Expanding LIS Subsidies Could Save Part D Beneficiaries Money

Summary

Avalere assessed the impacts of select policies to expand low-income subsidy (LIS) eligibility under Medicare Part DAs part of recent healthcare reform discussions in Congress, the topic of expanding the LIS program has received significant attention. Avalere Health analyzed 3 policies to expand LIS eligibility and considered patient impacts by state including:

- Raising the full LIS income limit from 135% to 150% of the Federal Poverty Level (FPL)

- Eliminating cost-sharing for generic drugs for LIS beneficiaries

- Removing the beneficiary asset test for LIS eligibility

The analysis found that beneficiaries would see substantial premium and cost-sharing savings due to the expansion of the LIS program.

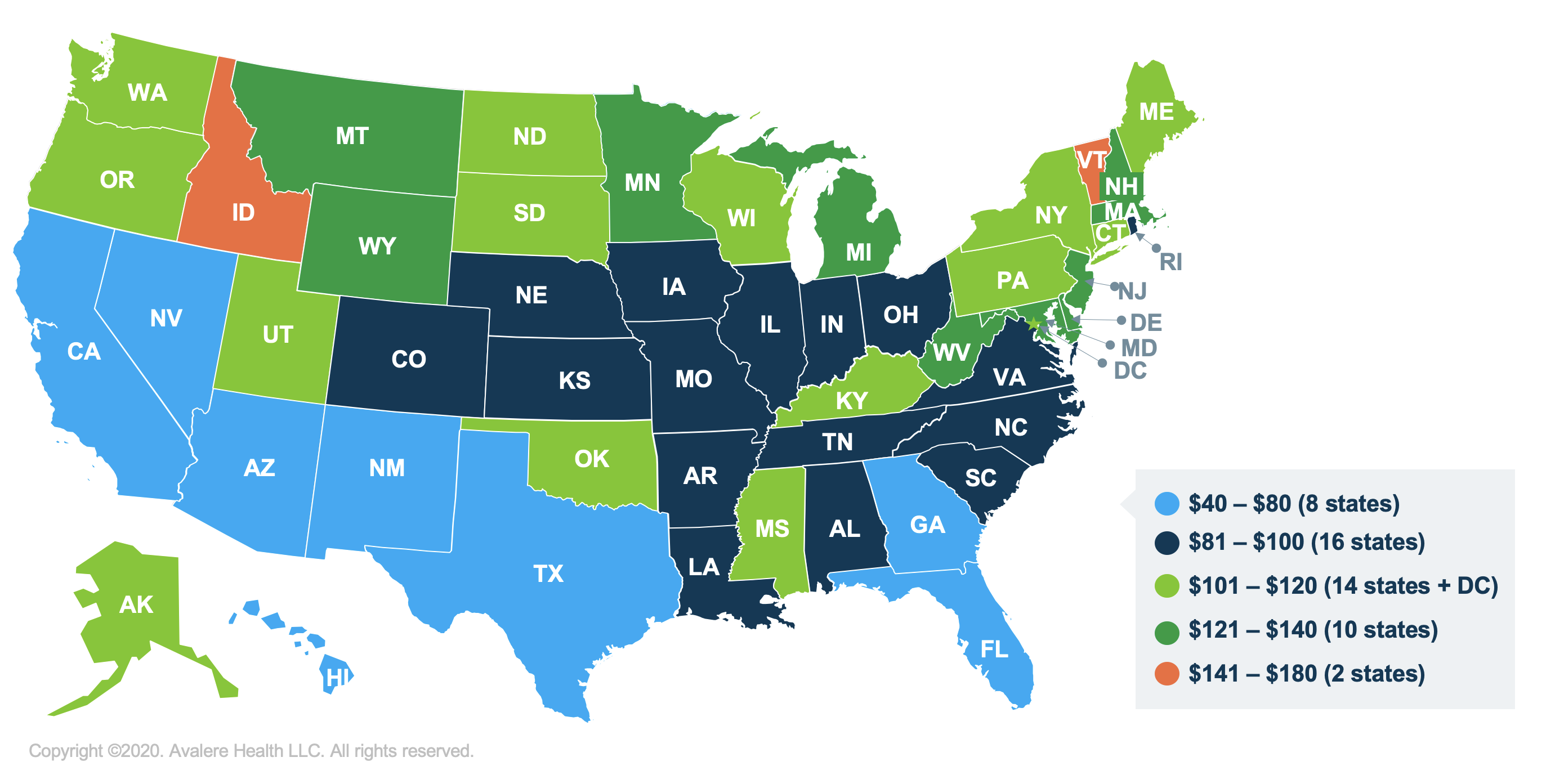

Policy 1: Raising the Full LIS Income Eligibility Limit

The first policy proposal would allow beneficiaries with incomes between 135% and 150% of the FPL—who are currently eligible for the partial LIS—to become eligible for full LIS in Medicare Part D. Full LIS beneficiaries receive additional assistance with cost-sharing and premiums compared to partial subsidy beneficiaries. Avalere’s analysis found that if full LIS eligibility was extended to individuals with income between 135% and 150% FPL, the average yearly savings per eligible beneficiary in all 50 states and DC would be $103 for premiums and $102 in cost-sharing.

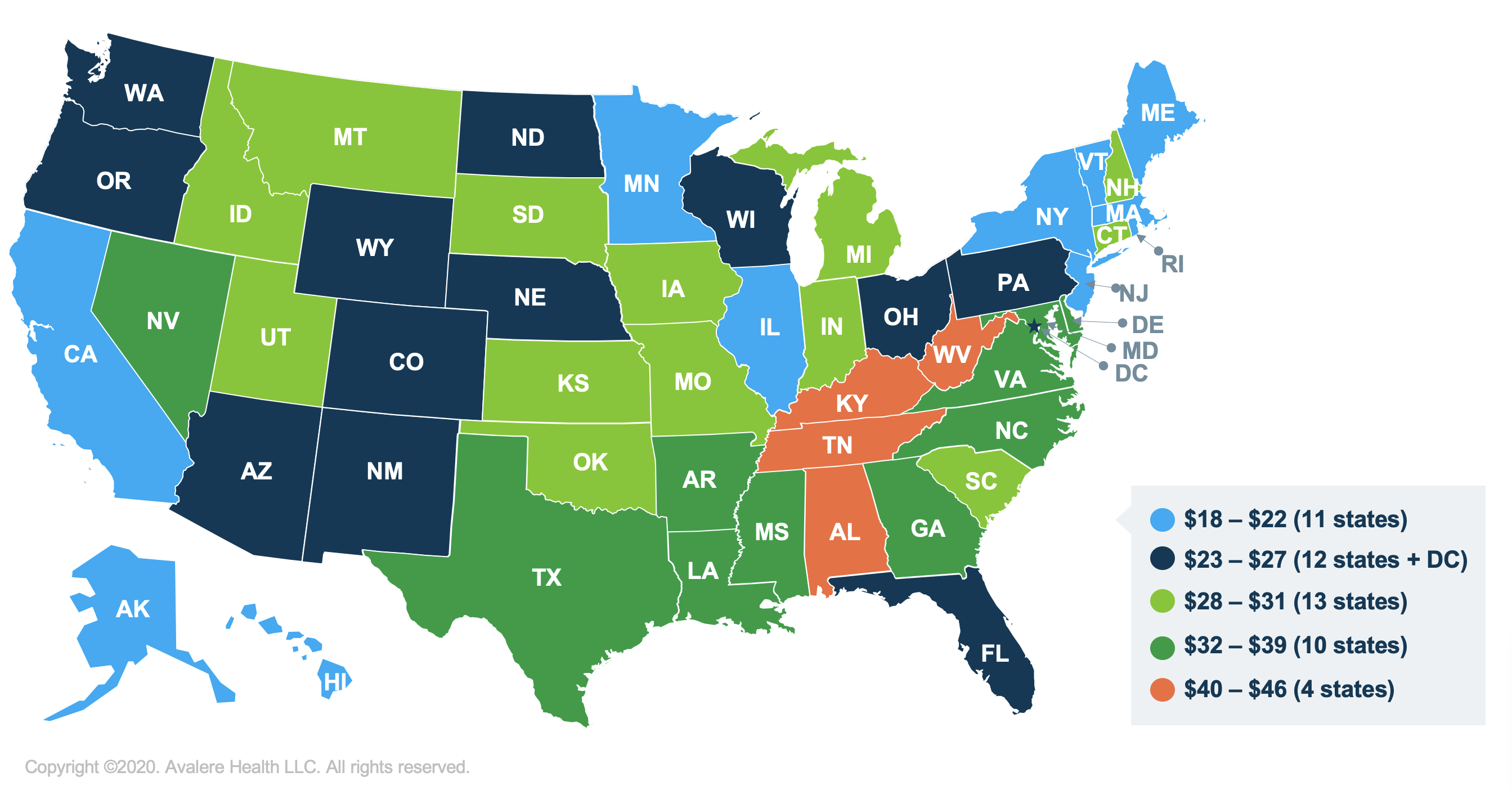

Policy 2: Eliminating Cost-Sharing for Generic Drugs for LIS Beneficiaries

This policy would remove cost-sharing on generics for LIS beneficiaries, thereby reducing their out-of-pocket costs. All full LIS beneficiaries would be eligible for no cost-sharing for generic drugs, compared to the current benefit which requires copays of up to $3.60 (in 2020) for generic products. Avalere’s analysis found that approximately 11 million eligible LIS beneficiaries in all 50 states and DC would save an average of $28 per year if cost-sharing was removed for generic drugs.

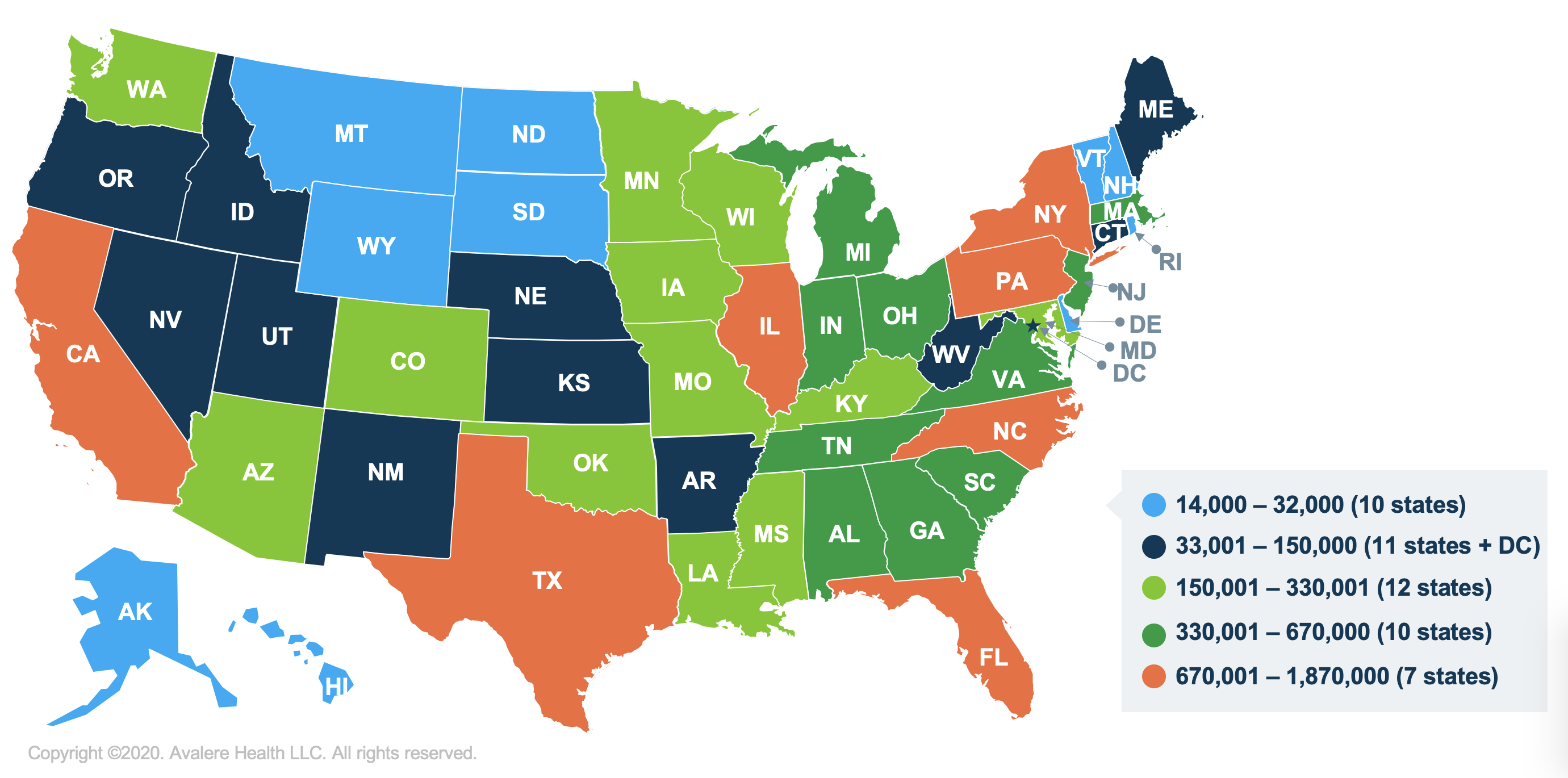

Policy 3: Removing the Beneficiary Asset Test for LIS Eligibility

The third policy would eliminate the asset test currently required for LIS eligibility. Avalere found that over 16 million beneficiaries would be eligible for LIS if this policy change were enacted, though some of those beneficiaries are currently eligible and simply not enrolled.

Methodology

Avalere conducted this analysis using the 2018 Prescription Drug Event claims data under a research-focused data-use agreement with the Centers for Medicare & Medicaid Services (CMS). Avalere’s analysis captured beneficiaries enrolled in the Part D program via standalone PDP and MA-PD plans. Avalere excluded beneficiaries enrolled in Employer Group Waiver Plans from Policy 1 and 2 assessments. Avalere also used the following data sources:

- Plan Characteristics file with premium and cost-sharing levels from the CMS

- Partial LIS indicator from the 2018 Medicare Beneficiary Summary File

- Income levels for Part D enrollees from the 2016 Medicare Current Beneficiary Survey

- 2016 Health & Human Services Poverty Guidelines

- CMS Part D monthly enrollment files by contract/plan/state/county, March 2019