States Choosing Healthy Adult Opportunity Program Will Need to Generate Savings to Stay Below Capped Funding Levels

Summary

New analysis from Avalere finds that states currently covering non-mandatory adult populations who choose to participate in the Healthy Adult Opportunity (HAO) initiative may need to generate up to 8% in Medicaid savings to keep spending below new capped funding levels.On January 30, CMS announced the Healthy Adult Opportunity (HAO), a new Section 1115 demonstration initiative to allow states to move toward capped financing models with an opportunity to share in savings and implement new program flexibilities. A 5-year HAO demonstration would allow states to operate under an aggregate cap (also known as a block grant) or per capita cap financing model for non-mandatory adult populations under age 65.

Under the HAO, states could exercise new flexibilities, including changes to benefits covered for their adult populations, Medicaid program eligibility levels, prescription drug formularies, provider payments, and Medicaid managed care oversight, to reduce costs below the caps.

Key Modeling Assumptions

To provide an estimate of magnitude of the savings states may need to generate to stay below an aggregate or per capita cap, Avalere assessed the amount of federal funding states would receive under the HAO funding formulas. For purposes of analysis, Avalere modeled the impact if states were to move all non-mandatory adult populations into HAO demonstrations. The actual impact of the HAO, however, will be dependent on state uptake of this model, the populations each state selects to include, and the flexibilities each state uses to stay under their capped funding amount. It is unlikely that all states modeled will seek to implement a HAO demonstration, and those that do, may use it to enroll new Medicaid beneficiaries or a subset of their existing populations. As a result, this analysis should be viewed as an estimate of the potential scale of required reforms for states considering this opportunity.

Given a lack of clarity around some aspects of the HAO funding formulas outlined in the State Medicaid Director Letter, Avalere has made several key modeling assumptions, including:

- Estimating the size of the mandatory adult Medicaid populations in each state and excluding them from the analysis (e.g., pregnant women and low-income parents)

- Excluding states that do not cover a significant number of non-mandatory adults through Medicaid expansion or other optional coverage

- Calculating a state growth rate, for purposes of growing the federal funding cap in each state, based on per capita Medicaid spending growth in that state

- Conducting a static analysis focused on the difference between federally capped funding and the current projected baseline for federal Medicaid funding

- Presenting the results as a percentage reduction of total federal Medicaid funding, rather than as a percentage of funding for non-mandatory adults under 65, to better contextualize the scale of the reductions

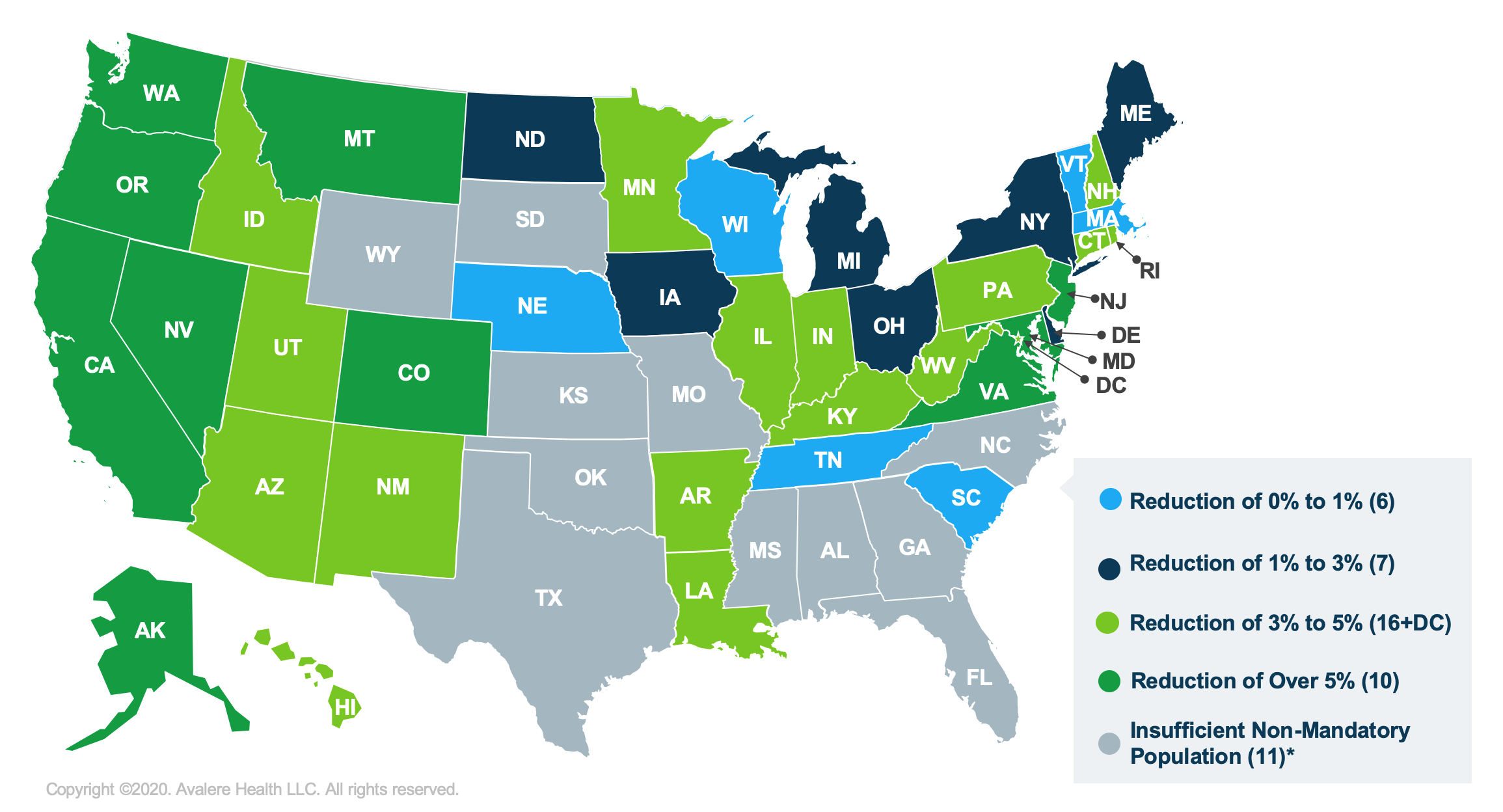

Results: Aggregate Cap

States that choose to participate in the HAO may need to generate up to 8% of total Medicaid savings to stay below an aggregate cap over the 5-year life of the demo. Under this option, if states are successful in achieving spending below the cap they will be eligible to share those savings with the federal government. Medicaid expansion states would need to generate the greatest savings under the proposal, largely due to the number of non-mandatory adults enrolled in each state; however, many of these states are least likely to pursue the demonstration.

Potential percentage reductions in total federal Medicaid funding over 5 years ranges from 0.1% in NE to 8.1% in NV. A minority of states, 13, would see reductions of less than 2% over 5 years. However, 10 states would see reductions of more than 5%. Importantly, several states most likely to pursue this demonstration do not currently cover sufficient numbers of non-mandatory adults to model the implication on existing federal funding. For these states, the HAO may provide an opportunity to expand coverage with additional flexibilities.

*Insufficient Non-Mandatory Population refers to those non-expansion states that, after removing the mandatory populations from their “Adult” Medicaid population, did not have sufficient numbers of individuals eligible for a capped approach under HAO to model. As a result, these states are unlikely to pursue such an approach for their existing Medicaid population.

Results: Per Capita Cap

States pursuing a per capita cap financing model under the HAO may need to generate up to 6% in savings over 5 years, a lower level of savings than under an aggregate cap. Potential reductions in federal funding over 5 years for the states analyzed range from 0.2% in Massachusetts to 6.1% in New Jersey, while 25 states would see reductions of less than 2% over 5 years.

*Insufficient Non-Mandatory Population refers to those non-expansion states that, after removing the mandatory populations from their “Adult” Medicaid population, did not have sufficient numbers of individuals eligible for a capped approach under HAO to model. As a result, these states are unlikely to pursue such an approach for their existing Medicaid population.

Conclusion

The analysis demonstrates that participation in an aggregate cap demonstration will generally create a lower federal funding cap for states than per capita caps; however, the variation between the funding approaches differs by state. In addition, in the case of an economic downturn, per capita caps would better protect federal Medicaid reimbursement as the total reimbursement to the state would rise with an increase in enrollment. Aggregate caps, in comparison, do not rise during an economic downturn and increase in Medicaid enrollment.

Appendix

| State | Medicaid Expansion | Aggregate Cap | Per Capita Caps | ||

|---|---|---|---|---|---|

| 5-Year Change in Total Federal Funding | Percent Change in Total Federal Funding | 5-Year Change in Total Federal Funding | Percent Change in Total Federal Funding | ||

| Alabama | No | N/A | N/A | N/A | N/A |

| Alaska | Yes | -$420 | -5% | -$310 | -4% |

| Arizona | Yes | -$2,000 | -4% | -$1,170 | -2% |

| Arkansas | Yes | -$1,480 | -4% | -$980 | -3% |

| California | Yes | -$22,460 | -6% | -$11,740 | -3% |

| Colorado | Yes | -$2,190 | -7% | -$1,720 | -5% |

| Connecticut | Yes | -$1,530 | -5% | -$1,000 | -3% |

| Delaware | Yes | -$140 | -2% | -$170 | -2% |

| District of Columbia | Yes | -$380 | -3% | -$550 | -4% |

| Florida | No | N/A | N/A | N/A | N/A |

| Georgia | No | N/A | N/A | N/A | N/A |

| Hawaii | Yes | -$370 | -4% | -$270 | -3% |

| Idaho | Yes | -$690 | -5% | -$260 | -2% |

| Illinois | Yes | -$2,410 | -3% | -$1,790 | -2% |

| Indiana | Yes | -$1,530 | -3% | -$1,250 | -3% |

| Iowa | Yes | -$600 | -3% | -$420 | -2% |

| Kansas | No | N/A | N/A | N/A | N/A |

| Kentucky | Yes | -$2,240 | -5% | -$1,990 | -4% |

| Louisiana | Yes | -$2,290 | -5% | -$1,270 | -3% |

| Maine | Yes | -$240 | -2% | -$250 | -2% |

| Maryland | Yes | -$2,570 | -5% | -$1,550 | -3% |

| Massachusetts | Yes | -$40 | 0% | -$80 | 0% |

| Michigan | Yes | -$2,210 | -3% | -$1,760 | -2% |

| Minnesota | Yes | -$1,840 | -4% | -$1,190 | -3% |

| Mississippi | No | N/A | N/A | N/A | N/A |

| Missouri | No | N/A | N/A | N/A | N/A |

| Montana | Yes | -$460 | -5% | -$460 | -5% |

| Nebraska | No | -$10 | 0% | -$20 | 0% |

| Nevada | Yes | -$1,550 | -8% | -$680 | -4% |

| New Hampshire | Yes | -$320 | -5% | -$200 | -3% |

| New Jersey | Yes | -$3,230 | -6% | -$3,190 | -6% |

| New Mexico | Yes | -$1,300 | -5% | -$780 | -3% |

| New York | Yes | -$2,100 | -1% | -$2,790 | -2% |

| North Carolina | No | N/A | N/A | N/A | N/A |

| North Dakota | Yes | -$100 | -2% | -$110 | -2% |

| Ohio | Yes | -$2,450 | -3% | -$2,080 | -2% |

| Oklahoma | No | N/A | N/A | N/A | N/A |

| Oregon | Yes | -$2,960 | -8% | -$2,170 | -6% |

| Pennsylvania | Yes | -$3,980 | -4% | -$3,270 | -3% |

| Rhode Island | Yes | -$370 | -5% | -$240 | -3% |

| South Carolina | No | -$160 | -1% | -$220 | -1% |

| South Dakota | No | N/A | N/A | N/A | N/A |

| Tennessee | No | -$100 | 0% | -$110 | 0% |

| Texas | No | N/A | N/A | N/A | N/A |

| Utah | Yes | -$910 | -5% | -$330 | -2% |

| Vermont | Yes | -$30 | 0% | -$60 | -1% |

| Virginia | Yes | -$2,230 | -5% | -$1,540 | -4% |

| Washington | Yes | -$3,750 | -7% | -$2,240 | -4% |

| West Virginia | Yes | -$760 | -4% | -$700 | -3% |

| Wisconsin | Yes | -$150 | 0% | -$290 | -1% |

| Wyoming | No | N/A | N/A | N/A | N/A |

Methodology

Avalere used its proprietary Medicaid forecasting and simulation model to estimate the national and state-level effect of the HAO aggregate cap and per capita cap options, focusing specifically on funding for adults (both newly eligible and traditionally eligible, non-mandatory populations) in the Medicaid program. Avalere’s model uses a combination of CMS’s Medicaid Statistical Information System and Medicaid Budget and Expenditure System data from the Medicaid and CHIP Payment and Access Commission to estimate recent and historical Medicaid spending and enrollment. To estimate future Medicaid spending and enrollment, the model uses the most recent CMS Medicaid Actuarial Report (2017) for future per enrollee spending growth by basis of eligibility (BOE) group and a combination of US Census Bureau state population projections and each state’s historical enrollment to estimate future state-specific enrollment by BOE group. For states that have expanded Medicaid in the past 2 years, Avalere assumes that per enrollee spend for newly eligible adults will be equal to that for traditional adults and utilizes state-published enrollment data or projections. To estimate mandatory adult populations in each state, Avalere analyzed data from the American Community Survey. Avalere uses Congressional Budget Office assumptions for national federal Medicaid spending under current law.

Avalere projects medical inflation (CPI-M) using the most recently available prior 4 years of Bureau of Labor Statistics CPI-M data. To calculate the growth rate in each state, for purposes of the base period growth rate calculation, Avalere uses the most recent 5-year per capita growth rate trend for each state’s Medicaid population. Given the lack of detail in the initiative around the specific parameters of the “state growth rate,” Avalere has made this explicit assumption about the meaning of state growth rate. Direct changes in federal Medicaid spending exclude the effect of any resulting changes in Medicaid enrollment. The simulation assumes HAO capped funding policies start in 2021 (using the 8 most recently available quarters of data, i.e., 2018 and 2019, as the benchmark year for spending levels) and that states do not alter enrollment or benefits. Avalere’s forecast period for this analysis aligns with the 5-year demonstration window outlined in the HAO State Medicaid Director letter.

To receive Avalere updates, connect with us.

Find out the top 2020 healthcare trends to watch.

Learn More