Copay Caps Could Reduce OOP Costs for Part D Beneficiaries

Summary

Analysis shows adding prescription drug copay caps to Part D benefit redesign could reduce OOP costs by 45% per enrollee.The Inflation Reduction Act (IRA) includes several policies intended to reduce Part D beneficiaries’ out-of-pocket (OOP) costs and improve prescription drug affordability. Beginning in 2025, the law redesigns the Medicare Part D benefit by eliminating the coverage gap, establishing an annual beneficiary OOP cap of $2,000, increasing plan liability in the catastrophic phase, and creating a new manufacturer discount program across coverage phases. Additionally, a “smoothing” provision will allow patients to pay OOP expenses incurred under the annual cap in monthly installments throughout the plan year to avoid spikes in spending.

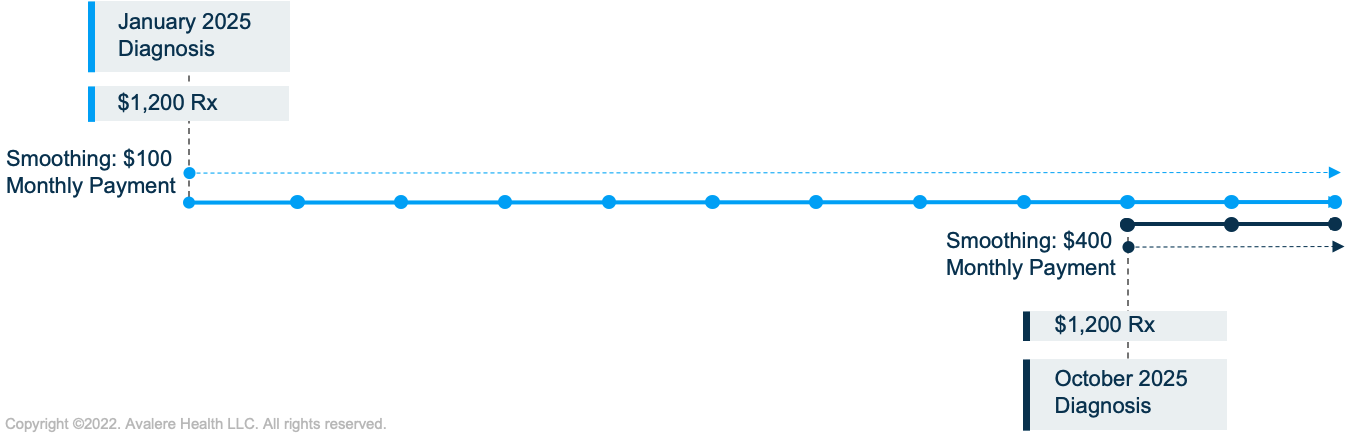

Despite these changes, some beneficiaries may still face challenges paying for their prescriptions. For example, the smoothing policy spreads costs across the remaining months in the plan year. However, if a beneficiary fills an eligible prescription toward the end of the year, their costs will be spread over fewer months, potentially resulting in a significant monthly payment (Figure 1). Congress also specified that smoothing will require beneficiaries to opt-in, which may limit uptake of the payment flexibility.

At the same time, lawmakers continue to be interested in reforms that may lower the OOP cost of prescription drugs for seniors in the Medicare program. In an October 2022 executive order, President Biden instructed the Center for Medicare & Medicaid Innovation to identify new care models that lower the OOP cost of drugs for seniors and promote treatment adherence.

Given the continued interest in prescription drug affordability, advocates are considering additional reforms that could build on the Part D policies created by the IRA. One such policy would cap OOP costs for beneficiaries with lower incomes on a per prescription basis. Supporters of this policy have suggested such a policy would create an additional layer of financial protection for lower income beneficiaries and streamline the prescription benefit design.

Avalere was recently commissioned to analyze the impact of incorporating a $35 copay cap into the Part D benefit structure for non-Low-Income Subsidy (LIS) enrollees under specified income thresholds, beginning in 2024. Avalere examined the policy’s impact on average annual OOP spending per beneficiary, federal Part D program outlays in 2023–2033, and total beneficiary Part D costs from 2023–2033, in comparison to such spending if Part D redesign was implemented without the copay cap policy.

Copay Cap Policy and Analysis

The policy would limit copays to a maximum of $35 per 30-day supply of a brand-name prescription drug for certain Part D beneficiaries who are not eligible for the LIS and have incomes below a certain threshold. The analysis tested the impact on three income ranges based on the Federal Poverty Level (FPL): 150–300% FPL, 150–400% FPL, and 150–500% FPL.

The difference between the copay cap and what beneficiaries would have paid would be covered by a new government subsidy. In addition, the subsidized copay amount would not count toward a beneficiary’s true out-of-pocket costs, leading to slower progression through the Part D benefit.

Avalere modeled the policy as an add-on to IRA benefit redesign but did not incorporate interactions with other Part D policies, such as drug negotiation or inflation-based rebates. The analysis used scoring assumptions generally consistent with the Congressional Budget Office (CBO), such as baseline federal program spending, beneficiaries’ behavioral response to lower cost sharing, and the relationship between drug utilization and medical costs.

Beneficiary-Level Impact

Avalere assessed how a copay cap policy could change OOP spending on a beneficiary level. To understand this relationship, Avalere modeled the impact of a copay cap policy for beneficiaries below the 500% FPL threshold with varying amounts of total annual drug costs and script counts. The analysis indicates that a $35 copay cap would reduce annual OOP costs across all drug spending levels by an average of $339 (45%), for eligible beneficiaries compared to their projected spending under the Part D redesign alone (Table 1).

This effect is magnified for eligible patients with higher drug costs who would otherwise reach the $2,000 annual cap under Part D redesign. Beneficiaries with medium levels of drug costs would save $1,489 in annual OOP spending from expected spending under IRA redesign, a 74% reduction. Patients with high drug costs would have their annual OOP spending reduced by an estimated $1,606, or 80% compared to expected spending under IRA redesign.

| Total Beneficiary Drug Costs | Pre-IRA | IRA Part D Redesign | Percent Change from Pre-IRA | $35 Copay Cap Policy* | Percent Change from IRA Redesign |

|---|---|---|---|---|---|

| Low <$6,500/year | $629 | $624 | -1% | $409 | -35% |

| Medium $6,500–$8,999/year | $2,724 | $2,000 | -27% | $511 | -74% |

| High ≥$9,000/year | $4,768 | $2,000 | -58% | $394 | -80% |

| All Eligible Beneficiaries | $918 | $746 | -19% | $407 | -45% |

* The average number of scripts per beneficiary varies across drug cost levels and affects the estimates for OOP spending. Beneficiaries with high drug costs use a higher proportion of specialty drugs, and reach the annual OOP limit based on a lower overall number of specialty scripts relative to the other beneficiary cost groups.

Source: Avalere simulation of Medicare Part D program using 2020 Part D Drug Event (PDE) data.

Aggregate Impacts

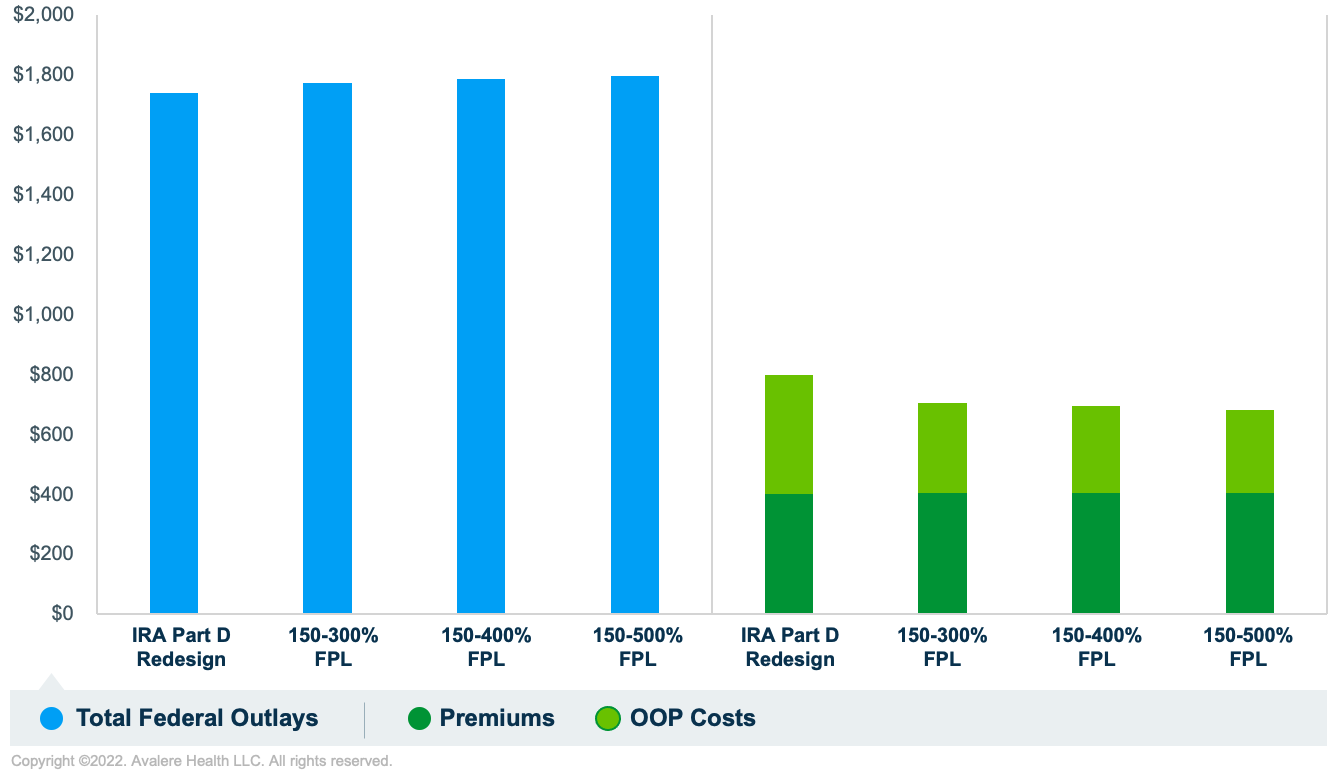

In aggregate, Avalere estimates that a copay cap policy would reduce total cost sharing for the non-LIS Medicare population without a substantial increase in government spending. For example, with a $35 copay cap applied to beneficiaries with incomes below the 500% FPL threshold, from FY 2023–2033:

- Total federal Part D program outlays would increase 3% ($56B) relative to spending under IRA Part D redesign

- Total beneficiary costs would decrease 15% ($118B). Total beneficiary costs consist of OOP cost sharing and premiums:

- Cost sharing would decrease by 31% ($122B) over the Medicare population

- Premiums would increase 1% ($4B)

If the FPL threshold for eligibility is lowered, aggregate beneficiary savings would be reduced because the copay caps would be applied to a smaller population (Figure 2). Federal Part D program outlays would decrease slightly due to reduced liability from the new government subsidy.

Source: Avalere simulation of Medicare Part D program using 2020 PDE data.

Implications

The IRA makes significant changes to the Part D benefit in 2025. However, despite these reforms, seniors with lower incomes may continue to have high OOP spending for certain drugs—particularly those that treat specialty conditions. A new copay cap can provide additional financial support for beneficiaries with income under 500% of the FPL for a 2.6% increase in Part D expenditures and a 0.3% increase in total Medicare outlays over 2023–2033. Stakeholders interested in these issues should consider appropriate avenues, such as legislation or new payment models, to further examine and advance such reforms.

Funding for this research was provided by the Alliance for Aging Research. Avalere retained full editorial control.

To learn more about Medicare Part D, connect with us.

Methodology

Avalere used 2020 Medicare PDE data accessed via a research collaboration with Inovalon, Inc. and governed by a research-focused data use agreement (DUA) with the Centers for Medicare & Medicaid Services to simulate the Part D benefit for 2023–2033. Per the DUA’s requirement, Avalere identified a random sample representing less than 20% of the total Part D population. Avalere excluded individuals residing outside the 50 states and DC and those enrolled in the Limited Income Newly Eligible Transition program.

Avalere approximated FPL for each beneficiary by applying a national distribution from the 2019 Medicare Current Beneficiary Survey.

The analysis used scoring assumptions generally consistent with the CBO, such as baseline federal program spending, beneficiaries’ behavioral response to lower cost sharing, and the relationship between drug utilization and medical costs. However, given the uncertainty of behavioral responses by manufacturers and plans, Avalere did not consider any behavioral responses regarding changes to drug prices or rebate negotiations.