Which Therapeutic Areas Are Likely to Be Affected by IRA Negotiation?

Summary

Sponsors with portfolio or pipeline assets within certain therapeutic areas can prepare for the downstream effects of price negotiation on the market.One of the most significant provisions of the Inflation Reduction Act (IRA) is the mandatory price negotiation between the Centers for Medicare and Medicaid Services (CMS) and manufacturers for eligible Part B and D products. Along with Part D out-of-pocket (OOP) smoothing, changes to the Part D maximum OOP limit, and inflation rebates, price negotiation is expected to generate significant shifts in the pharmaceutical marketplace for both negotiated products and their competitors.

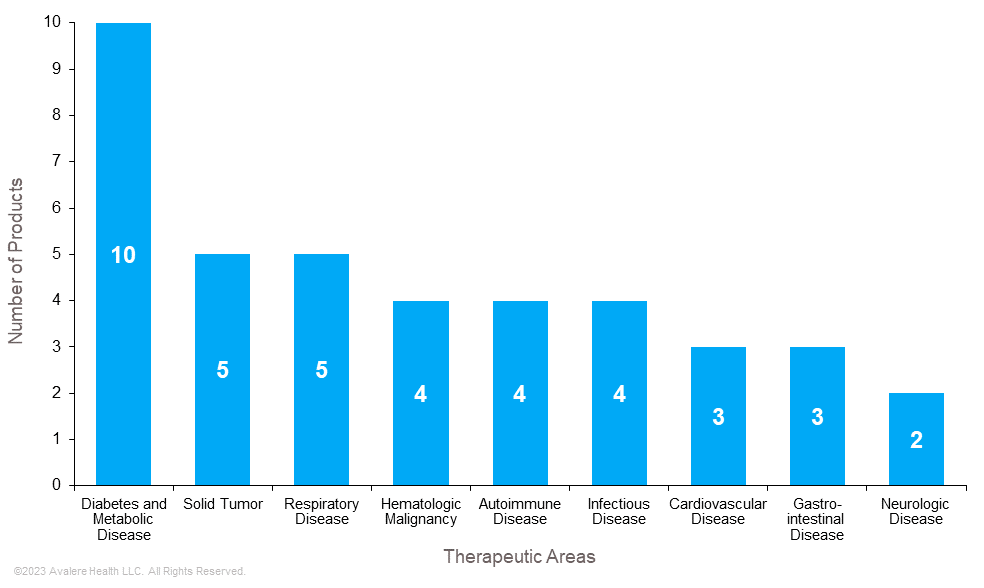

While the IRA is likely to affect the entire pharmaceutical market, some therapeutic areas are expected to see a greater and more rapid shift in market dynamics as negotiation nears (see Figure 1). It is essential for sponsors to understand how changes to the market ecosystem driven by price negotiation will shape their ability to achieve and maintain a successful market position throughout the product lifecycle.

Avalere analyzed 40 medical products expected to be negotiated in the first 3 years of negotiation after accounting for exclusions (e.g., orphan indication, expected generic, biosimilar entry). Medical products were categorized into therapeutic areas based on primary use and approved indications. Certain products may have indications that span multiple therapeutic areas, adding additional complexity for future assessments.

Products primarily used to treat diabetes, solid tumors, and respiratory conditions are among the most common therapeutic areas of the first 40 products expected to be negotiated. Those treating autoimmune conditions, infectious diseases, and hematologic malignancy were also strongly represented on the list.

Recent Product Launches

Sponsors that do not anticipate their product to be negotiated for several years should be prepared for the indirect effects of price negotiation and anticipate significant shifts in market dynamics. Sponsors that do not anticipate ever having to negotiate their prices are still likely to feel the effects of this IRA provision in the future. The effects of IRA price negotiation are likely to cause pricing and marketplace shifts which could affect sponsors with products in the same therapeutic area, treating similar patient populations, and/or those with comparable indications. Adjustments in the forecast, in-market strategies for growth in share, and sustained patient access must also now be considered through the lens of the initial indication for a product while balancing decisions for follow-on indication sequencing.

Pipeline Strategy Considerations

Sponsors of products in clinical development must plan for the additional hurdles that CMS-manufacturer price negotiation will present to the industry moving forward. Sponsors can address those challenges by optimizing several elements of commercialization, including but not limited to indication sequencing, market selection, evidence strategy, pricing strategy, filing pathway options, market landscape analysis, and payer mix identification.

This internal analysis evaluates the first 40 Part B and D products expected to be negotiated in the initial 3 years of negotiations. In future years, additional markets will likely be directly affected by price negotiation. To address IRA-related risks, early strategic planning on key decisions such as initial indication selection and positioning of assets aligned to a tactical evidence development and regulatory plan is recommended.

The IRA is poised to transform many aspects of modern drug and biologic development, investment decisions, and commercialization. Avalere experts in pricing and commercialization, evidence strategy and generation, and government markets are actively helping sponsors forecast and prepare for these changes.

To learn more about how the IRA will affect market dynamics and prepare for the changing healthcare landscape in 2023 and beyond, connect with us.