Technology Is Driving Innovation in Women’s Health

Summary

The FemTech industry is rapidly growing and evolving as health equity and women’s health research become a larger focus and target priority in the US.Access Challenges in Women’s Health

Increased cultural focus on women’s health is driving a paradigm shift towards improved innovation and investment in products and services. At the same time, longstanding disparities in access to care have persisted, garnering increased attention within health equity discussions.

For example, in 2023 the Biden administration launched an initiative to accelerate and increase research in women’s health to address these disparities. Women face many barriers within the current healthcare system, including the underdiagnosis of medical conditions, fragmentation of the care continuum, inadequate representation in clinical trials, and ambiguities surrounding insurance coverage for necessary care. These obstacles have contributed to the United States displaying less favorable metrics and worse outcomes than other developed countries despite spending the most on healthcare.

One notable example of this is maternal health outcomes. A Commonwealth Fund analysis found that the United States has the highest maternal mortality rates when compared to other high-income nations, with about 24 maternal deaths per 100,000 live births; this is substantially higher than the next highest country (New Zealand) at 13.6 maternal deaths. Data from the Centers for Disease Control and Prevention has identified racial disparities in US maternal health outcomes: women of color are three times more likely to die from pregnancy-related causes than White women.

Further, women have historically been underrepresented in medical research, employed women’s out-of-pocket costs are an estimated to be $15.4 billion higher than those of men, and social and political stigma are widespread within women’s health. Health disparities are further compounded by provider bias, structural racism, lack of access or affordability, and systemic challenges.

Current structural challenges in coverage, coding, and reimbursement have triggered the need for innovative paths to bring necessary services to market, such as self-pay or employer-covered benefits. In women’s health, digital health companies are working to close gaps within fundamental access challenges, with a market potential of around $50 billion in 2025. Stakeholders have focused on improving access to and awareness of care for more innovative solutions in fertility services, menopause care, and chronic disease management. As these stakeholders push to unlock expanded coverage, coding, and payment options for women’s health, the FemTech space can assist in providing broadened and equitable care.

What is FemTech?

The term “FemTech”, coined by Ida Tin, encompasses technology-based innovation in the women’s health space, including products, diagnostics, medical devices, digital therapeutics, consumer applications, and services. FemTech intends to address female health issues by developing evidence, improving consumer experience, improving diagnoses, and ultimately improving overall health and wellness. While the term is just that—a term—it describes a new wave of inclusive innovations to support women and their families.

Innovations in women’s health have often centered around the following subsectors, likely addressing issues in more than one sector at a time.

Figure 1: Interrelated Women’s Health Technology Sectors

Clearly, women’s health extends beyond maternal health. As of 2021, companies that provided pregnancy services comprised about 21% of the FemTech market, followed closely by those offering reproductive health and menstrual health services. The industry strives to destigmatize discussions and treatment related to women’s health, addressing areas such as sexual wellness and education, menopause, pelvic healthcare, and chronic disease management.

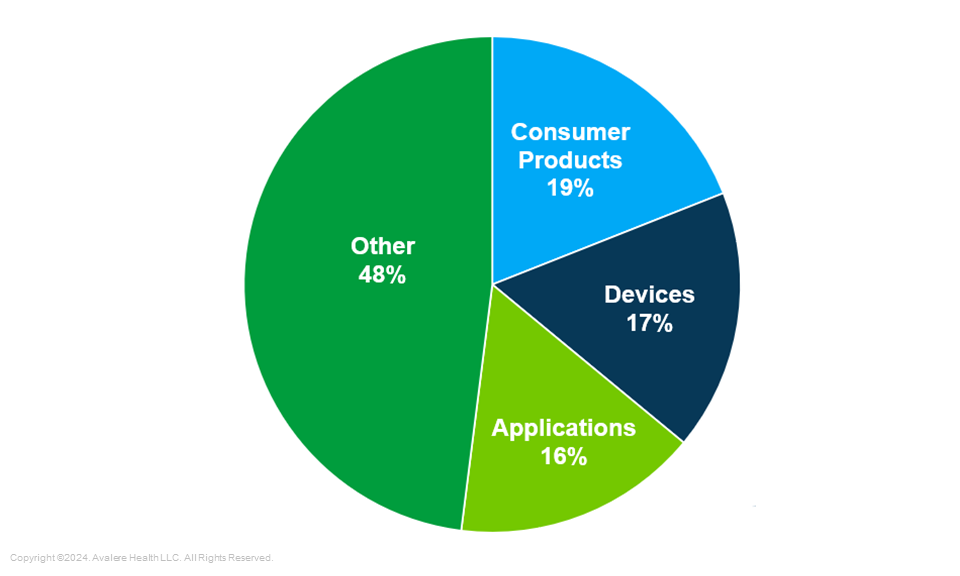

Women’s health technology encompasses various product types and conduits for service, including consumer products, devices (e.g., wearables and hardware), apps, digital platforms, healthcare software, and diagnostics. The top three product types collectively account for over 50% of the product share within women’s health technology.

Figure 2: Proportion of Product Types in FemTech

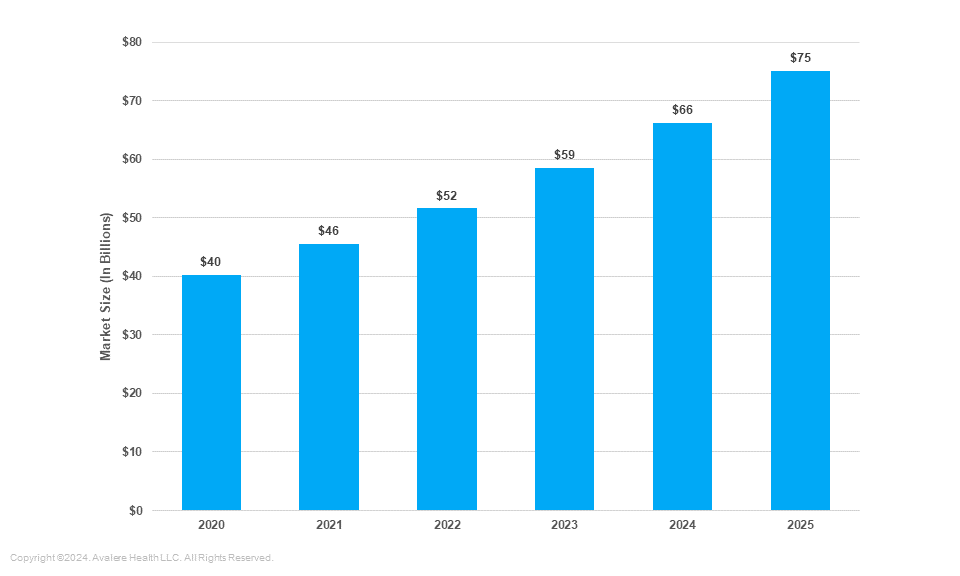

As of 2024 estimates, the FemTech market has an estimated value of $50 to $60 billion, marking a substantial increase from its $130 million value in 2013. Projections indicate that the market is expected to sustain its growth, with an anticipated compound annual growth rate (CAGR) of 16% from 2023 to 2032.

Figure 3: Projected FemTech Market Size, 2020–2025

Source: Ariston Advisory & Intelligence, FemTech Market Size

Reimbursement for FemTech Products and Services

Payment within the FemTech space has deviated from traditional methodologies, as many of the products and services offered may not be covered by typical health plans through medical or pharmacy benefits. Payment is often routed through one of three end-markets: traditional health plan coverage, employer-sponsored coverage, and direct-to-consumer models. The latter two markets are currently the more common, although all three face unique challenges. Coverage, coding, and payment structures—which are critical to defining reimbursement—are often unclear. In addition, the perceived value of products and services may be variable, and the awareness of need, demand, and service options is limited.

Until recently, traditional insurers often did not realize the value of many women’s health services for which FemTech is garnered. While traditional coverage is expanding, the market has also employed alternative pathways such as direct-to-consumer models, employer carve-outs, and outsourced care management models. For example, Maven Clinic, Ovia, or Wildflower offer digital solutions for Medicaid beneficiaries by partnering with managed care organizations to enhance maternity services. Health plans have sought to support employers in this arena as well. For example, UnitedHealthcare (UHC) launched its UHC Hub (a digital health contracting platform) with partners Maven Clinic, Cleo, and Wellthy in January 2024. In the menopause space, groups like Midi Health, Elektra Health, and others are finding traction with employers and health plans by billing for services as an in-network provider. While these payment methodologies and avenues are useful, they are not sustainable or equitably distributed within the women’s health technology space, as they are dependent upon patients’ disposable income, employers’ offerings, and reactive coverage options.

Learn More about the Potential of FemTech

Little research has been done to assess traditional payer perspectives of women’s health technology, including coverage of, payment for, and value of products and services. While subsectors such as fertility services and menopause have slowly gained traction among employer benefits, Avalere is primed to research additional subsectors within women’s health that may see increased volume through technology.

Advancing the sector will require multi-stakeholder partnerships, including provider engagement to understand how to incorporate FemTech solutions into the treatment journey and improve care delivery, as well as leveraged payer and employer perspectives on evidence needed to drive broader coverage of these solutions. It will also require increased access to patients to drive improvements in health equity, and improved understanding of potential payment and care delivery models.

Avalere is uniquely positioned to support innovators in navigating these policy, access, and evidentiary questions. To speak with an Avalere subject matter expert on any of these issues and what they mean for your organization, connect with us.