountability to comply with parity expectations. These additional legislative requirements may spur shifts in mental health parity compliance.

3. Network Adequacy

Inadequate networks fuel out-of-network use and may subsequently limit beneficiary access through the likelihood of increased out-of-pocket costs for care. Over half of respondents (Figure 2) recognized a considerable amount of behavioral health “leakage” of out-of-network service use due to inadequate breadth of in-network services for behavioral health. Surveyed plans recognized the need to expand behavioral health provider networks and indicated ongoing efforts to recruit additional providers. However, a national shortage of behavioral healthcare providers may be limiting network expansion efforts.

4. Level of Reimbursement

Low reimbursement rates for behavioral health services were widely recognized as a key barrier in establishing and maintaining behavioral health network adequacy and may be partially responsible for inadequate provider networks. According to survey respondents, 75% of plans anticipate raising rates by at least 6% in the near term in response to reimbursement barriers.

5. Implementation of Telehealth Tools

In addition to network expansion and adequate reimbursement, behavioral telehealth may play a key role in increasing access to mental health care. Most plans leveraged telehealth to increase access to behavioral health services throughout the PHE, and many respondents plan to continue to offer a range of services beyond the PHE. In addition, 75% of organizations expect to increase the proportion of behavioral telehealth services offered to members. Despite their intent to increase proportion of services offered via telehealth, reimbursement parity for telehealth services may limit network adequacy, as only 72% currently reimburse telehealth at the same rate as face-to-face services.

6. Use of Value-Based Payments (VBPs)

Plans reported low use of VBP arrangements and alternative payment models, with 33% of respondents indicating current use. Low incidence of alternative payment models in the behavioral health space may be attributable to a lack of applicable measures that are outcomes-oriented and therefore translatable to payment evaluation and implementation. Despite challenges, various examples of alternative payment models across the behavioral health space may indicate room for greater use. One example, the Alliance for Addiction Payment Reform’s Addiction Recovery Medical Home – Alternative Payment Model (ARMH-APM) is a patient-centric recovery model that integrates economic benefits and risks between payers and delivery systems to promote accountability and care design that is comprehensive and holistic. The ARMH-APM adopts elements of episodes of care and bundled payments and rewards clinical outcomes based on recovery-linked process measures. Risk-bearing providers have 3 mechanisms through which they assume risk: episodes of care, quality achievement payment, and performance bonuses. Additionally, many state Medicaid programs have begun to implement VBPs across behavioral health benefits. For example, in its Roadmap to Value-Based Payment, Oregon has identified behavioral health as a key care delivery area for VBP implementation in 2022.

Given the growing interest in VBPs, commercial payers may continue to follow suit; 58% of plans not currently offering alternative payment models for behavioral health services indicated interest in doing so. Of those plans that did utilize value-based schemes, over half claimed payments to be linked to either alternative payment models or population-based payments (Figure 3). Value-based payments may serve to broaden breadth of services covered by plans while distributing risk more equitably across stakeholders, ultimately allowing for coverage of innovative or novel medications or interventions.

Implications for Stakeholders Moving Forward

While survey results indicate that payers have not typically prioritized management and expenditures around behavioral health at the highest level, the PHE’s exacerbation of the existing mental health crisis has helped to reinforce the importance of these services. Payers are beginning to take steps to increase access to care through improving network and reimbursement adequacy, implementing collaborative care, and increasing access to and use of telehealth services.

New mental health parity legislation (e.g., CAA) will reinforce increased access to behavioral healthcare as payers undertake efforts to ensure compliance. Interest and expected implementation of value-based coverage for behavioral health services may present opportunities for innovative engagement on behalf of behavioral health stakeholders and may ultimately result in beneficiary access to a broader set of services and therapies.

Avalere has deep expertise in the behavioral health space, including tracking and evaluating state and federal policies and regulations as well as creating innovative solutions for clients who are commercializing treatments in this space. To learn more about how Avalere can support you in understanding the evolving behavioral health and payer market landscape, connect with us.