Medicare Enrollees with COPD Compared to the General Population

Summary

The percentage of Medicare enrollees with chronic obstructive pulmonary disease (COPD) in Medicare Advantage (MA) plans is growing (3.1% growth projected between 2020 and 2030), but the majority (60%) of enrollees with COPD are in fee-for-service (FFS) Medicare. Compared to the general FFS Medicare population, more beneficiaries with COPD are dual eligible for Medicaid and fewer beneficiaries with COPD have employer sponsored insurance as a source of supplemental coverage.COPD is an incurable respiratory disease and, if left untreated, can lead to complications or mortality. Treatment for COPD requires use of healthcare services and reliance on medications, such as inhalers and nebulizers.

COPD increases with age; the prevalence of COPD is higher in adults 65 and older than in younger adults. The association between older age and COPD is a relevant concern for the Medicare program, which primarily serves adults 65 years old and older. The Medicare program also provides coverage for people under age 65 who are disabled or have end stage renal disease. Avalere examined the prevalence of COPD in Medicare FFS and Medicare Advantage (MA) populations and explored supplemental health insurance coverage for FFS beneficiaries with COPD.

Medicare Enrollees with COPD

Avalere found that approximately 11% of Medicare enrollees had COPD in 2019 (6.15 million enrollees). Of the Medicare population with COPD in 2019, 40% were in an MA plan, up from 32% in 2015. Between 2015 and 2017, the overall percentage of Medicare enrollees in MA plans was similar to those with COPD, (overall: 31% in 2015 and 2016 and 33% in 2017 compared to COPD: 32%, 32%, 33%), however in 2018 and 2019, a slightly higher percentage of Medicare enrollees with COPD were enrolled in MA plans compared to Medicare enrollees overall (overall: 35% in 2018 and 36% in 2019, compared to COPD: 38%, 40%; Figure 1).1

Source: Analysis was conducted using the MORE2 Registry year 2019 (the sample was scaled in line with national MA population) and with 100% Medicare FFS claims for year 2019.

On average, the 2019 MA population with COPD was younger than the FFS population with COPD. Compared to FFS beneficiaries, a smaller percentage of MA enrollees with COPD were over 85, and a larger percentage of MA enrollees with COPD were younger than 65. Compared to the overall 2019 MA population, a larger percentage of MA enrollees with COPD were over age 76. Compared to the overall 2019 FFS population, a larger percentage of FFS beneficiaries with COPD were younger than 65 and a larger percent of FFS beneficiaries with COPD were 76–85 years old (Figure 2).

Source: Analysis was conducted using the MORE2 Registry year 2019 (the sample was scaled in line with national MA population) and analysis was conducted with 100% Medicare FFS claims for year 2019.

Switching from FFS to MA

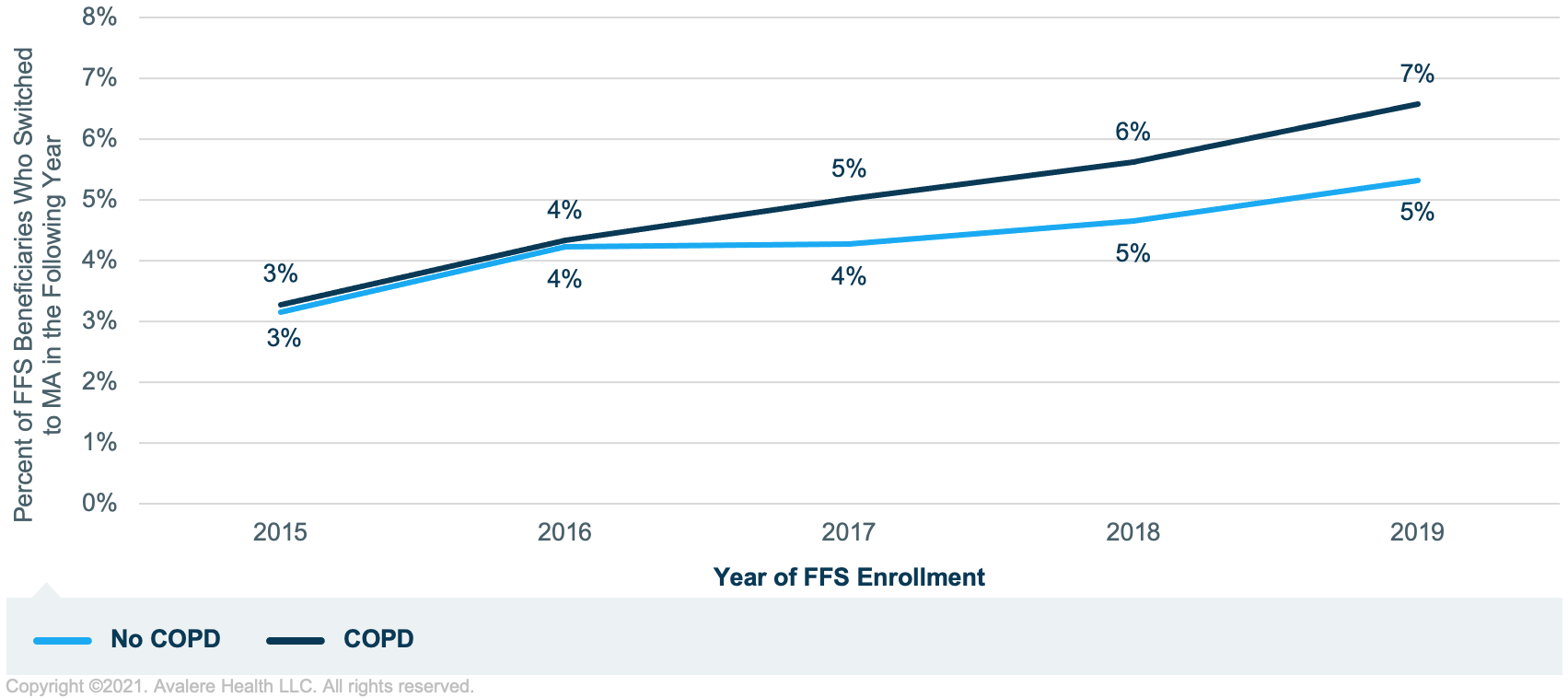

The percentage of Medicare enrollees with COPD in MA plans is growing (3.1% growth projected between 2020 and 2030). However, the majority (60%) of enrollees with COPD are in FFS Medicare (Figure 1). The choice of enrolling in FFS or MA is important as enrollment choice can have ramifications on the cost of treatment, and few enrollees switch between plan types. Avalere calculated the percent of FFS beneficiaries who switched to an MA plan in the subsequent year and found roughly 5% of enrollees in FFS Medicare in 2019 switched to an MA plan in 2020. The percentage of FFS enrollees who switched to an MA plan increased from 3% in 2015 to 5% in 2019 (Figure 3). Compared to the general Medicare population, a higher percentage of 2019 FFS enrollees with COPD switched to an MA plan in 2020 (7% with COPD compared to 5% in the general population), however the difference between the switching rate of enrollees with COPD and the switching rate of the general population was not statistically significantly different (P = 0.42).

Source: Analysis of 100% Medicare FFS claims for 2015–2019 and the 2015–2019 Master Beneficiary Summary File (MBSF).

Supplemental Coverage for COPD Enrollees

COPD enrollees in MA plans always have an annual limit on out-of-pocket spending on Part A and B services, because MA plans are required to have a maximum out-of-pocket (MOOP). FFS Medicare does not have a MOOP, but many FFS beneficiaries have some type of supplemental insurance to provide additional coverage of Medicare FFS cost sharing (e.g., Medicaid, TRICARE/ Veterans Affairs, employer coverage, Medigap). Using the 2019 Medicare Current Beneficiary Survey (MCBS), Avalere linked Medicare FFS claims to supplemental benefits to examine the types of supplemental coverage maintained by FFS Medicare beneficiaries with COPD.2

A higher percentage of COPD enrollees, compared to the general Medicare population, were dual eligible beneficiaries with Medicaid or public coverage in addition to FFS (18% of all Medicare FFS beneficiaries compared to 29% with COPD; Table 1). Compared to non-dual eligible beneficiaries, dual eligible beneficiaries tend to have lower incomes, allowing them to qualify for Medicaid benefits, and are often a less healthy population, with more beneficiaries qualifying for Medicaid through disability benefits rather than age. A lower percentage of COPD beneficiaries, compared to the general Medicare population, had employer sponsored insurance, a (34% of all Medicare beneficiaries compared to 25% with COPD; Table 1). Beneficiaries with employer sponsored insurance plans tend to have higher incomes than the general Medicare population. The percent of Medicare beneficiaries with COPD and no supplemental coverage is similar to the overall percent of Medicare beneficiaries with no supplemental coverage.

| Coverage Type | All Medicare FFS Beneficiaries | Medicare FFS Beneficiaries with COPD |

|---|---|---|

| Medicaid/Public | 18% | 29% |

| Employer Sponsored Insurance | 34% | 25% |

| Supplemental/Medigap | 29% | 29% |

| TRICARE/Veterans Affairs | 6% | 7% |

| No Supplemental Coverage | 12% | 10% |

Source: 2019 MCBS.

Conclusion

COPD is an incurable respiratory disease that requires regular medical care, including both healthcare services and pharmaceuticals, to avoid complications or mortality. More COPD beneficiaries are dual eligible than the general Medicare population, and fewer COPD beneficiaries have employer sponsored insurance as a source of supplemental coverage. These points suggest that a greater proportion of beneficiaries with COPD are low income than the general FFS population.

Funding for this research was provided by Theravance. Avalere Health retained full editorial control.

To receive Avalere updates, connect with us.

Methodology

Avalere identified a cohort of Medicare FFS beneficiaries using the 2015-2019 100% files of Medicare FFS Parts A and B data, accessed via a research-focused data use agreement with the Centers for Medicare & Medicaid Services. MA enrollees were identified using the Inovalon MORE2 Registry®, a large scale, real-world multi-payer dataset comprising medical, pharmacy, and lab claims, as well as clinical data on more than 332 million de-identified patients. The dataset contains claims across commercial markets (group, individual, and exchanges), MA, and the Medicaid Managed Care population.

Medicare enrollees with COPD were identified by diagnosis or medication. Identification by diagnosis required at least 1 inpatient visit or 2 outpatient visits with a COPD diagnosis (ICD-10 codes: J40-J44.9) within the identification year. Identification by medication required at least 2 claims for inhalers or handheld nebulizers. 2,531 National Drug Codes (NDC) were used to identify COPD enrollees by medication, 43% of NDCs were for inhalers and 57% for nebulizers. Inclusion required enrollment in FFS or MA on the day of the identifying claim (diagnosis or medication).

The switching analysis also used the 2015–2019 MBSF, which included enrollment information on Medicare Parts A, B, C (MA), and D. Avalere identified enrollees with 7 months of coverage in Medicare Parts A and B in a given year who also had 7 months of Part C coverage in the following year. For example, an enrollee with at least 7 months of FFS coverage in 2018 who was enrolled on an MA plan for at least 7 months of 2019 would be identified as having switched.

The FFS supplemental coverage analysis utilized the MCBS. To be included, enrollees were required to have Medicare Part A or B coverage, in addition to any other coverage they may or may not have had. MA enrollees were excluded as the MCBS does not match the Medicare enrollment file, and COPD status is not visible for MA enrollees as MA claims cannot be linked to the MCBS. A hierarchy was applied for any enrollee with multiple types of coverage. If a beneficiary was indicated as having Medicaid or other public insurance, they were assigned to that group. If they did not have any Medicaid or other public insurance, Avalere checked for employer sponsored insurance and then TRICARE/Veterans Affairs coverage. Enrollees not identified as covered under any of the above plan types were assigned as supplemental/Medigap if they had supplemental FFS insurance, or no supplemental insurance if did not have any additional coverage. MCBS weights were used to project national numbers from the survey.

Notes

- Kaiser Family Foundation (KFF) analysis of MPR, “Tracking Medicare Health and Prescription Drug Plans: Monthly Report,” 2000–2005.

- Percentages supported by a KFF study from 2016.