Eliminating Drug Rebates Requires Complex Solutions

Summary

Reforms to “eliminate rebates” could have varying impacts based on features of their design.Drug manufacturer rebates have emerged as an area of focus in the Trump administration’s drive to lower drug costs. The administration’s drug pricing Blueprint and corresponding request for information (RFI) highlight the role of prescription drug manufacturer rebates in drug prices. On July 18, the Office of Management and Budget (OMB) announced it is reviewing a proposed rule focused on the removal of safe harbor protections for rebates. i Statements from administration officials regarding “eliminating rebates” suggest this rule could propose to prohibit current rebating practices, which are often determined after the point of sale based on volume and other considerations. This rule is expected to focus on Medicare Part D, with potential implications for other markets (e.g., Medicaid, commercial).

A regulatory change resulting in the elimination of prescription drug rebates would significantly alter business practices and incentives across the drug supply chain. Given drugs’ complex flows of information and funds, replacing the rebate structure could dramatically affect drug manufacturers, wholesalers, health plans, pharmacy benefit managers (PBMs), pharmacies, and patients.

A Theoretical Supply Chain Model Based on Discounts

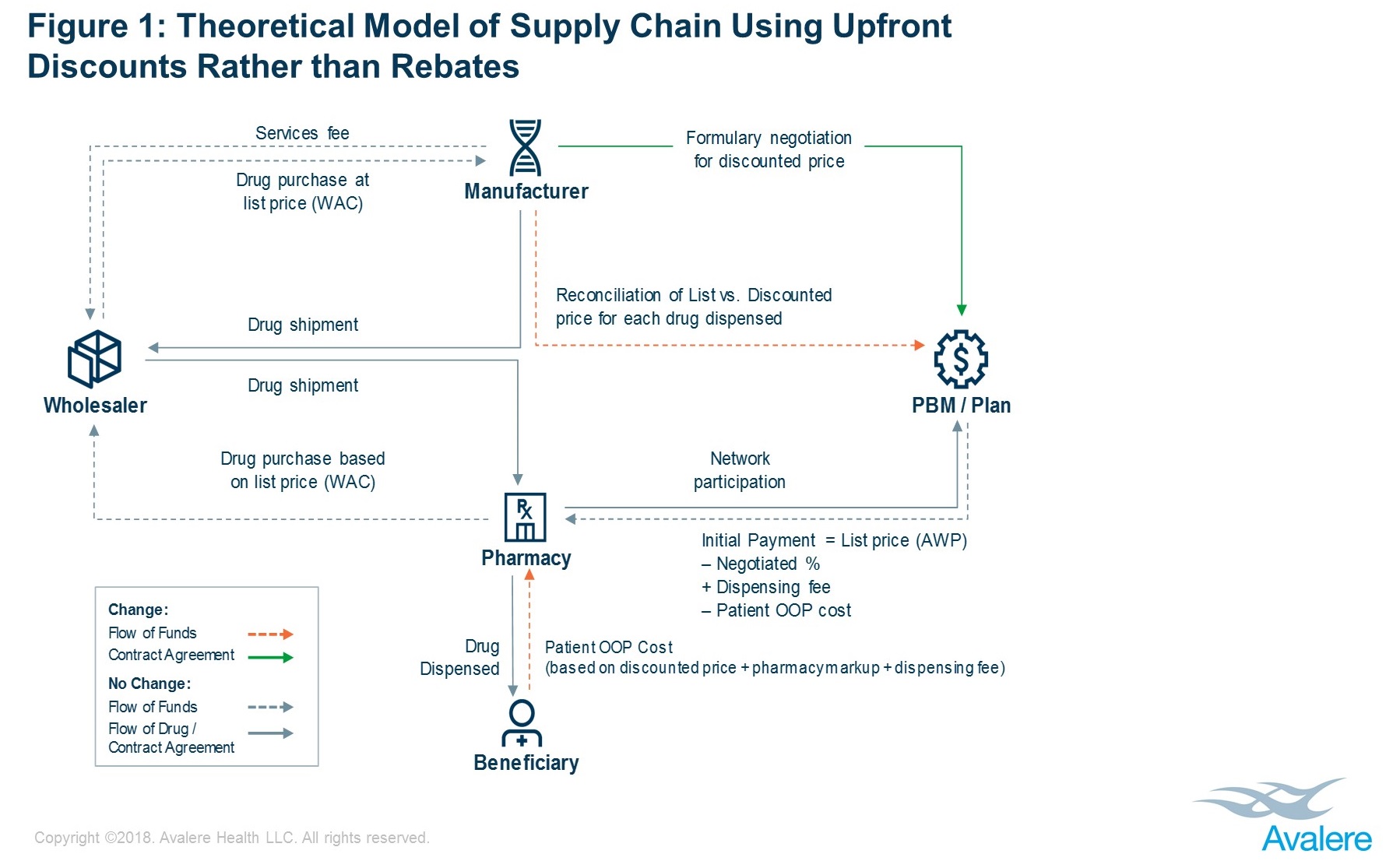

In place of rebates, manufacturers and plans/PBMs may negotiate upfront, fixed discounted drug prices. One potential operational model within which a manufacturer and health plan/PBM could negotiate an upfront discounted price for a given drug’s formulary placement is shown in Figure 1.

In the model depicted, a manufacturer and a plan/PBM would directly negotiate a discounted price for a given drug (hereafter referred to as the “discounted price”). The drug would flow through the supply chain based on list price (WAC), as it does today. Current relationships between the manufacturer, the wholesaler, and the pharmacy would be maintained without change.

When the drug is dispensed, the patient would pay out-of-pocket (OOP) cost based on the discounted price, plus a pharmacy markup and dispensing fee. The plan/PBM would pay the pharmacy based on the list price (AWP) minus patient OOP cost, also adjusted for any markup and dispensing fee. In total, the pharmacy would effectively be paid as it is today, being made whole by payments from the patient and the plan/PBM.

As a final step, the plan/PBM would reconcile with the manufacturer for any difference between the discounted price and the list price paid to the pharmacy. This could leverage existing contract relationships and structures between the plan/PBM and the manufacturer.

Key Scenario Considerations & Design Levers

Several policy levers must be considered when designing a discount-based model:

– Change to fixed fees from percentage-based fees: While moving from rebates to fixed, discounted drug prices would likely be core to any new operational model, models could differ in their treatment of wholesaler and pharmacy fees. These could remain as percentage-based fees, with amounts changing in response to changes in drug price, or they could be converted to fixed fees, which could affect how wholesaler and pharmacy fees encourage preference for higher-cost drugs.

– Change to OOP costs: Currently, beneficiary cost sharing is based on a list price, but under an upfront discount model, it could be based on a discounted price. Accordingly, cost sharing would reflect some of the savings from the manufacturer’s discount. It is likely that only individuals filling scripts with coinsurance (or while within their deductible) would see this impact directly, since coinsurance amounts—but not copays—are based on a drug’s price. It is possible, under the policy model outlined above, that copays would decrease to meet actuarial value requirements within the program.

– Changes to current operational relationships: Shifting to upfront discounts would require changes to logistical relationships and interactions, disrupting the complex flows of information, funds, and drugs used today. These changes would affect the feasibility and workability of discount models. For example, plans/ PBMs are typically “at risk” for rebate amounts before they are paid by the manufacturer; under a discount model, this could remain the same (as in the policy depicted) or could change so that the pharmacy or another entity would take on the financial burden of seeking reconciliation payment.

There are several possible approaches to designing an upfront model. However, any discussion of such reforms must take into consideration the interdependence of the stakeholders in the current system and the differential effects that any replacement model could have on stakeholders.

i. HHS / Inspector General proposed rule, entitled “Removal of Safe Harbor Protection for Rebates to Plans or PBMs Involving Prescription Pharmaceuticals and Creation of New Safe Harbor Protection”

For more on Avalere’s policy work, connect with us.