2020 Exchange Plan Networks Are the Most Restrictive Since 2014

Summary

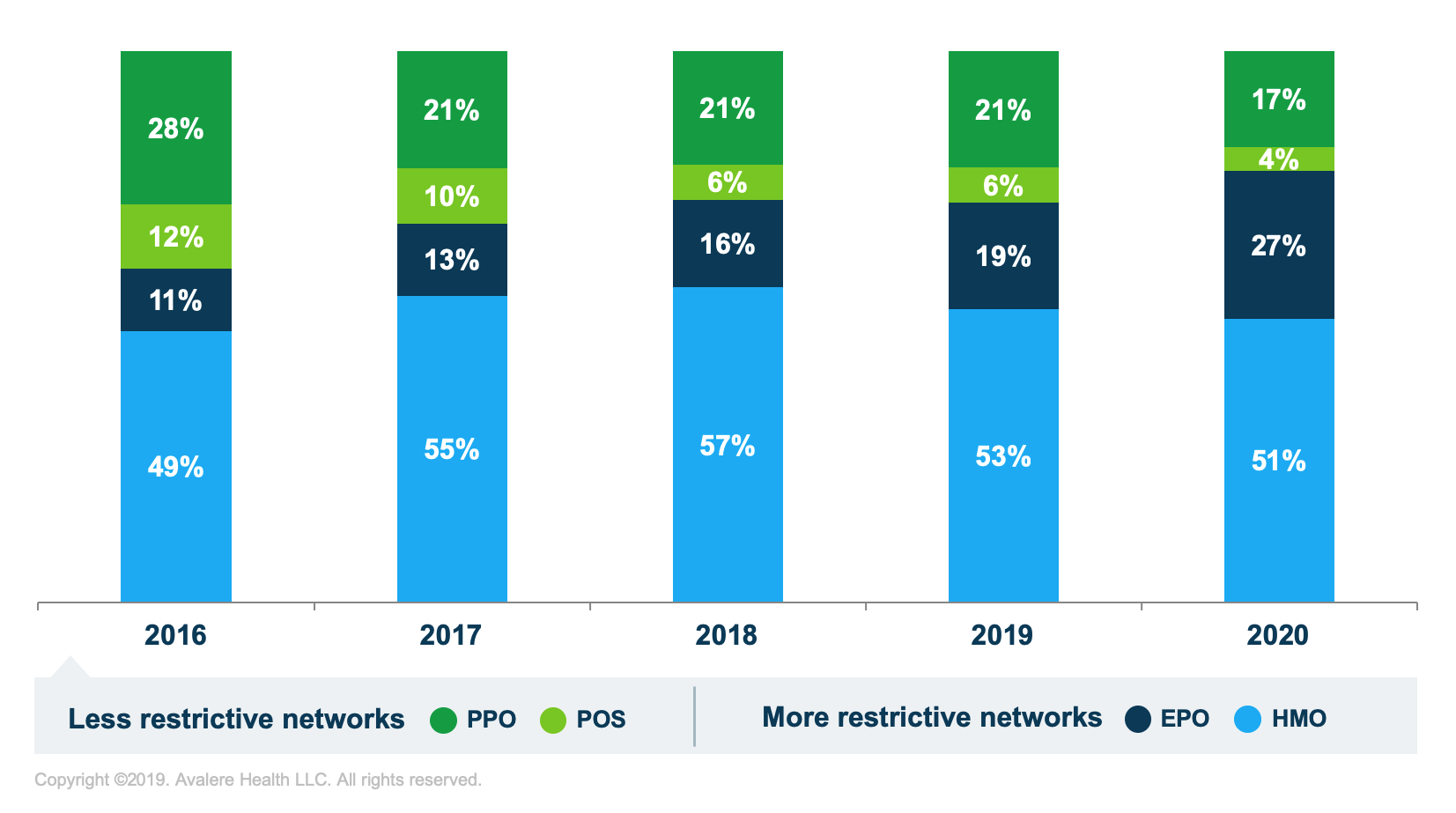

Restrictive network plans comprise over 75% of the exchange market.New analysis from Avalere finds that health plans with more restrictive networks, including health maintenance organizations (HMOs) and exclusive provider organizations (EPOs), continue to grow and are, by far, the most common types of plans in the exchange market. In 2020, 78% of plan offerings in Healthcare.gov states included “restrictive networks” that offer limited to no coverage outside their network. The remaining plans are Preferred Provider Organizations (PPO) and Point of Service (POS) plans, which tend to offer comparatively broader coverage and typically cover some services out of network.

“Health plan offerings on the exchanges are increasingly utilizing more restrictive networks to help control premiums,” said Chris Sloan, associate principal at Avalere. “While many patients are satisfied in restricted networks, unknowingly going out of network or needing a provider that isn’t in-network can lead to surprise bills and high out-of-pocket costs.”

While the trend toward plans with restrictive networks slowed in 2019, the market is experiencing an uptick again in 2020. Under HMO and EPO plans, consumers are generally required to use in-network providers to obtain coverage. EPO plans, which have seen the largest share increases since 2017, growing by nearly 14 percentage points, allow beneficiaries to use all providers within the network without a referral but provide no out-of-network benefits. PPO and POS plans typically cover care conducted either within or outside of a provider network.

Methodology

Avalere analyzed health plan information for states participating in the Healthcare.gov exchanges to capture a large sample of plan designs utilized throughout the country in the 2016, 2017, 2018, 2019, and 2020 plan years. Avalere analyzed the Healthcare.gov landscape file for 2016 (extracted October 2015), 2017 (extracted October 2016), 2018 (extracted October 2017), 2019 (extracted October 2018), and 2020 (extracted October 2019).

To receive Avalere updates, connect with us.

Find out the top 2020 healthcare trends to watch.