PBM Reform on Top of Congress’s Healthcare Agenda

Summary

Avalere Policy Edge survey of bipartisan health policy experts suggests that PBM oversight and reform legislation will pass during this Congress.A recent Avalere Policy Edge™ survey of former Congressional and administration officials indicates that legislation on pharmacy benefit manager (PBM) oversight and reform is likely to advance in the current Congressional session, while Republican efforts to alter the Inflation Reduction Act drug-pricing provisions are unlikely to gain momentum.

PBM Reform Anticipated

The majority of respondents (78%) believe that it is likely or very likely that Congress will pass PBM oversight and transparency legislation during the 118th Congress.

In May 2022 and February 2023, the Senate Committee on Commerce, Science, and Transportation held hearings on prescription drug cost transparency and federal oversight of PBMs. At the beginning of the 118th session, Sen. Maria Cantwell (D-WA) reintroduced the PBM Transparency Act, which would prohibit certain PBM practices, create new PBM transparency requirements, and mandate PBM reporting to the Federal Trade Commission. In March, the Senate Finance Committee held a hearing on the role of PBMs in the prescription drug supply chain and voted 18–9 to advance the PBM Transparency Act. Later that month, the House Oversight and Accountability Committee launched an investigation of PBMs’ business practices.

In the last two weeks of April, the Senate Health, Education, Labor and Pensions Committee is expected to mark up bills on PBMs and competition in the generics market. Senate Majority Leader Chuck Schumer (D-NY) has indicated that drug-pricing legislation (including a PBM reform bill) may reach the Senate floor as soon as May, with a spokesperson for his office stating, “Prescription drug reform and insulin pricing remain a top priority.”

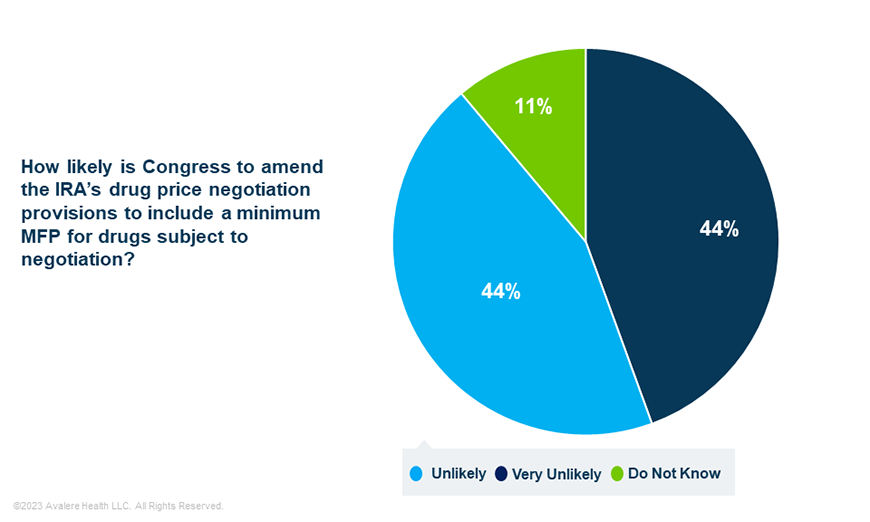

Congress Unlikely to Change MFP Provisions

The vast majority (88%) of Policy Edge respondents believe that it is unlikely or very unlikely that Congress will impose a floor on the maximum fair price (MFP) for drugs subject to Medicare drug price negotiation.

Note: Due to rounding, percentages do not total 100%.

In March, the Centers for Medicare & Medicaid Services (CMS) issued initial guidance detailing the process it will use to select drugs and negotiate MFPs for price applicability year 2026. Among other topics, the document clarifies how CMS will establish a single proposed MFP for negotiations and a ceiling MFP, and indicates its methodology for developing an initial price offer. It also clarifies that CMS will calculate a per-unit MFP for selected drugs that will be applicable across dosage forms and strengths. The MFP will be based on a per-30-day equivalent supply and then adjusted for dosage and strength. The guidance does not specify a process for providing the MFP to dispensing entities. This could lead to divergent approaches between manufacturers, potentially creating challenges for various supply chain entities in operationalizing the MFP.

About Policy Edge

Policy Edge is a subscription-based policy market research tool that offers data-backed insights on what actions Congress and the administration may take, when they will act, and how to best influence policymakers’ decisions. Each quarter, Avalere fields a survey to seasoned health policy experts with a wide breadth of experience in the Food & Drug Administration’s approval process, Medicare Part D, Medicare physician payment, and the health plan and PBM market.

The data above are drawn from our most recent survey, which included experts across the political spectrum (56% Republican, 44% Democrat) with an average of 8 years working in Congress or an administration. To learn more about Congressional and administrative priorities, as well as anticipated policymaking around the debt limit and Medicare funding, explore a preview of the survey results.

Policy Edge surveys provide exclusive data on anticipated policy developments shaping the healthcare market. Our healthcare policy experts will help you translate this information into actionable business insights. Learn more by connecting with us or by signing up for Policy Edge today.