Use of Dispense as Written Codes After Generic Entry

Summary

Analysis of Dispense as Written codes highlight that many factors influence stakeholder preferences for brand or generic drugs after loss of exclusivity.Generics in the Marketplace

Drugs approved by the Food and Drug Administration (FDA) as new molecular entities (NMEs) are granted regulatory and patent exclusivity, which protect the product from market competition and patent infringement for set periods of time. These protections help sponsors recoup their initial research and development investment before the product faces direct competition in the market. However, once market protections expire, generic versions of those drugs can enter the market and introduce new competitive dynamics. Generic drugs are approved through abbreviated new drug applications (ANDAs) and obtain the exact label language, dosage forms, and strengths as the reference product that received NME approval. Products approved by ANDA are considered therapeutically equivalent to their reference products and can be substituted by pharmacies or prescribing physicians, usually at a lower price than their branded counterparts.

Shifts to Generics Are Not Immediate

In theory, once regulatory and patent protections are lifted and generics can launch, a product market could undergo rapid economic shifts due to availability of new supply. However, in practice, shifting from brand to generic involves multiple stakeholders in the value chain, including wholesalers, pharmacies, payers, and prescribers. This means that in some cases, the shift to generics does not occur overnight or automatically. Once generics are FDA-approved, there remain important considerations at the point of sale and at the point of prescribing that could provide reasons to continue using the brand for a period of time.

Dispense as Written (DAW) codes, used at the point of prescribing, are instructions on a prescription that indicate what the pharmacist should dispense. DAW codes could be used for various reasons (Table 1), including concerns about making changes in the middle of a patient’s treatment, uncertainty in supply, or because of other economic factors.

Table 1. DAW Code Descriptions

| Code | Description |

|---|---|

| DAW0 | No Product Selection Indicated |

| DAW1 | Substitution Not Allowed by Prescriber |

| DAW2 | Substitution Allowed – Patient Requested That Brand Product Be Dispensed |

| DAW3 | Substitution Allowed – Pharmacist Selected Product Dispensed |

| DAW4 | Substitution Allowed – Generic Drug Not in Stock |

| DAW5 | Substitution Allowed – Brand Drug Dispensed as Generic |

| DAW6 | Override |

| DAW7 | Substitution Not Allowed – Brand Drug Mandated by Law |

| DAW8 | Substitution Allowed – Generic Drug Not Available in Marketplace |

| DAW9 | Other (Plan Requires Brand) |

Source: Centers for Medicare & Medicaid Services Research Data Assistance Center

Analysis Results

Avalere analysis on Medicare claims shows that following entrance of generics, the use of DAW codes for prescriptions increases, and may be triggered by prescribers, patients, or payers to ensure that their preferred version of the product is ultimately filled in the prescription. Avalere has examined the 30-day scripts in both retail and specialty pharmacies across multiple therapeutic areas. The data suggest that in some cases, DAW code use shows prescribers or patients still requesting the brand one year following availability of generics. However, this DAW code use does vary by therapeutic area.

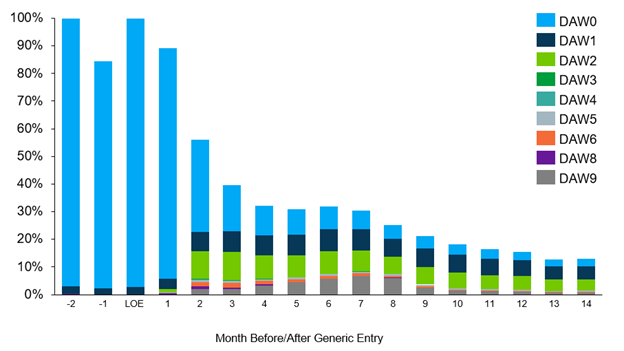

Oral Oncology Drug: In this example, data shows a steady amount of DAW1 and DAW2 code use even one year following the availability of generics, signaling prescriber and patient request for the brand. Additionally, use of DAW9 code usage in the first year after LOE may reflect payers requiring the brand for a period during an ongoing plan year, before re-evaluating for coverage of generic alternatives.

Figure 1. Brand Oral Oncology Drug 30-Day Script by DAW Code as a Percentage of Volume

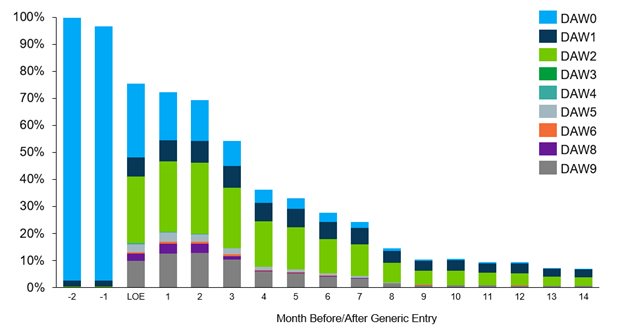

Cardiovascular Drug: In this example, the data similarly shows increased use of DAW codes in the first year of generic availability, especially DAW2, indicating patient preference for the branded options in this therapeutic area. The use of DAW9 similarly signals some payers preferred the brand in the first few months. Overall, the prescriptions with DAW codes account for most of the remaining brand volume, though by month 9, most of the volume has transitioned to generics.

Figure 2. Brand Retail Cardiovascular Drug 30-Day Scripts by DAW Code as a Percentage of Volume

Immunology Drug: Compared to the two other examples, the immunology example had more use of DAW1 codes by prescribers before generic entry. This may be due to higher payer management in this therapeutic area. The data shows that post LOE, use of DAW codes is higher than the other examples, including DAW2 (patient requested). This could be because of the chronic nature of the drug and stable patients not wanting to make changes.

Figure 3. Brand Immunology Drug 30-Day Script by DAW Code as a Percentage of Volume

Conclusion

The analysis of DAW codes used across therapeutic areas shows that payers, prescribers, and patients may have reasons to prefer a brand for several months following the availability of generics in the marketplace. In most cases, generic adoption exceeded 80% of Medicare prescriptions one year after LOE, though in some cases, the use of DAW codes contributed to higher volume remaining on the brand.

Methodology

Avalere performed this analysis using 100% Medicare Fee-for-Service (FFS) claims, accessed by Avalere via a research collaboration with Inovalon, Inc., and governed by a research-focused Center for Medicare & Medicaid Services data use agreement. This includes the 100% sample of Medicare Part A and Part B Medicare FFS claims data and the 100% sample of Part D encounter data for all Part D plans (including Medicare Advantage Part D plans).