Understanding the Combined Effects of Drug-Pricing Reforms

Summary

The interaction of recently announced drug pricing reforms will have differential implications for stakeholders.Following the May 2018 drug-pricing blueprint, the Trump administration has advanced a range of priority policies that have significant implications for drug pricing, formulary access, and broader stakeholder business imperatives. While the policy specifics and implementation status/timelines vary, the reforms largely center around providing plans with greater flexibility to manage drug spending, aligning system incentives toward lower drug prices, and reducing out-of-pocket costs for patients. Each of the key policies (outlined below) represents a fundamental change and will individually alter pricing and access dynamics across Medicare Part B and Part D markets, and potentially more broadly. However, it is critical that stakeholders assess how the combination of changes will interact and necessitate corresponding shifts in access strategies, particularly given the overlapping policy and implementation timelines.

AKS Changes Fundamentally Shift Part D Plan Incentives

The proposed changes under the Anti-Kickback Statute (AKS) safe harbor rule to move from rebate-based negotiation toward point-of-sale discount pricing and the creation of a PBM service fee safe harbor represent fundamental shifts in incentives for Part D plans, pharmacy benefit managers (PBMs), manufacturers, and potentially other supply chain stakeholders, including wholesalers and pharmacies. Most notably, the economics of how rebates today accrue to Part D plans is substantially different from how contracted pricing between manufacturers and PBMs that result in point-of-sale discounts will flow through the system under the proposed changes.

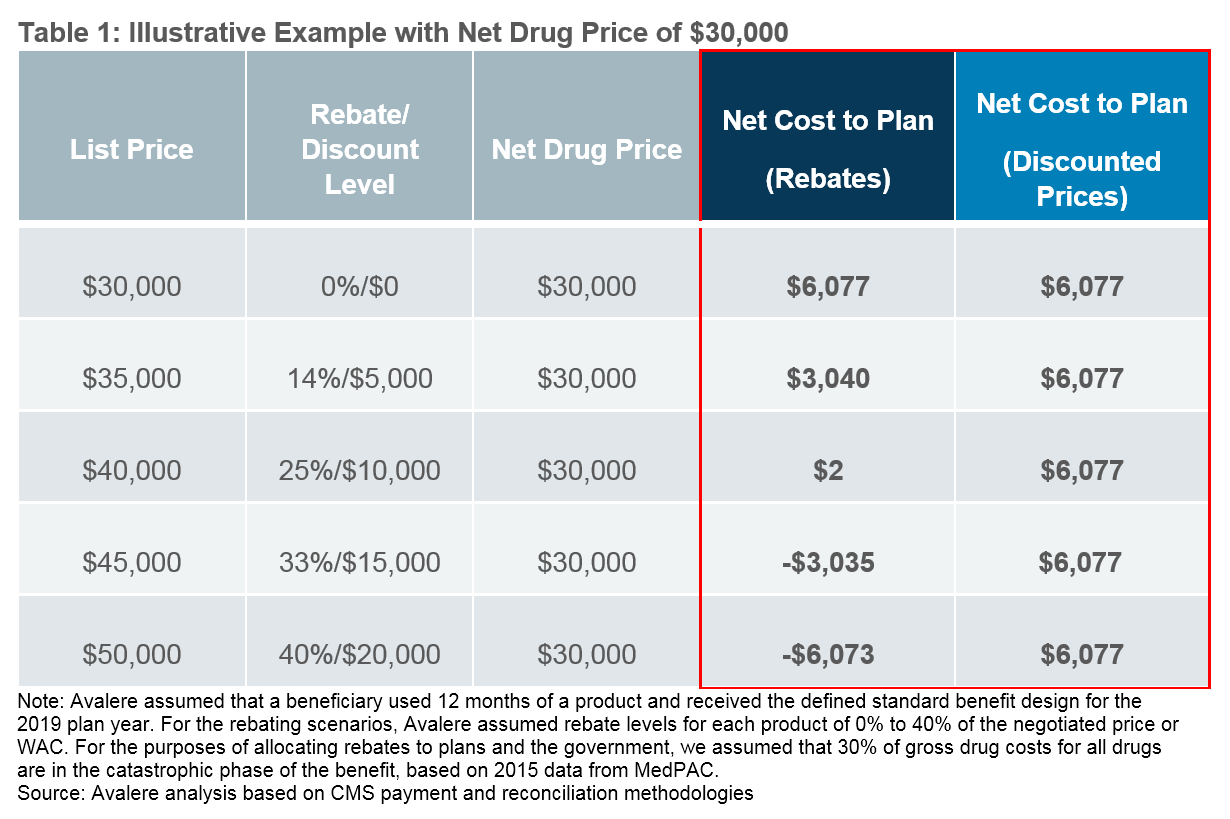

As illustrated below, the incentives around higher list price and higher rebate drugs that exist today will be diminished and effectively replaced by an overall drive toward lower net prices under a point-of-sale discounted price system. For example, a drug with a $40,000 list price and $30,000 net price via a $10,000 rebate yields a nominal net plan cost of $2. That same $40,000 list price drug that arrives at a $30,000 net price via a point-of-sale discounted price yields a net plan cost of over $6,000.

The administration estimates these changing dynamics will lead to increased Part D plan premiums ranging from $2.70 to $5.64 per beneficiary per month.1 As a result, plans are likely to consider how to use the new flexibilities identified above to constrain premium growth and meet consumer demands for low premiums. The nature of these changes and expectations for Part D plan behavioral responses will require manufacturers to re-evaluate current pricing and access strategies at a product-specific level and identify options to maintain or expand access in the new environment.

Considerations for Stakeholder Strategy

Manufacturers

- The cumulative effect of these policies will depend on a number of factors, including the number of drugs in the class/category, therapeutic area, patient population size, and manufacturer/drug current rebating and pricing strategies.

- Additional uncertainty remains, including the role of the chargeback administrator, the degree of plan/PBM formulary management, and the extent that plans/PBMs seek additional rebates in commercial markets.

- Manufacturers should also consider the transformations of the PBM business model and the effect of pricing transparency on patient enrollment decisions and utilization, as they refine their pricing and contracting strategies ahead of 2020.

Plans

- Given the importance of premiums as a competitive strategy for Part D plans, plans are likely to seek opportunities to manage costs to constrain premium growth.

- With newly permitted Part D formulary flexibilities, coupled with proposed policy changes, plans will have additional tools to manage formularies, including the use of indication-based formularies (particularly for products with high rebates across multiple indications) and application of step therapy for Part B drugs under MA.

Pharmacy Benefit Managers

- The elimination of rebates under the proposed AKS rule would represent a loss of a potential revenue stream if finalized as proposed.

- Given PBMs’ administrative and data capabilities and interest in mitigating the possible loss of revenue, PBMs may consider opportunities to facilitate discounts at the point of sale.

- The proposed creation of a PBM service fee safe harbor may evolve the types of arrangements into which manufacturers and PBMs enter.

- PBMs will have new management tools to leverage in negotiations with manufacturers on a discount basis.

Pharmacies

- With new formulary management tools, pharmacists will likely need to coordinate additional prior authorizations for drugs in protected classes with indications not on formulary or verifying indications for prescriptions on indication-based formularies.

- Pharmacies could face some level of financial risk as well as operational investments needed, depending on the type of reimbursement mechanisms under the proposed AKS safe harbor changes.

- Plans / PBMs with integrated pharmacies are likely to better manage any financial risk than independent pharmacies.

Chargeback Administrators

- Under the proposed AKS safe harbor rule, pharmacies may bear some financial risk by purchasing products at WAC-based prices while being reimbursed at discounted prices as negotiated between manufacturers and plans/PBMs. In this scenario, a chargeback administrator would be required to ensure pharmacies are adequately reimbursed.

- In the short term, PBMs—with their data capabilities and relationships with both manufacturers and pharmacies—are potentially able to play this role.

- Wholesalers, who have traditionally provided chargeback services, may attempt to position themselves as a viable chargeback administrator in the long term.

Patients

- The impact on patients will vary based on individual drug utilization patterns since Part D premiums are likely to increase while out-of-pocket costs would decrease.

- Part D beneficiaries using high-cost drugs may have lower patient cost-sharing if the AKS rule is finalized as proposed; the effect of additional formulary management tools for plans may reduce patient access to certain therapies.

- Beneficiaries using lower cost drugs may see higher premiums with minimal change in cost-sharing liabilities.

- Medicare beneficiaries will need to balance various factors in their plan selection.

To learn more about how Avalere can support you in understanding the implications of drug-pricing reforms on your business, connect with us.

References

- Office of Inspector General. Proposed Anti-Kickback Statute Rule. January 31, 2019. https://www.govinfo.gov/content/pkg/FR-2019-02-06/pdf/2019-01026.pdf.