Exchange Reinsurance Stabilization Package Could Reduce 2018 Premiums by 17%

Summary

Market stabilization efforts could also lead to higher enrollment in exchanges.Funding a $15 billion reinsurance stabilization package, in combination with a delay of the Affordable Care Act’s (ACA’s) health insurance tax (HIT) through the end of 2018 and guaranteeing funding of cost-sharing reductions (CSRs), could reduce average yearly premiums by $1,363 (a 17% reduction), according to new research from Avalere. Uncertainty in the individual market, rising premiums, and declining issuer participation have created the need for federal and state policy makers to address these issues to stabilize the marketplace.

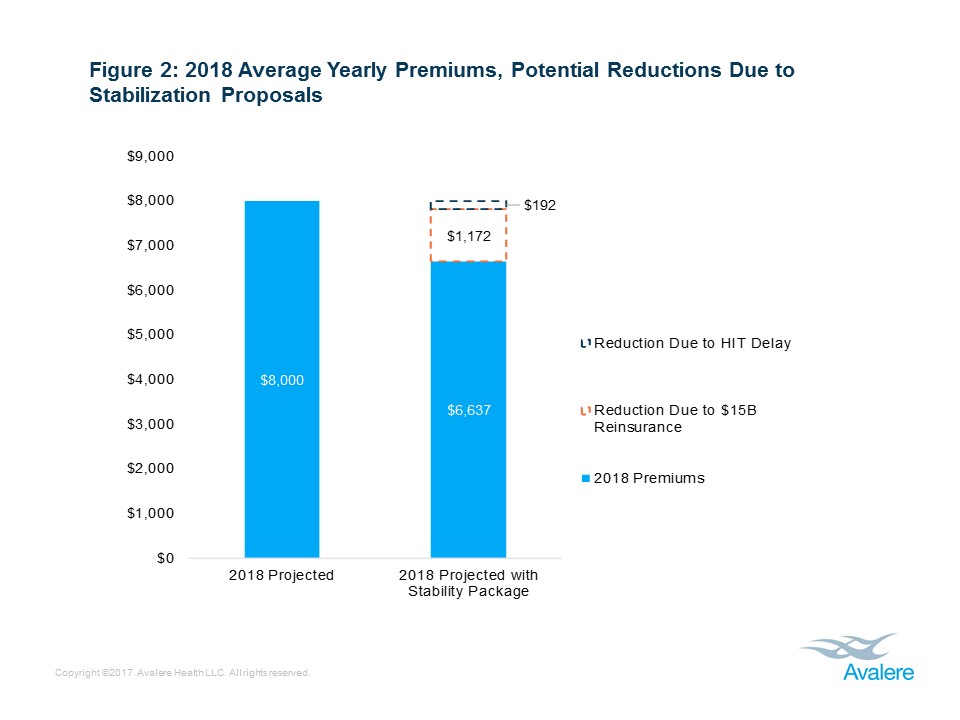

To understand which marketplace reforms could have the greatest potential to lower premiums, Avalere analyzed the possible impacts of $10 billion and $15 billion reinsurance stabilization packages in combination with a HIT delay. Avalere’s research found that funding a $15 billion reinsurance stabilization package would have the greatest impact, decreasing the average yearly individual market premium from $8,000 to $6,637 (17%). This stabilization package could also increase enrollment in the individual market to 18.6 million from the current 18.3 million. Lastly, funding a reinsurance program and decreasing the ACA’s HIT could lead to a $21.8 billion increase in federal spending and foregone revenues.

“Funding a reinsurance program for exchange plans, guaranteeing CSRs, and delaying the health insurance tax could lead to lower premium costs for consumers, while at a higher cost to the federal government,” said Chris Sloan, senior manager at Avalere. “While many exchange enrollees today are insulated from the expected premium increases for 2018, lowering premiums for the unsubsidized and incenting healthier individuals to sign up may help ensure a healthier market in the long-term.”

Avalere’s analysis also found that funding reinsurance programs would lead to the greatest savings compared to the delay of the HIT. The research showed that funding a $15 billion reinsurance program would reduce average yearly premiums by $1,172 compared to $192 per year if the HIT was delayed. The ACA created a HIT to be charged to entities that provide health insurance coverage, and the Consolidated Appropriations Act of 2016 suspended the fee for payments due in 2017.

“Providing direct funding for a reinsurance program rather than assessing a fee on health plans like in the ACA’s original reinsurance program would likely provide a simpler approach and better predictability for plans,” said Elizabeth Carpenter, senior vice president at Avalere. “Creating more certainty for plans could lead to greater marketplace stability and lower premium costs for consumers.”

Avalere’s report also examined the impacts of guaranteeing funding for cost-sharing reduction payments through 2018 and providing states additional flexibility to manage their individual insurance markets.

Access the full findings.

Funding for this research was provided by America’s Health Insurance Plans. Avalere maintained full editorial control.

Methodology

The modeling results are the output of Avalere’s proprietary model of individual market health insurance coverage. The underlying data in the model is drawn from the American Community Survey (ACS), Centers for Medicare & Medicaid Services (CMS) exchange enrollment reports, and general exchange market demographic data released by the United States Department of Health and Human Services’ (HHS) Office of the Assistant Secretary for Planning and Evaluation (ASPE). In addition, Avalere utilizes Inovalon’s proprietary MORE² claims database of individual market enrollees. This allows the model to take into account underlying risk, for purposes of calculating risk scores and modeling behavior, as well as risk selection by metal level, age, and gender.

For purposes of this analysis, Avalere assumed an expected average premium increase of 18% for 2018. Avalere did not assume any counties in the country without health insurer coverage, regardless of scenario modeled. Importantly, the reinsurance funding is assumed to be evenly distributed across the states and effectively removes that dollar value of funding from the claims cost of the individual market population for 2018, lowering average premium costs. For purposes of calculating premiums, Avalere assumes health plans price perfectly, matching the medical loss ratio requirements with expected claims costs of beneficiaries. Finally, the HIT impact on premiums is assumed to be 2.6%, as calculated by a recent Oliver Wyman analysis.